Debt is like a kiddie swing at your local playground—fun to get into, but a nightmare to get out of. The temporary fix with years of consequences.

So, how can you get out of debt? And perhaps more importantly, how can you get out of debt fast?

Enter the debt snowball method—

This one hits close to home for me. The debt snowball is actually how I erased $116,000 of debt before turning thirty. I created my own debt snowball spreadsheet, and it propelled me to pay off my debts in record time.

Over the past few years, I’ve refined the sheet, made it more robust, and now offer it to you—

It’s helped me and thousands of other people. Learn how to use it, and get out of debt now.

Want to set up your debt snowball spreadsheet in just a few minutes?

Head over to Etsy, make the small investment, get your instant download, and create a plan to become debt-free today. It comes with two download options – through Excel or Google Sheets!

One of our users, Redd, had this to say:

One of our users, Redd, had this to say:

“Great product! I can actually breathe a little better after entering all of my information and seeing a light at the end of the tunnel! Great customer service as well! Highly recommend.”

Check out our other debt snowball articles and tools:

Additional budget and investment resources:

Debt Snowball Method

Since the debt snowball method is the top choice for most finance experts and PhDs, you might expect it to be complex, but this couldn’t be further from the truth.

So, what is the debt snowball? Are you ready for a definition?

The debt snowball is a method of paying down your debts from smallest to largest.

That’s it. Seriously.

If you want to better understand the details of the debt snowball, see the simple process below.

Debt Snowball Steps

- Make the minimum payments on all the debts.

- Each month, apply any extra money you have to the smallest one.

- Pay off the smallest debt first.

- Move on to the new smallest debt.

- The interest you were paying on the first debt now gets snowballed into it.

- Keep the snowball going until all the debts are paid off, and you become debt free.

The debt snowball method is simple, yet extremely effective. I can attest to that with my $116,000 debt payoff, and Harvard backs up these claims with their fairly recent study: “Research: The Best Strategy for Paying Off Credit Card Debt”.

Want a better first-hand look at the debt snowball method spreadsheet? Click below for a video of the process:

Like what you see? Click here to get it for yourself.

(Want Something More? Check Out Our New Get Out of Debt Course!)

This is for those that want more. For those that want to pay off debt fast. For those absolutely hate their debt and want it gone for good.

This course includes the debt snowball spreadsheet, but also includes sooo many more extras!

This course includes…

- The debt snowball vs. debt avalanche calculator ($15 value)

- The weekly and monthly budget template ($10 value)

- An early mortgage payoff calculator ($10 value)

- 80 minutes of video instruction ($200 value)

- A complete slide deck of the video

- A full workbook

- And a live Q&A session with me in the next few weeks… ($100 value)

That’s $335 of value…all for just $79? Yeah, we’re doing that! Oh, and if you buy it and you’re not satisfied, we’ll give you a full refund.

We truly want to help as many people as possible.

If you want to get serious about your debt payoff journey, take the course. You won’t regret it. I can’t wait to meet you and hear your questions in the live Q&A!

