Affle India Ltd. – Mobile Ad Player

Affle was founded by Mr. Anuj Khanna Sohum (CEO) in 2005-06. With moto of “Built to Last”, Mr. Sohum has successfully navigated Affle through several industry and technological changes faced by the dynamic ever evolving ad-tech industry over past 15+ years. Affle is a global technology company with a proprietary consumer intelligence platform that delivers consumer engagement, acquisitions and transactions through relevant Mobile Advertising. The platform aims to enhance returns on marketing investment through contextual mobile ads and also by reducing digital ad fraud. The company now has ~3.2 Bn connected devices. Affle 2.0 aims to reach more than 10 Bn connected devices including mobile smart phones, connected TV, smart wearables and out-of-home screens to enable integrated omnichannel online and offline consumer journeys.

Products & Services:

The Company caters to two types of Platforms.

- Consumer Platform – Delivers consumer recommendations and conversions through relevant mobile advertising for leading brands and B2C companies globally. This platform is subdivided into CPCU (Cost Per Converted User) & Non-CPCU (Cost per million impressions) models.

- Enterprise Platform – It provides end-to-end solutions to enterprises for enhancing their engagement with mobile users, such as developing Apps, enabling offline to online commerce for offline businesses with e-commerce aspirations and providing enterprise grade data analytics for online and offline companies.

Subsidiaries: As on FY23, the company had 21 subsidiaries.

Key Rationale:

- Smartphone Era – Share of mobile in India’s digital media spends jumped to 76% in FY21 (vs 45% in FY19), growing at 45% CAGR to US$1.9 bn. Favourable macro trends like i) huge base of smart phone users in India & emerging markets with lower penetration compared to developed markets, ii) increasing internet data consumption and mobile screen time driven by lower data costs and iii) growing adoption of m-commerce gave significant boost to mobile being used as a preferred channel for advertising. Affle is well positioned to ride this growth wave with >95% revenue coming from mobile advertising.

- Business Model – Affle’s Cost Per Converted User (CPCU) is a differentiated business model in an industry which usually operates on Cost per Media (CPM) (Media based business model) or Cost per Click (CPC) model. A CPCU model means that revenue is earned when a user is converted into a consumer by clicking on the ad followed by a download or purchase or registration; as opposed to CPM / CPC which earn revenues on a “per 1000 views” basis or merely “click basis”. Around 93% of the overall revenue is derived from the CPCU model of the company in Q1FY24. The company is currently focusing on high growth industry segments across E (E-Commerce, Edtech, Entertainment), F (Fintech, FMCG, Foodtech), G (Gaming, Government, Grocery) and H (Healthtech, Hospitality & Travel). Revenue contribution from these four categories is around 90%+ in Q1FY24.

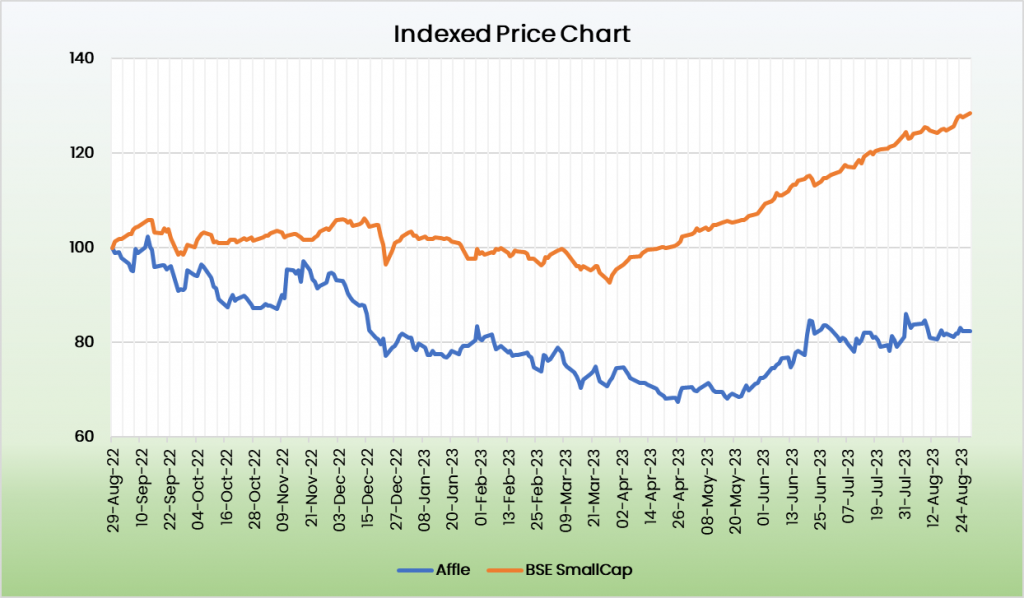

- Q1FY24 – In Q1FY24, Affle posted a revenue of Rs.407 crore, registering a growth of 14.3% on a QoQ basis and 17% on a YoY basis. Its consolidated EBITDA for the quarter grew by 9% QoQ and 15% YoY to Rs.78 crore, led by the sharp recovery in the international business. However, the company’s EBITDA margins declined by 80bps QoQ to 19.2%. It reported a net income of Rs.66 crore, up 6% QoQ. The CPCU business delivered 68.7mn conversions in Q1FY24 at a CPCU rate of Rs.55, totalling to a segment topline of Rs.380 crore. The company’s India business stood flat and reported a growth of 0.4% QoQ. On the International Business front, the company reported a healthy growth of 22% QoQ, led by robust device addition.

