Check-Cap (CHEK) (~$12MM nano cap) is an Israeli based clinical-stage medical device company that is trading well below cash and recently announced that it hired Ladenburg Thalman (they’ve generated a few buzzy reverse mergers in the past) to run a strategic alternatives process. The company previously was developing a colon cancer screening test but those efforts failed and alongside the strategic review announcement, Check-Cap also announced they are laying off 90% of their workforce, fully raising the surrender flag.

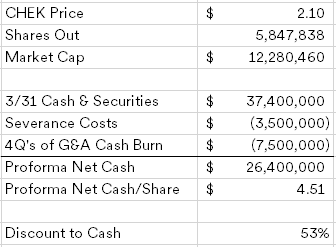

Running it through a really basic liquidation analysis (it should be noted the company didn’t include a liquidation in the list of strategic alternative options, but rather they’re looking at a sale, licensing agreement or reverse merger):

The severance costs for the 90% reduction in force weren’t disclosed, so that’s a guess, along with the G&A, but this one still trades at a wide discount to what it could distribute in a liquidation. Now there are some red flags, I don’t see a significant shareholder to protect shareholder interests and the foreign company listing and raising money in the U.S. risk is present here, although not entirely uncommon for biotech/bio medical device companies to be based in Israel.

Note this is a tiny company, don’t use market orders, but the discount here is wide enough for me to add a small position to my growing basket of broken biotech liquidation candidates.

Disclosure: I own shares of CHEK