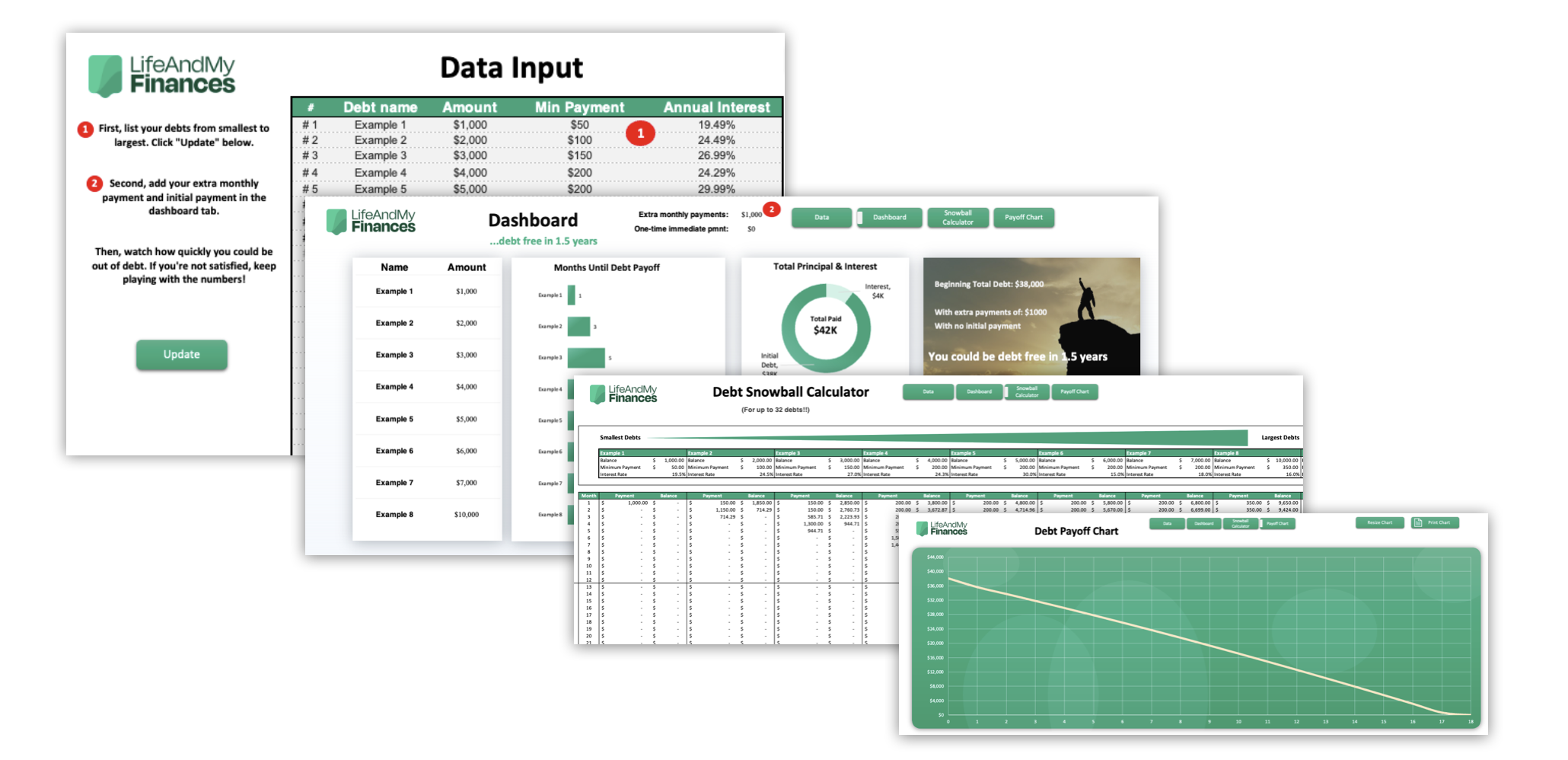

Debt Snowball Spreadsheet – Sneak Peek

In my opinion, the debt snowball Excel spreadsheet is the most impactful tool out there. This sheet will help lay out your debts and motivate you to do more. The result? You’ll pay off your debts in record time!

But how? Check out the screenshots of the debt snowball calculator below:

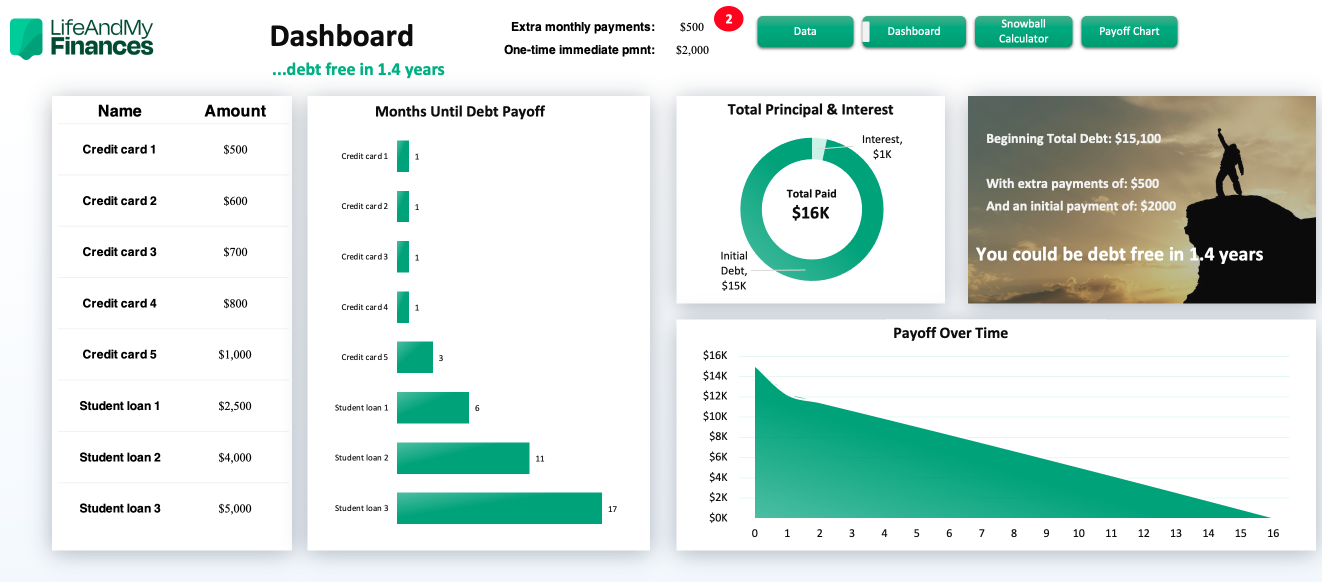

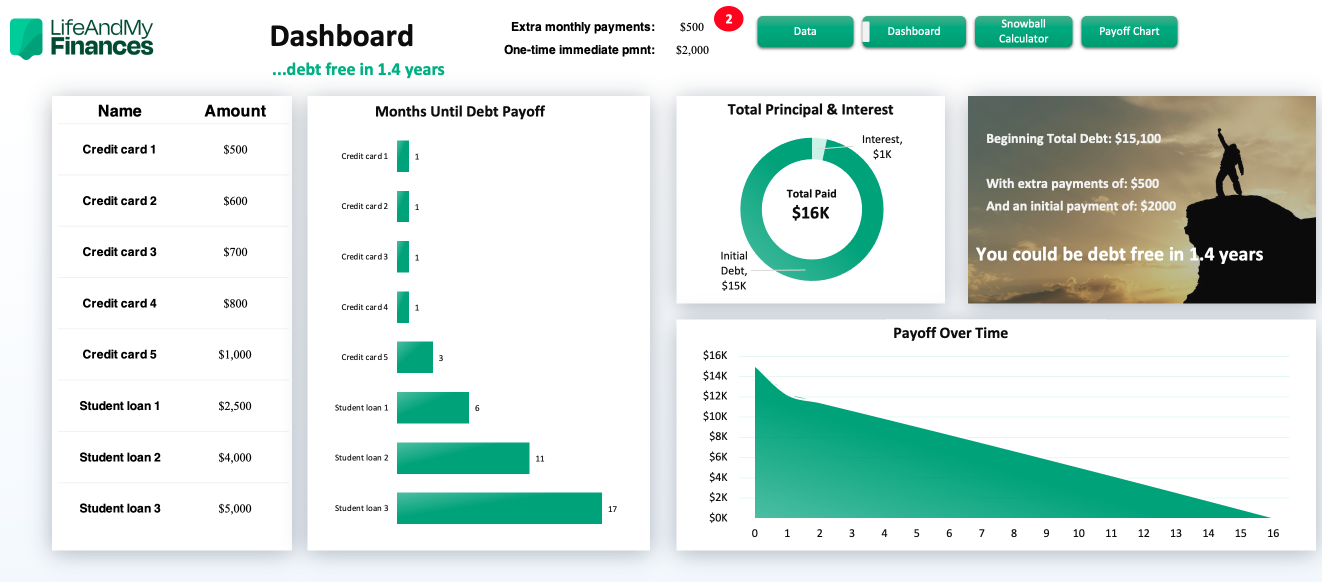

As you can see, I already populated the snowball with some debt entries. They are listed from smallest to largest.

