Today, I am Perth giving a keynote presentation to the Royal Australian and New Zealand College of Psychiatrists (RANZCP) 2023 Congress. My talk is titled – Why fiscal fictions lead to inferior health policy outcomes. Given the travel time to the other side of the world (the continent at least) – us East Coasters get restless when we have to come here – and my commitments at the Congress, I haven’t time to produce a post. So today, thanks to our regular guest blogger Professor Scott Baum from Griffith University who has been one of my regular research colleagues over a long period of time, we have a discussion about fiscal fictions and higher education policy, which is a very nice dovetail to the theme of today. Today he is specifically going to talk about the current concerns about student debt in Australia. Over to Scott …

Background

When I completed my university degree (with excellent teaching by a certain Professor Bill Mitchell) it was largely free.

The free university education I received came to a screaming halt with the introduction of a Higher Education Contribution Scheme (HECS) by the Hawke Labor government in 1989.

The introduction of the scheme was part of a more widespread restructuring of the university sector in the wake of the – Report of the Committee on Higher Education Funding – aka the Wran Report (April 1988).

At the time:

The Committee on Higher Education Funding was asked to develop options for supplementing the funding of the Australian higher education system which could involve contributions from students, their parents, and employers.

The basic idea of the original program was that students were charged a fee of $1,800 per year with the balance of the cost being met by the federal government.

Students could pay their contribution (HECS) upfront or defer payment in which case they accumulated a HECS debt.

When a student accumulated a HECS debt they would repay the debt via the taxation system once their income reached a predetermined threshold.

The loans are interest-free.

However, the amount of debt is increased each year according to the Consumer Price Index.

The amount a student repays varies according to the level of income they receive and varies from 1 per cent of their income up to 10 per cent of their income.

The scheme has continued to the current day with various amendments and changes to the level of fees charged and the earning thresholds at which the debt is paid back.

In the most recent iterations of the program (now called the HELP program-HELP standing for the Higher Education Loan Program) governments have attempted to use the scheme as a price mechanism to lure students into certain degrees and areas of study.

The extreme of this approach was the former coalition government’s – Job Ready Graduates Package that aimed to:

incentivise students to make more job-relevant choices, that lead to more job-ready graduates, by reducing the student contribution in areas of expected employment growth and demand.

They did this by radically shaking up the payment tiers:

For example, a student studying humanities or social science courses in 2020 was liable for a student contribution of $6,684 pa, whereas someone commencing the same courses in 2021 has a student contribution of $14,500 pa. On the other hand, someone studying agriculture or mathematics had a contribution of $9,527 pa in 2020, which is reduced to $3,950 pa in 2021. Continuing students will pay the lesser of the amount their course is liable for in 2021 and the indexed 2020 levels. Thus, for example, a student continuing in communications qualification can only be charged $6,804 pa in 2021, while a new student in the same course could pay $14,500 pa.

A tax on graduates

There are most likely a lot of people who think that graduates should pay their way.

There would be the usual arguments about “taxpayers’ money” and “responsible spending” etc.

But the HECS/HELP repayments are an extra tax on graduates.

Once a graduate earns $48,361 (around $6000 more than the minimum wage) they start paying an additional one per cent of their income.

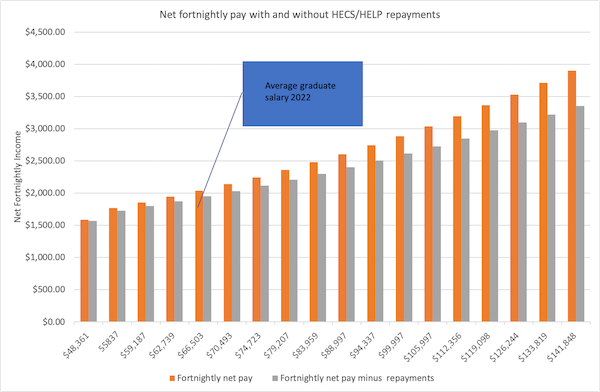

At the average graduate salary of around $68,000 they pay 3.5 per cent and once their income reaches $141,848 they pay an extra 10 per cent.

As the graph below illustrates, at lower levels of gross income the difference between take-home pay with and without a HECS/HELP debt is in the region of around $30 per fortnight, it ramps up to around $100 difference at the average graduate income and around $350 at the extreme end.

So we have the situation whereby graduates, who often have already forgone significant levels of income during the years spent studying are screwed a bit further by what is essentially an extra tax for their troubles.

But it doesn’t stop there.

Because the debt is indexed annually in line with the Consumer Price Index (CPI), the time it takes graduates to clear even a modest debt tends to blow out.

Let us assume that I have just completed my Bachelor of Economics (let’s hope the course is framed using a solid MMT lens).

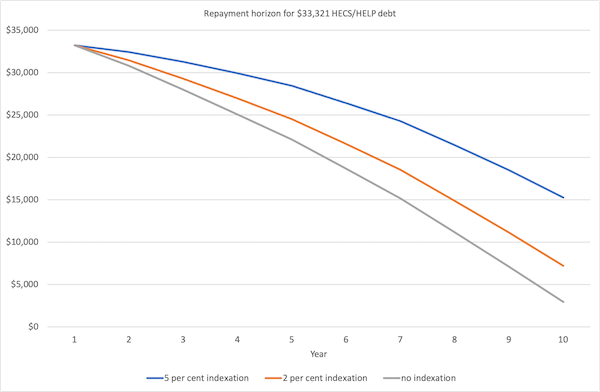

Given current fee structures my 3-year degree would have attracted a debt of $33,321.

Let’s also assume that I start earning the average salary for an economics graduate of $68,000 and that I am lucky enough to get an annual pay increase of 2 per cent.

