In the 2023-24 Budget, finance minister Nirmala Sitharaman has increased the tax exemption limit on leave encashment, on the retirement of non-government salaried employees to Rs 25 lakh, from Rs 3 lakh. The latest leave encashment exemption limit is applicable from FY 2023-24 (AY 2024-25).

If you are a salaried individual, I am sure your are aware of different types of LEAVES like casual leave, earned leave, sick leave, personal leave etc., Sometimes, you may not avail all the leaves that are available to you and some of your leaves may remain unused. So, your leaves can also bring you some income.

In this post, let us understand – What is Leave Encashment? What are the new and latest leave encashment taxation rules? Is Leave encashment amount tax exempted? How to calculate Leave encashment tax exemption limit? What is the Leave encashment calculation formula?…

What is Leave Encashment?

Most of the companies allow you to encash the unused balance of leaves during your service or during resignation. You are also allowed to encash them on retirement. So, encashing the leave balance is known as ‘Leave Encashment’. (Leave encashment is a defined benefit scheme). Leave encashment rules fall under Section 10 (10AA)(ii) of the Income-tax Act.

Many organizations provide the facility of encashment of leave either;

- During the period of employment (or)

- At the time of retirement (including separation on account of resignation, retrenchment, VRS etc other than termination) of the employee (or)

- At the time of Termination of the employee.

Now, the question arises, if this leave salary is taxable or tax-free? Are the Leave encashment taxation rules same for Govt and Private employees?

Latest Leave Encashment (or) Leave Salar Tax Treatment Rules

For tax treatment of leave encashment under section 10(10AA) of Income Tax Act 1961, the employees have been classified into two types:

- Govt Employees and

- Non-Govt employees (PSU or Private employees)

Let’s note that if you (Gov/non-govt) receive leave encashment while you are in service, that amount becomes fully taxable and forms part of your ‘Income from Salary’.

I) Govt Employee & Tax treatment of Leave encashment (LC)

- During the period of employment / service, if an employee encashes any leaves, the entire LC amount is fully taxable.

- At the time of retirement or separation or resignation, LC is fully exempted from Income Tax.

- At the time of termination of employee, it is fully taxable.

| Leave Encashment amount received | Taxable / Tax-Exempt? |

|---|---|

| During employment / service | Fully Taxable |

| At the time of Retirement / Separation / Resignation | Fully Tax-exempt |

| On Termination of employment | Fully Taxable |

II) Non-Govt Employee & Tax treatment of Leave Encashment

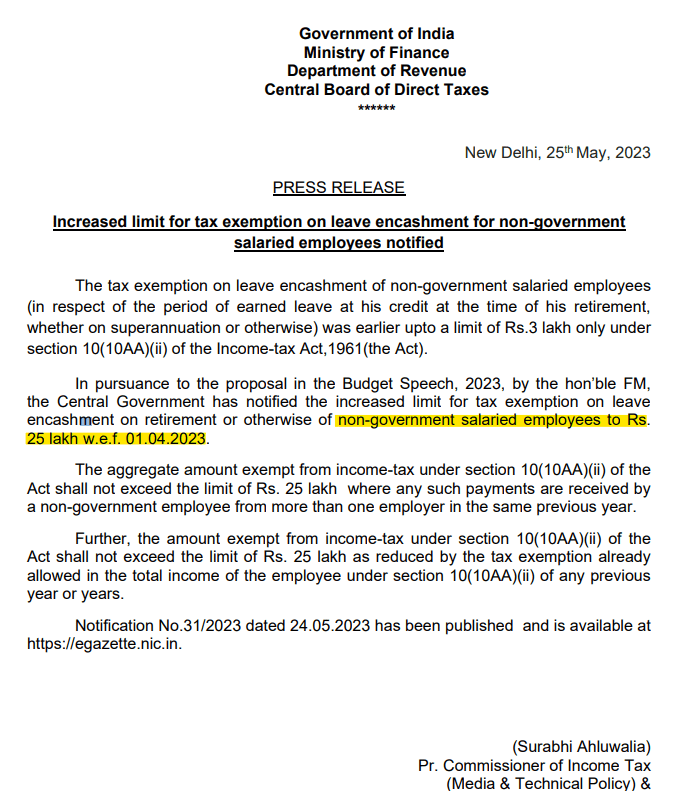

Previously, non-government employees could receive a maximum tax exemption of up to Rs 3 lakh on leave encashment. This limit was set in 2002 when the highest basic pay in the government was Rs 30,000 per month. This limit has been increased to Rs 25 Lakhs w.e.f 1st April, 2023.