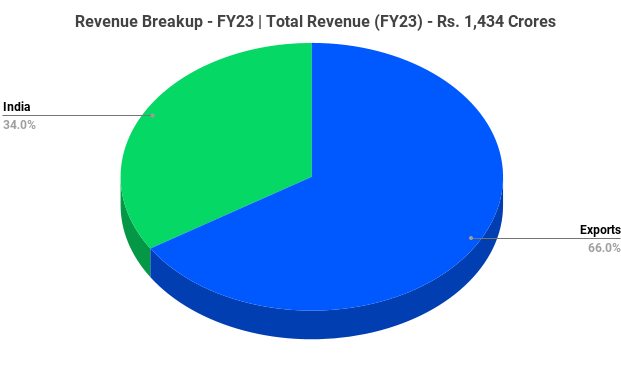

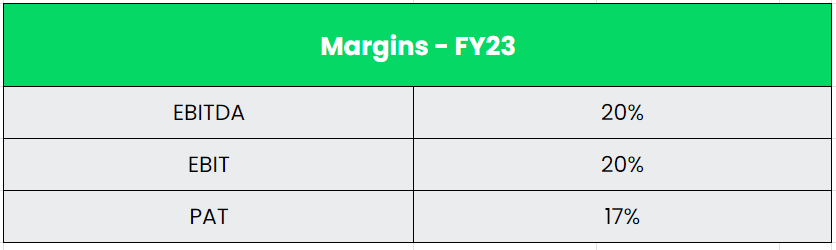

- Financial Performance – The 5 Year revenue and profit CAGR stands at 54% and 54% respectively between FY18-23. The balance sheet of the company is strong with a debt-to-equity ratio of 0.1x. The Operating Cash flow of the company has grown at a 44% CAGR from Rs.42 crore in FY18 to Rs.260 crore in FY23. The OCF/EBITDA ratio of the company stands at 90% in FY23 which indicates a strong cash conversion from EBITDA.

Industry:

India is the world’s second-largest telecommunications market with a subscriber base of 1,170.75 million in January 2023 and has registered strong growth in the last decade. The total subscriber base, wireless subscriptions as well as wired broadband subscriptions have grown consistently Tele-density stood at 84.51%, as of March 2023, total broadband subscriptions grew to 846.57 million until March 2023. The aggregated data consumed as on 31st December 2022 was 14,024,519 GB. As per GSMA, India is on its way to becoming the second-largest smartphone market globally by 2025 with around 1 Bn installed devices and is expected to have 920 Mn unique mobile subscribers by 2025 which will include 88 Mn 5G connections. It is also estimated that 5G technology will contribute approximately $450 Bn to the Indian Economy in the period of 2023-2040. Global Digital Advertising is riding on a strong growth and it is expected to reach $785 bn in 2025 from $381 bn in 2020 at a CAGR of 16%. Digital Ad spends as a % of total Advertising expense in India is at a mere 29% in 2021 compared to China with 82%.

Growth Drivers:

- Only half the world is online with US/UK at ~80% smartphone penetration and Emerging Markets trailing with much lower levels of smartphone penetration.

- In Union Budget 2023-24, the Department of Telecommunications was allocated Rs.97,579.05 crore (US$ 11.92 billion). Of this, US$ 48.88 million (Rs.400 crore) is for Research and Development, US$ 611.1 million (Rs.5,000 crore) is for Bharatnet.

- India is one of the highest consumers of data per day with approximately 5 hours of daily time spend on smartphones. Active internet users in India are expected to reach 900 Mn by 2025.

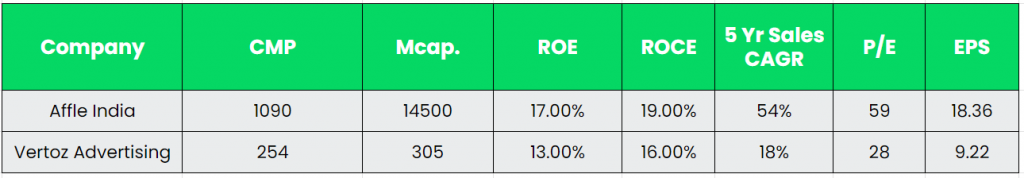

Competitors: Vertoz Advertising.