See what happens immediately?

When you enter your debts into the data tab and click “Update”, the Dashboard shows you how long it will take to get out of debt when you only make your minimum payments.

Pretty cool, right? Just wait, it gets cooler.

Look at the top of the sheet (labeled as #2 in the screenshot). This section allows you to enter a larger monthly payment, and it gives you a spot for a one-time lump-sum payment.

Example

Say you’ve got $2,000 stashed away somewhere. Maybe you could bump up your additional monthly payment from $0 to $500 by taking on a part-time job.

Type that in and—whoa! This would cut down your payoff timeframe from 4.4 years down to just 1.4 years. For me, that would totally be worth the sacrifice.

Where to Find This Debt Snowball Excel Template

See what I mean when I say this debt snowball spreadsheet can motivate you to pay off your debts faster?

The above section was just a quick sneak peek of the tool. There are more instructions and tips later in this post.

Don’t want to wait for further instructions? Here’s a ready-made debt tracker spreadsheet: You can find it on our page for just $9.99. It holds up to 32 debts and has a chart, so you can visualize your debt payoff plan. Click and get an instant download.

Why The Debt Snowball Works So Well

Put simply, the debt snowball method keeps people motivated.

They see immediate progress, they’re inspired to keep going, and perhaps to do even more. What do I mean by this?

Let’s say you have three debts:

- Credit card = $9,000 at 17% interest

- Car loan = $2,000 at 3% interest

- Student loan = $8,000 at 7% interest

And, let’s say you have $400 extra dollars to put toward your debts each month.

With other debt payoff techniques, you might first start tackling the high-interest debt. In this case, that would be the $9,000 credit card at 17% interest.

Logically, it makes sense. Emotionally, it’s like prepping to climb Mount Everest, where you could have hiked up California’s Half Dome.

Do you think you’ll stay motivated for that 2-year stretch without paying off a single debt? Not likely! Instead of paying off your debts by highest interest rate first, you may want to give the debt snowball a shot and experience the power of the debt snowball effect.

The Debt Snowball Effect

How does the debt snowball effect work? Let’s explain it by taking you through the above example again, but with the debt snowball method this time.

Instead of waiting two years to pay off that first debt, with the debt snowball you’ll first tackle the smallest debt, the $2,000 car loan.

And what’s the result?

That car loan will be gone within 5 months!

You’ll feel great, you’ll be energized, and you’ll be ready to take down the next debt. This is why Harvard touts the debt snowball as the best debt payoff method out there.

This Method Will Build Momentum as Time Goes By

Those who choose the debt snowball method for paying off their debts often talk about how they built momentum as time went on.

In other words, they were able to pay off their debts faster and faster:

- With each debt payoff, there is more money (the minimum payments) to put toward the next debt.

- As you see progress, you’re inspired to earn more and cut back on expenses, so you essentially find more money to put toward your debts each month.

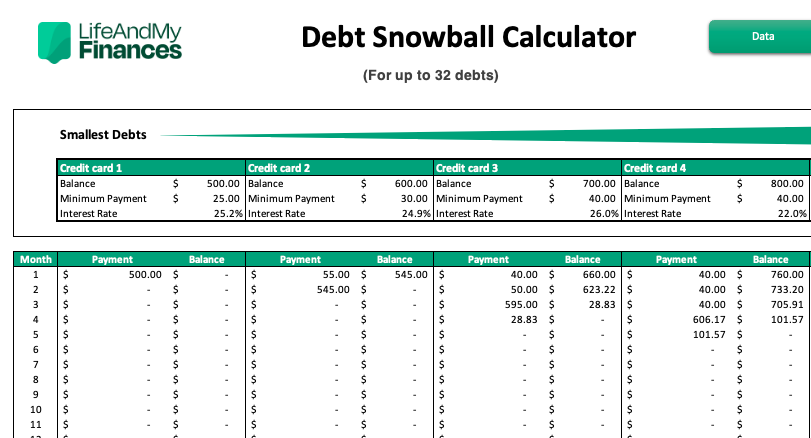

Snowballing Minimum Payments

We can visually see the first reason in the detail tab of the spreadsheet. After you pay off the first debt, you no longer have to make that minimum payment. So, you’ve got an extra $25 to put toward your next debt that you really didn’t have before.

