In This Article

A voided check is simply a check that you can no longer use to make a payment or withdraw money from your checking account. You may need to void a check for several reasons, including setting up online bill pay or direct deposit.

Voiding a check helps ensure others can’t cash or deposit money from your account. Because checks have important bank information on them, be sure to void them correctly when you don’t want to use them. Learn how to properly void a check below.

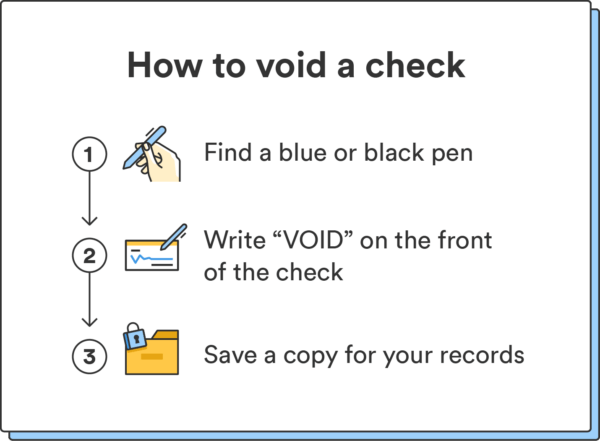

How to void a check

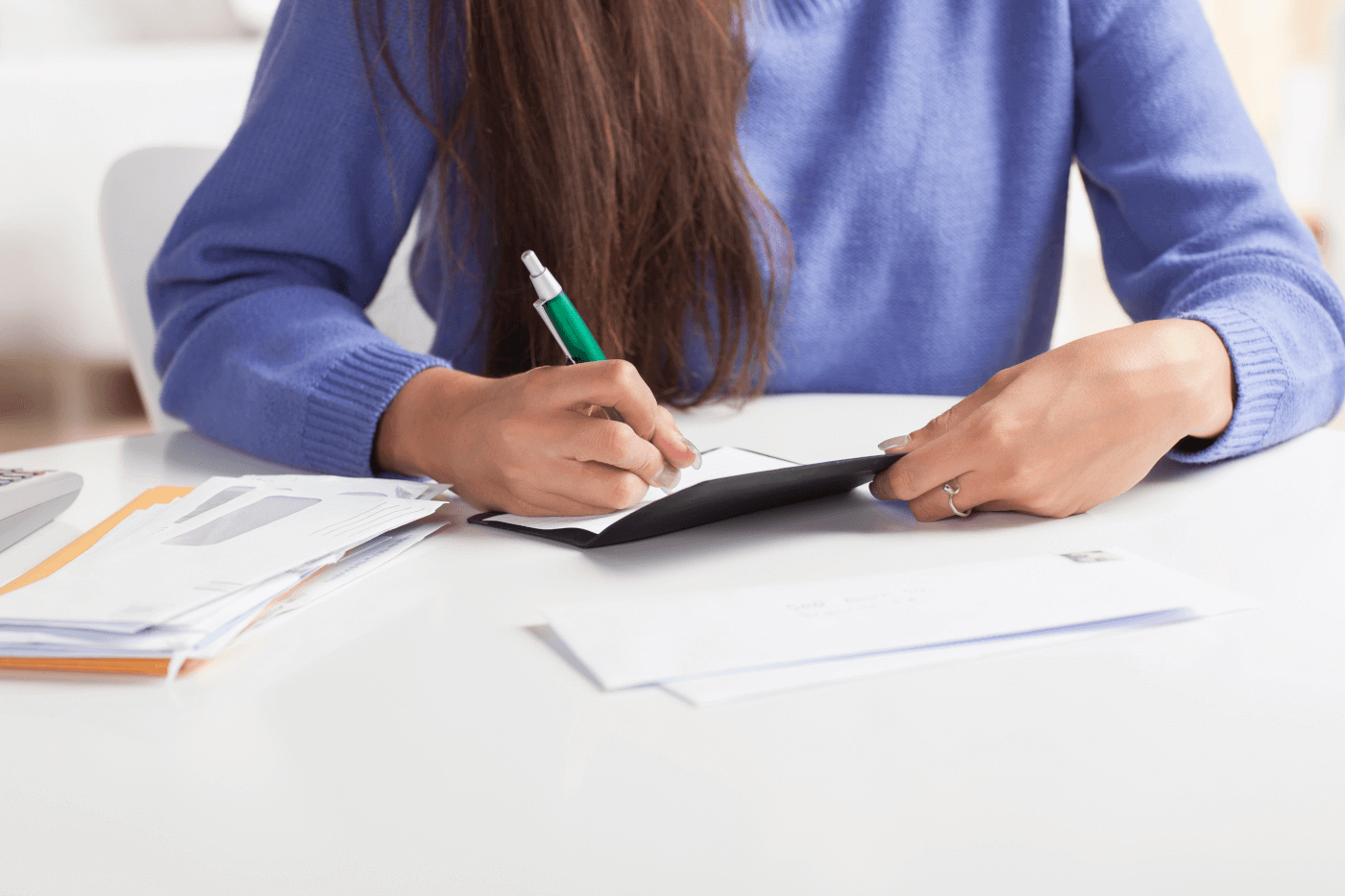

Voiding a check is simple and only requires a pen or marker, and the check you’d like to void. Here’s how to do it.