The graph below illustrates the impacts of different indexation scenarios on my repayments.

At 5 per cent indexation, I would be left with a debt of around $15,000 after 10 years of constant minimum repayments.

At 2 per cent indexation, the same starting debt would be reduced to around $7,000 after 10 years.

If there was no annual indexation, my 10-year balance would be around $3,000.

These are fairly conservative scenarios.

There are lots of stories floating around at the moment about graduates facing significant levels of debt years after they have finished university because either their level of income has not been significantly high to put a dent in their balance and/or because annual indexation has simply wiped away any payments made.

For example:

1. How HECS and HELP debts have helped entrench women’s economic disadvantage (March 4, 2023).

2. Growing calls for student HECS-HELP loan indexation to be abolished as inflation sends debts soaring (April 3, 2023).

Such is the reward for obtaining a tertiary education!

A Call to Action

Given these types of outcomes, there have recently been calls for action on student debt targeting the level at which repayments kick in and also the indexation of debt.

Unfortunately, there has been no talk about wiping student debt and making tertiary education free.

In federal parliament, the Australian Greens party have been leading the charge as this UK Guardian report (January 28, 2023) – Inflation-driven higher education debt increases to hit millions of Australians – illustrates.

We read that:

Abolishing indexation on student debt and raising the minimum repayment threshold would be a good start, and provide much needed money in people’s pockets at a time when they are struggling to make ends meet or pay rent.

This ukg report (May 8, 2023) – MPs push to ease student debt burdens as record Help loan indexation looms – demonstrates that other politicians, including the newly elected independent MP Zoe Daniels argue that the scheme:

After being set up in the 1980s, Help is no longer fit for purpose and is overdue for independent review.

I agree! It was poorly conceived at the time and has become more problematic as time has passed.

Predictably, the suggestion that changes should be made to the system was met with a brick wall.

There were all the usual reasons – the government can’t afford it, it is unfair to taxpayers etc.

The argument that changing the threshold or freezing indexation will cost taxpayers is a complete furphy.

A furphy is a rumour or story, especially one that is untrue or absurd), perpetuated by those who do not understand the way government spending operates.

Sadly, this includes one of the architects of the original HECS program, Bruce Chapman (an economist) who frankly should know better, but I guess you can’t teach an old dog new tricks.

In an ABC news article (April 19 2023) on the government’s refusal to budge on HECS/HELP debt – Freezing HECS-HELP indexation won’t put more money in your pocket in the short term – Chapman was quoted as saying:

… having graduates pay indexation on their degree was still the fairest way to support university students.

Further:

In the absence of indexation, all taxpayers are paying for the opportunity cost of the debt.

To apparently help clarify his position he presented an example of a graduate with a $10,000 debt (pretty unrealistic given current rates).

He opined:

It might have taken that graduate a number of years to earn enough to start repaying the debt. And it might ultimately take them, say, 13 years to pay the debt back … By this time, that $10,000 might only be worth $8,000 in today’s money thanks to price inflation.

True, a dollar today is worth less tomorrow, but what is the problem?

He goes on to suggest that:

If the graduate pays back the $10,000 without any indexation, there is a gap of $2,000 that the government ultimately misses out on.

… If you just get the $10,000 back and no more, the government is subsidising that by a very large extent because price inflation is taking away the value of the $10,000.

Then he asks the big question:

Where’s the other $2,000 coming from? It’s coming from taxpayers.

Oh dear, what can I say?

Education as nation building

Governments of all persuasions are fond of talking up nation-building investment.

At times they seem obsessed with it.

This makes you wonder why they don’t treat education as an important investment in nation-building.

There is no end of research and reports that point to the national benefit achieved via a strong tertiary education sector (and all education for that matter).

Even in the original Wran report we read

The Committee agrees with the general arguments that it is in the interests of all Australians to have a better educated population for a variety of social, cultural and economic reasons. A better educated population strengthens our culture and promotes a fuller understanding of ourselves as a community. Australia’s future economic prosperity depends, in part, on access to a more flexible and responsive labour force, high quality research and development, and technological innovation, in all of which higher education has an important role to play.

If this was the view of the Committee, then why on earth did we go down the path of burdening graduates with an extra tax and debt that would take years to extinguish?

It was clear that while the importance of higher education was understood, the government’s emerging neo-liberal agenda meant that tertiary education was recast as a private good to be paid for by students.

The Wran report states:

Society in general benefits from higher education, but considerable private benefits accrue to those who have the opportunity to participate … While more and better higher education is an important national need, its achievement would involve a substantial drain on Government outlays if funded by the Commonwealth alone.

It would be fair to say that the development of the scheme was poorly informed by the facts.

Firstly, while it is true that individuals benefit from their tertiary education, the actual division between private and public benefits of tertiary education was never spelt out in the report.

Some research suggests that the public benefits outweigh the private benefits, but it is fair to say that the actual division is difficult to measure precisely.

See for example – Estimating the public and private benefits of higher education.

The papers do make a solid case for identifying the suite of public benefits that accrue from tertiary education.

Secondly, the idea that expanding the provision of services in the tertiary education sector would be a drain on government outlays is, as we know, patiently incorrect. A sovereign currency-issuing government faces no constraints on its ‘outlays’.

Time for a rethink

So how do we fix all of this?

If we accept that education and the development of skills and knowledge is an important nation-building investment, then the answer should be clear.

The government should immediately wipe all existing student debt and make higher education free to anyone who wishes to undertake it.

Added to this tertiary education institutions should be properly funded and dismantled from the current market-led approaches that have destabilised high education over the past few decades.

History has shown free tertiary education leads to desirable outcomes for individuals and results in positive wide-ranging benefits to the country as a whole.

The government just needs to get on and do what is right.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.