Momentum With Progress

After paying off that initial debt, you might be so pumped that you decide to bartend on the weekends, which earns you an extra $500 a month. Plus, you might choose to cut your cable and save $100 a month.

Think I’m making this up? I’m not. This study actually proves it: “Psychological Momentum – The Key to Continued Success,” by Seppo E. Iso-Ahola and Charles O. Dotson.

The Main Benefits of Using the Debt Snowball Method:

- You’ll see immediate progress.

- You’ll stay motivated to continue to pay down your debts.

Other Debt Reduction Strategies

So far, we’ve spoken extensively about the debt snowball (not surprising though, since it’s proven to be the best method).

But what other methods are there? Might it make sense to follow a different method, given your circumstance?

Let’s check out the other debt reduction methods to see if one of them might work better for you—

The Debt Avalanche Method

The debt avalanche method is where you organize your debts from highest interest to lowest interest and pay them off in that order.

Continuing with the example from above, with the debt avalanche, we’d no longer pay off the car first, the student loan second, and the credit card debt third.

Instead, the debt avalanche would have us pay off the debt in this order:

- Credit card = $9,000 at 17% interest

- Student loan = $8,000 at 7% interest

- Car loan = $2,000 at 3% interest

This is the preferred method of all the Spock-like mathematicians out there. Based on the math alone, the debt avalanche method pays off more quickly than the debt snowball every time.

Debt Avalanche vs Debt Snowball

All else being equal, the debt avalanche pays off your debts faster than the debt snowball. But it won’t provide you with positive reinforcement as quickly.

The debt snowball will help you build up your motivation and is more likely to keep you on track.

Make an informed decision when picking between the two.

If you’re curious how both methods stack up, use my debt avalanche vs snowball calculator to model your financial future see how they compare—Debt Snowball vs Avalanche Calculator

Variation of the Debt Snowball

The “variation of the debt snowball” method is for those that might have similar debt balances in their snowball, but very different interest rates.

For example, let’s say the below is your debt snowball layout:

- Credit card #1: $1,000 at 12% interest

- Credit card #2: $9,000 at 9% interest

- Credit card #3: $9,500 at 28% interest

- Credit card #4: $12,000 at 14% interest

Look at debts #2 and #3. The balances are similar, but the interest rates are different. The slightly larger one is 28%, the smaller is 9%.

It makes a ton of sense to flip debts #2 and #3 around. In other words, set up your debt plan to pay off the larger interest rate first. You’ll save money, and it won’t change your momentum all that much.

Do some modelling yourself with our Free Debt Avalanche Excel Spreadsheet.

Stair Stepper Strategy

The stair stepper strategy is another variant of the debt snowball, but mixes in the mathematical elements of the debt avalanche—

- Lay out your debts from smallest to largest, just like you would for the debt snowball.

- Split your debts into several groups (i.e., if you have nine debts, perhaps make three groups—the low balance group, the medium balance group, and the high balance group).

- Within those groups, pay off the debts by highest interest first to lowest interest.

So, you’d still tackle the small debts first, but you’d start paying off the highest-interest debt of the small debt group.

This way, you still get the momentum of paying off the small debts first, but you also get the mathematical savings of paying each group down from the highest interest to the lowest interest.

User Defined Method

This debt payoff method is basically the free-for-all method. It’s up to the discretion of the debt holder.

Perhaps you have a personal debt that you owe your mom, and it’s just been eating you up inside. Put this item first on the list.

Maybe there’s the debt holder you’re just irritated with, and you’d rather pay it off last. Then, sure, put it last on the list.

I don’t condone this method, as it’s clearly not the most effective, but I totally get it. Sometimes we need to put things in order of our emotions, not based on momentum or the math. Do what you’ve got to do.

How to Make a Debt Snowball Spreadsheet

Are you wondering how to build and set up your own bill payoff spreadsheet?