1. Find a blue or black pen

Find a blue or black pen to write with.

2. Write “VOID” on the front of the check

Write “VOID” in large letters across the front of the check. It’s okay if it covers up the different text boxes on the check.

You can also write “VOID” in a smaller font on the payee line, date line, amount line, signature line, and in the amount box.

3. Save a copy of the voided check

Make a note of the checking number and make a physical copy of the voided check to keep for your records.

Chime tip: Never give someone a blank check; they can fill it out with a higher amount or even use it fraudulently.

Reasons for voiding a check

You might need to void a check for several reasons. You may want to ensure no one else uses it, or you may need to present a voided check for someone to access and confirm your banking information.

Here are the most common reasons for voiding a check:

- To set up direct deposit: Setting up direct deposit requires giving your employer your bank account information, which you can quickly do by providing a voided check.

- To set up automatic bill pay: You can set up your car payment, mortgage, or other online bills for automatic payment. One autopay method includes submitting a voided check tied to your checking account.

- To complete automated clearing house (ACH) transfers: ACH transfers, such as businesses setting up payments to vendors, or sending an online payment to the IRS, may require a voided check.

- When you made a mistake on a check: If you wrote the wrong amount on a check, addressed it to the wrong person, or dated it incorrectly, voiding keeps others from using it.

Voiding a check makes it useless for payment or for withdrawing money. That way, you’re helping protect yourself if someone else finds your check.

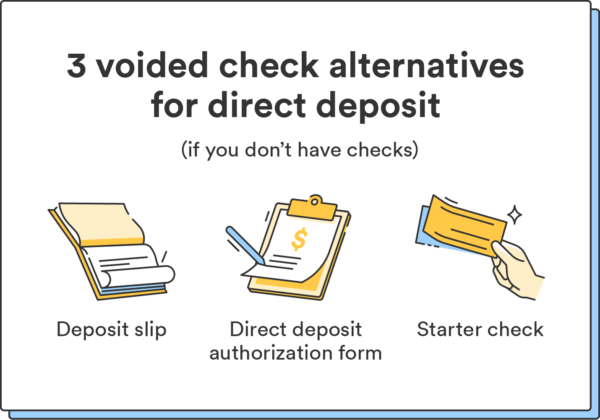

How to get a voided check for direct deposit if you don’t have checks

If your checking account doesn’t offer checks, you may be able to set up direct deposit in other ways.

- Use a deposit slip: If your bank offers deposit slips (these also contain your routing and bank account numbers), see if your employer would accept one instead of a check.

- Use a direct deposit authorization form: Your employer may offer a direct deposit authorization form – you can fill in your routing and bank account numbers on this form instead of a voided check.

- Request a starter check from your bank: Some financial institutions can print a starter check containing your account and routing numbers. If yours does, you can use this and fill it in like a regular voided check.

While some companies offer alternative ways to set up direct deposit if you don’t have access to checks, not all do. Be sure to speak with your employer to review your options.

Voiding a check made easy

Paper checks aren’t as common as they were before the rise of mobile banking. However, people still use them, so you’ll want to know how to correctly fill them out, use them, and get rid of them. If you decide to use a check, learn the correct way to void it to keep you and your money safe.

FAQs about how to void a check

Find any lingering questions about how to void a check below.

Can you go to the bank and get a voided check?

Yes, if your bank has a physical branch, you can speak with a teller and request a voided check. The bank can void the check by stamping or writing “VOID” on it.

How do you get a voided check online?

You can often get a voided check online by logging into your bank’s website or mobile app and selecting an option to request a voided check. Some banks also offer the ability to print a voided check directly from their website.

Why would you void a check?

You may need a voided check to set up a bank account, direct deposit, or automatic bill payment. You may also decide to void a check if you filled it out wrong or completed a mobile deposit and want to prevent others from using it.

What can someone do with a voided check?

A voided check still shows information about you and your bank account. It will likely have your name, address, bank name, account number, and routing number. If someone has your voided check, they can see and use all of this information.

Why do employers ask for voided checks?

Employers might ask for a voided check to set up direct deposit. They can then enter your account information and confirm that your paycheck is going into the correct account.

Do you sign a voided check?

No, you do not sign a voided check. Instead, just write “VOID” on it in large letters. When you void a check, it becomes invalid and unusable.

Can you cash a voided check?

No, you cannot cash a voided check. The purpose of a voided check is to certify your bank account information. Once you void a check, it becomes invalid and useless for payment.

The post How To Void a Check (the Right Way) appeared first on Chime.