Peer Analysis:

There is no comparable listed peer because they operate in different geographies or service different parts of ad-tech value chain. Vertoz, is the only Ad-tech peer listed in Indian Markets. It offers programmatic advertising platform; however, it derives 90% of revenue from international markets and has revenue size of just ~5-6% of Affle.

Outlook:

Management continues to target upselling and cross-selling of AFFLE’s solutions, with unique ad placement across OEM and operator app stores. CPCU models provide CTV (Connect TV) solutions with household sync capabilities in the US and global emerging markets. The company has also successfully launched a full-funnel proposition on the iOS App Store, becoming a frontrunner on the Apple SKAN (StoreKit Ad Network) ecosystem. Management indicated that AFFLE is likely to achieve 20-25% growth in India and other emerging markets in FY24, and expects similar momentum in FY25. From a long-term perspective, the company expects to see multi-quarter tailwinds in device additions together with higher client acquisition, which should boost revenue potential. The company believes it is well-positioned to counter short-term challenges and has taken decisive actions in areas such as people, partnerships, products and platforms, which it believes will yield results in FY24, marked by project ramp-ups in Q2 and turnaround in Q3FY24.

Valuation:

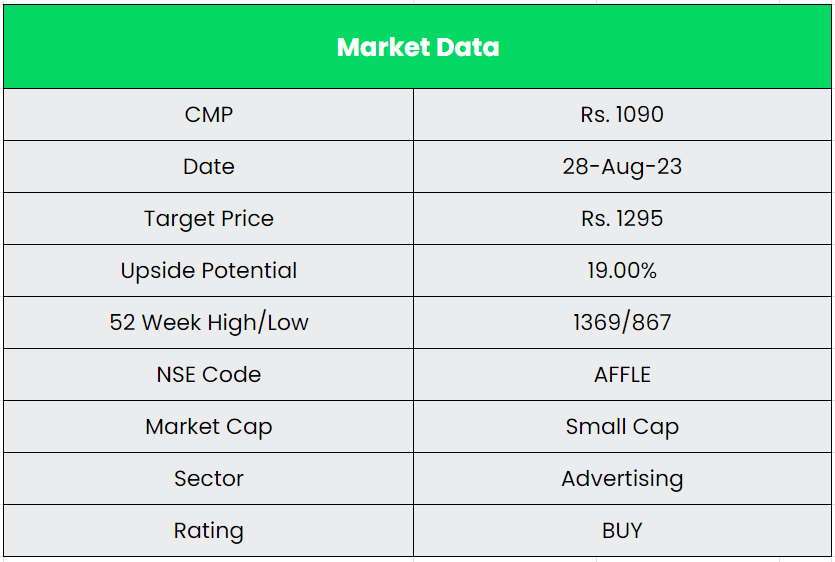

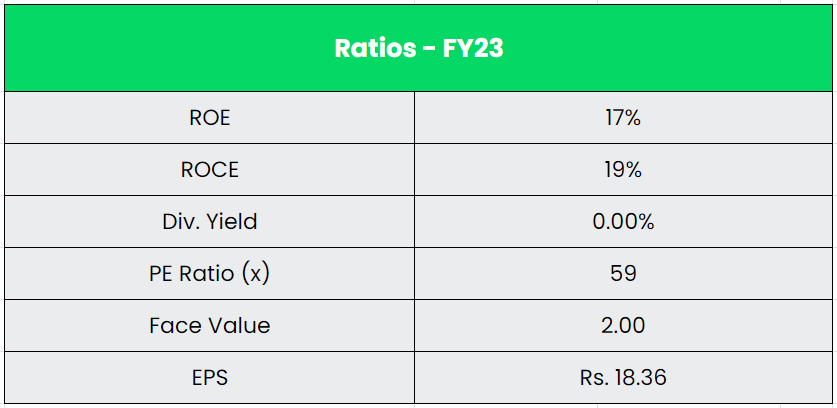

We believe Affle has a unique business model and a strong strategy to penetrate the targeted geographies and verticals. Also, the company has superior penetration in the international business and strong revenue growth potential going ahead. We recommend a BUY rating in the stock with the target price (TP) of Rs.1295, 47x FY25E EPS.

Risks:

- Regulatory Risk – The digital advertising business model is highly susceptible to data privacy regulations. Stricter regulations or restrictions on access to such direct or third-party data could increase the cost of compliance, adversely impact inventory and data cost, and reduce the accuracy and efficacy of existing algorithms.

- Competitive Risk – The market for mobile advertising solutions is highly competitive with several regional and global players. Besides Google and Facebook, there are several relatively smaller players, such as InMobi, Criteo, etc. who compete with Affle across various geographies.

- Economic Downturn – AdTech is inherently a cyclical business and has a high correlation with economic growth. Downturns typically lead to businesses cutting down on their discretionary spend, especially those related to advertising.

Other articles you may like

Post Views:

44