It’s not hard to set up the structure of a debt snowball worksheet, but it is incredibly difficult to get all the formulas right so that your sheet calculates the correct amounts at precisely the right time.

If I were you, I’d simply visit my Etsy page and choose the debt payoff worksheet that works best for you. You can pay as little as $3.99 for the 16-debt version of the debt snowball or the debt avalanche.

But if you’d still rather build your own debt tracker spreadsheet, see below for the steps I’d take to do it—

Step-By-Step Process For Making a Debt Tracking Spreadsheet

- Open a blank page in Google Sheets or Excel.

- List your debts across the top with your balance, interest, and minimum payment amounts.

- Add a column for months and extra payments on the left-hand side.

- Be sure to have columns for “payment amount” and “balance amount” for each debt.

- Add a column for months and extra payments on the left-hand side.

- Be sure to have columns for “payment amount” and “balance amount” for each debt.

- Enter a calculation like the below to reduce the balance each month, or calculate it manually.

- To include the interest incurred during the prior month, be sure to include a formula like the below (taking 1/12 of the annual interest since there are 12 months in each year):

- Adjust the calculations at the point where each debt pays off (since you’ll need to have some dollars applied to the first debt and then the remaining amount to the next debt).

- Once you work your way through all the cells, you’ll have your own personalized debt snowball worksheet. (Yes, setting this up is a pain.

Honestly, consider purchasing the pre-made dynamic tool that took us years to craft. It’s well worth the $9.99.

If you do decide to download one of the debt snowball spreadsheets, all you need to do is enter your debt amounts, interest rates, and minimum payments. It’ll take you, like, 3 minutes. Seriously. The tool automatically calculates everything.)

How to Create a Debt Reduction Plan

If you want to pay off your debts badly, you’ll want to ensure success, which means you should have a plan of attack.

Here’s the debt reduction plan I followed a few years back—

- Negotiate interest rates on your debt.

- Be certain that you’re adequately insured for medical, auto, and home (to protect yourself from accidentally going deeper into debt).

- Save up one month’s worth of expenses in your savings account (typically $2,000 or so).

- Follow the debt snowball method and start paying down your first debt.

- Sell anything you’re not using and use that money toward your debts.

- Track your expenses from the past six months, and cut out anything you can.

- And do whatever you can to earn more (side gigs, overtime, ask for an overdue promotion, etc.).

You Can Negotiate the Interest Rates

A little public service announcement here—

Before you pay down any debts, write down all your loans and call the debt holders. Let them know that you’re doing your best to pay all your bills, but that you could really use some help.

When trying to reduce interest rates on your credit cards, Experian recommends that you—

- Start with the card you’ve had the longest.

- Ask for a temporary break if necessary.

- Try again if it didn’t work the first time.

- Call the rest of your issuers.

If you have debts in collections and have some money in savings, you could always offer to pay off the debt at a severely reduced amount (say, 25%–50% of the current balance). If they accept, great! But always get the agreement in writing.

How Do I Decide On a Debt Reduction Plan?

Review the debt reduction plan that I followed when I got myself out of $116,000 worth of debt.

If you like the plan, go with it. If you want to make it your own, you can do that too. It’s your debt. It’s your life. Do what feels right to you.

How to Use This Debt Snowball Excel Spreadsheet in Excel and Google Docs

So far, we’ve gone through the basics of the debt snowball Excel spreadsheet, but there’s even more you can do with it—

Download Your Free Debt Snowball Excel Template

We currently offer the 16-debt and the 32-debt tracker tools on Etsy. The current rate is $3.99 and $9.99, respectively.

If you don’t have that many debts, or if you just want to get a feel for the tool, we also offer a free debt snowball worksheet. Download the free debt tracker spreadsheet right here.

If you have Excel, just open the download once it’s fully loaded. Be sure to enable editing once you open it, so you can enter all your debt numbers. What if you don’t have Excel? And what if you’re a Mac user? Don’t worry. The free tool and the Etsy downloads can all be used in Google Sheets and Mac Numbers.