The CBDT has recently released a latest notification (as below) on the increased limit of leave encashment.

- Any leave encashed during the period of employment / service is fully taxable.

- LC is either fully or partially exempted at the time of retirement or resignation. Tax Exemption on LC availed during retirement or resignation is least of the following:

- Rs 25,00,000.

- Actual Leave encashment amount that has been received by an employee.

- 10 months’ Salary.

- Cash (salary) equivalent of leaves that is available at the time of retirement. Leave calculation is done subject to maximum of 30 leave per completed year of service. (Do note that, least of these is exempted from income tax, the remaining LC balance (if any) is taxable)

- At the time of termination, it is fully taxable

| Leave Encashment amount received | Taxable / Tax-Exempt? |

|---|---|

| During employment / service | Fully Taxable |

| At the time of Retirement / Separation / Resignation | Tax-Exemption is least of the following;

A. Rs 25 Lakhs (new statutory limit) B. Actual leave encashment amount C. 10 months Salary (on the basis of average salary D. Cash equivalent of leaves that are lying credit |

| On Termination of employment | Fully Taxable |

(Definition of ‘Salary’ for Leave Encashment : Salary = Basic salary + Dearness Allowance + Commission)

The tax treatment and implications of LC are pretty clear regarding a Govt employee.

However, regarding LC by a non-govt employee, we need to do some calculations w.r.t ‘cash equivalent of leaves’ (point no 4).

Cash equivalent of leave at the time of retirement or resignation = { ( ( ( Y * C) – A ) / 30) * S }

- ‘Y’ is No of completed Years of service (you need to exclude part of an year, if any).

- ‘C’ is total no of leaves Credited per year. If company provides 40 leaves per year, for calculation purpose we need to take 30 leaves only.

- ‘A’ is total no of leaves Availed during the service (total no of leaves minus no of leaves that were encashed).

- ‘S’ is average salary for last 10 months.

Important points on Leave Encashment & Taxation:

- Leave credit is only on completed years of service. (If it’s 25 years 6 months, it should be taken as 25 years.)

- If leaves are credited at the rate of say 55 days leave for each year of service then calculation shall be made at the rate of 30 days leave only for each year of service . If, however, earned leave is credited at the rate of say 25 days leave for each year of service, calculation shall be made at the rate of 25 days leave for each year of service (w.r.t. above ‘cash equivalent of leave’ calculation).

- Has the Leave encashment tax Exemption limit been increased form 2023? Yes, Rs. 25 lakh is the maximum tax relief that an employee can claim in his/her lifetime.

- If you have claimed a tax exemption of Rs 20,00,000 during a financial year on receipt of leave encashment then a maximum exemption of Rs 5,00,000 can only be claimed in the future years.

- If you receive LC from two or more employers in the same year, then the aggregate amount of leave salary exempt from tax cannot exceed Rs 25,00,000.

- Is Leave Encashment amount received by a legal heir taxable? – Leave encashment received by your nominee / legal heir is not taxable for all types of employees.

- In case of Non-Govt employees, LC received at the time of resignation or retirement is either fully or partially (as explained above) exempted from Income Tax. For example – If leave encashment is Rs 25 Lakh (received by a pvt employee on resignation) and the actual exemption is say Rs 20 Lakh (as per above calculation) then Rs 5 Lakh is taxable (as per your income tax slab rate) and Rs 20 Lakh is exempted.

- Though the official notification (as above) has been issued on 25th May, 2023, this shall be deemed to have come into force w.e.f. 1st April, 2023. So, if you are retired between 1-Apr-2023 and 24-May2023, the employer would have assumed the tax-free limit to be Rs 3 lakh. You can revert to the employer and request for the additional amount of leave encashment if it was due.

- Where can I find details on my encashed leaves? – You can find Details of your Leave Encashment in Final settlement document / Salary Certificate / Form 16.

Continue reading:

- Resignation : Employee Benefits & Personal Finances – Checklist

- 13 FAQs on Gratuity Benefit Amount & Tax Implications

- EPF Interest Income & Withdrawals | Tax Implications | Is EPF Interest taxable?