The Bank of Canada says it has growing concerns about the ability of households to service their debt, particularly with mortgage holders facing payment increases of up to 40% at renewal.

“In light of higher borrowing costs, the Bank of Canada is more concerned than it was last year about the ability of households to service their debt,” reads the Bank’s 2023 Financial System Review. “More households are expected to face financial pressure in the coming years as their mortgages are renewed.”

Compounding the issue is the fact house prices have come down from last year’s highs, reducing the amount of equity some owners have.

“…some signs of financial stress—particularly among recent homebuyers—are beginning to appear,” the Bank noted.

20% to 40% payment increase expected at renewals

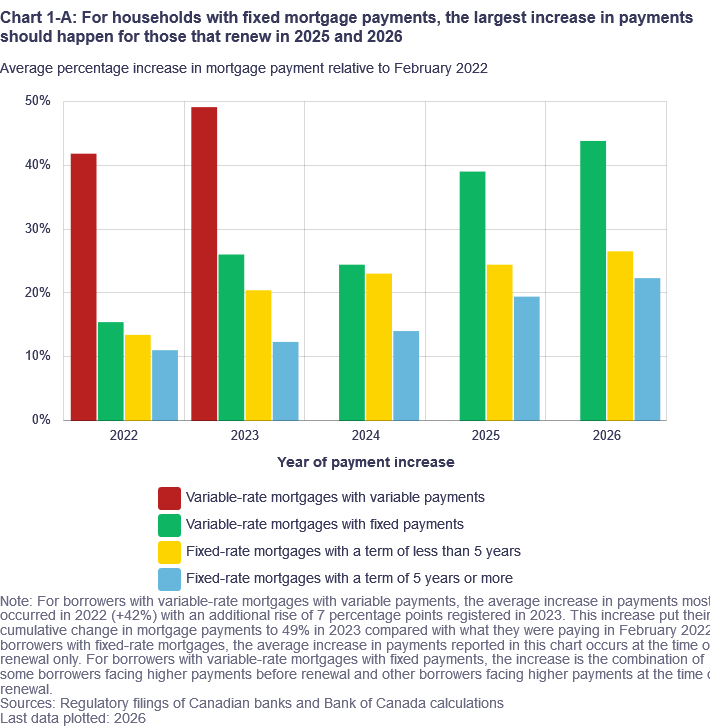

The Bank says about one third of mortgages have already seen increases in payments compared to February 2022, prior to the Bank’s latest rate-hike cycle.

However, by the end of 2026 it says all mortgage holders will have experienced a payment increase. The size of the increase will depend on their mortgage type and the previous rate they had obtained.

Most fixed-rate mortgage will face renewal in 2025-26, with payment increases expected to be 20% to 25%, the Bank said.

All adjustable-rate borrowers (those whose payments vary as interest rates change) have already experienced payment increases, with some seeing their payments surge by more than 50%. Variable-rate mortgage borrowers with static monthly payments, where the amount of the payment going towards interest rises as interest rates increase, will need to increase their payments an average of 40% to maintain their original amortization schedule. This assumes a renewal in 2025 or 2026.

Debt-service ratios on the rise

The FSR also noted that rising interest rates have increased debt-servicing costs for many mortgage-holders, some of whom have seen their ratios increase significantly.

The Bank says the median debt-service ratio (DSR) on new mortgages rose from 16% to more than 19% in 2022. Meanwhile, the share of new mortgages with a DSR greater than 25% jumped to 29% from 12% over the same period.

“Higher DSRs reduce flexibility for borrowers who experience unforeseen increases in expenses or losses in income,” the report reads.

Increases should be “manageable”

The Bank says that while the increase in mortgage payments should be manageable for most households, “the impact will be more significant for some.”

Many will also have a “buffer” to support higher payments thanks to being stress-tested at higher rates when their mortgage was originated.

“In addition, the federal government has proposed a guideline to ensure that…financial institutions explore mortgage relief options to help Canadians manage the increase in mortgage rates,” the Bank adds.

Also benefiting households is the fact many will have experienced some income growth between the time their mortgage was originated and their term renewal.

“For some households, however, the combination of higher DSRs, lower home equity and longer amortization periods will reduce household flexibility in the event of added financial stress, such as reduced income,” the Bank noted.