Related:

Debt Snowball For Google Sheets

Our debt snowball template is compatible with Google Sheets as well. And actually, we created a download specifically for Sheets to make sure you get the best experience.

So whether you download the 32-debt snowball tool or the freebie, both come with a Google Sheets download along with the Excel version.

Debt Snowball Spreadsheet For Mac

If you’re a Mac user, it’s best to use Google Sheets with this debt snowball tool. When you make your purchase on Etsy, just choose the link for Sheets instead of the Excel file.

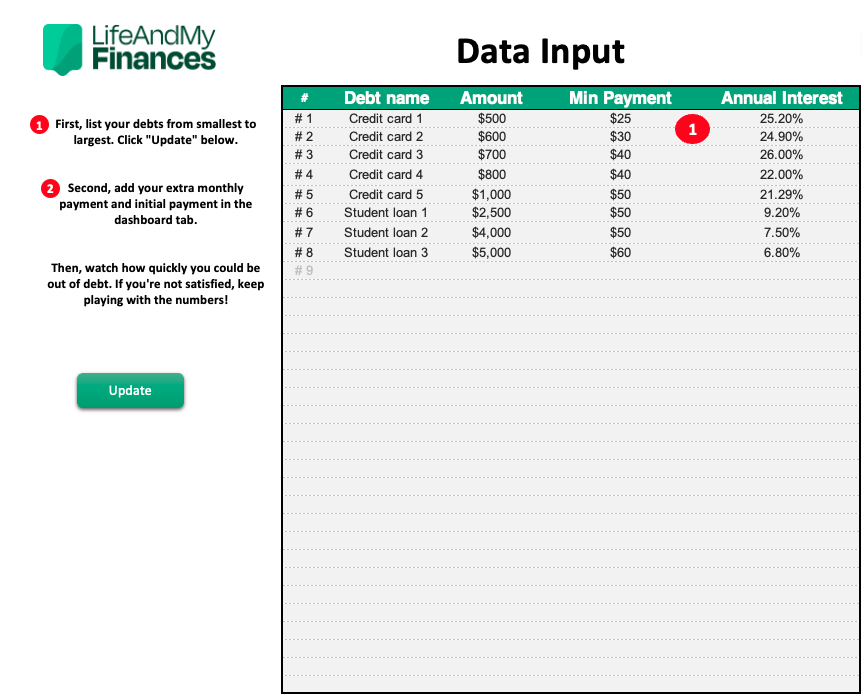

Enter All Your Debts Into The Debt Snowball Calculator

Once you have the file open, click on the data tab and update all example debts with your debts.

Then enter the appropriate balance amounts, minimum payments, and interest rates for each debt. Then click, “Update”.

I updated the sheet with some sample numbers. See the example below:

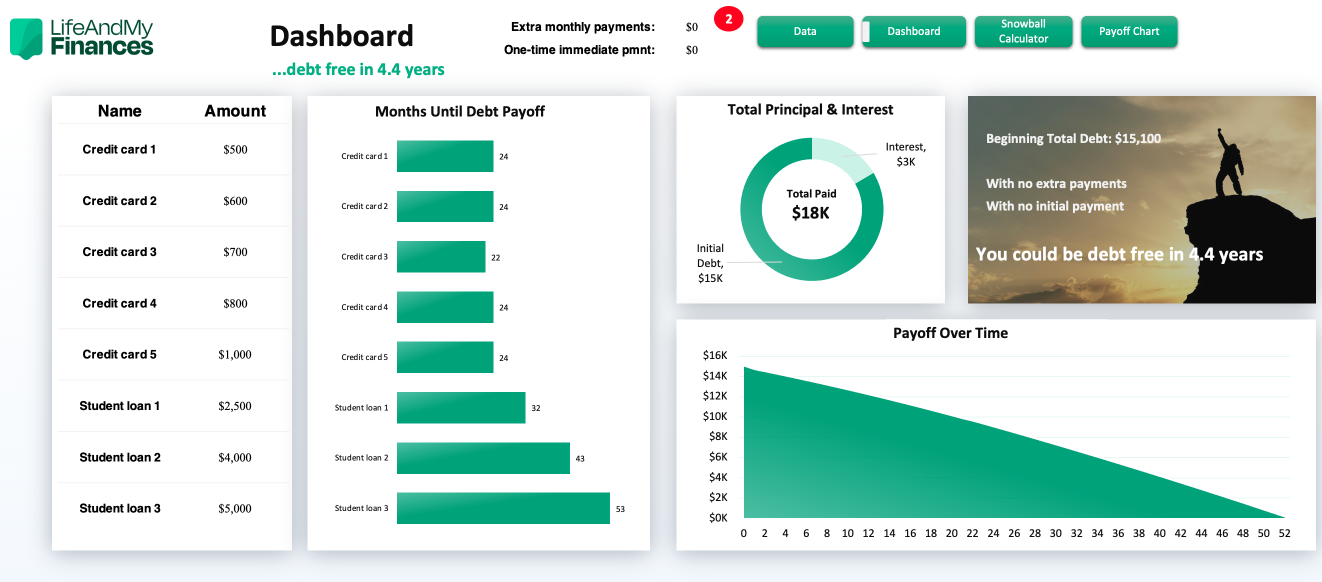

Calculate Your Debt Payoff Timeframe

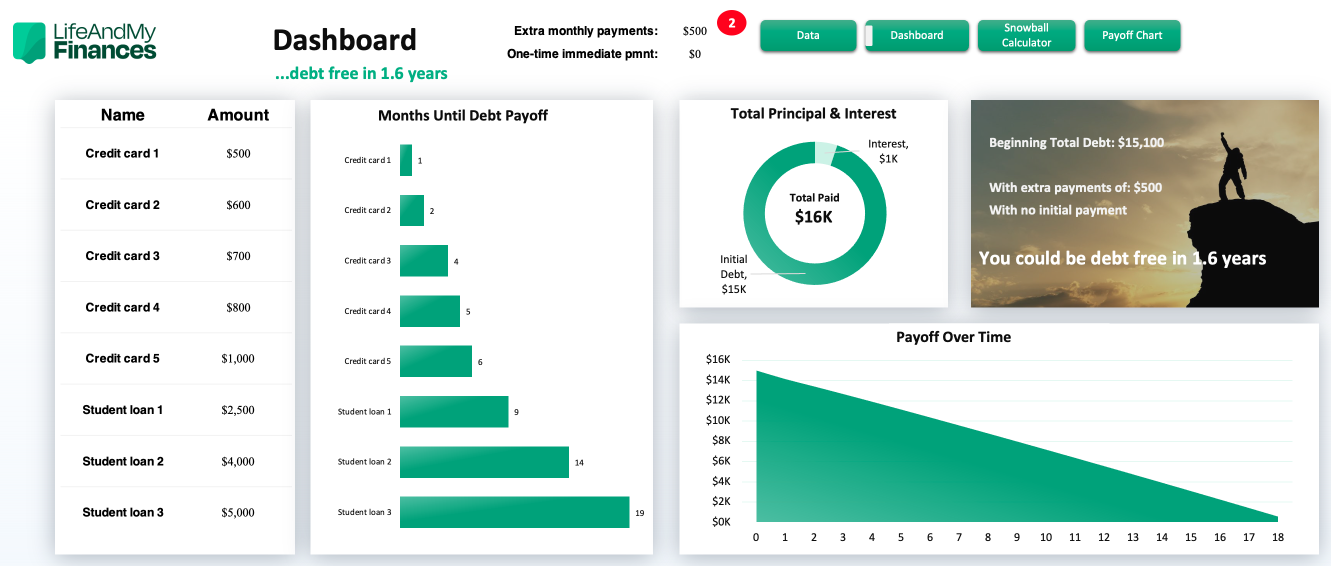

In the Dashboard tab, enter your “Extra monthly payment” and your “One-time start-up payment” (this is if you just sold something or had a significant savings amount you want to throw at the debt immediately).

Let’s say we can put an extra $500 a month toward our debts.

See the updated debt snowball tracker below:

As you can see, by paying an extra $500 a month, we’ll be able to snowball them and escape the grips of debt in just 1.6 years (instead of over four years).

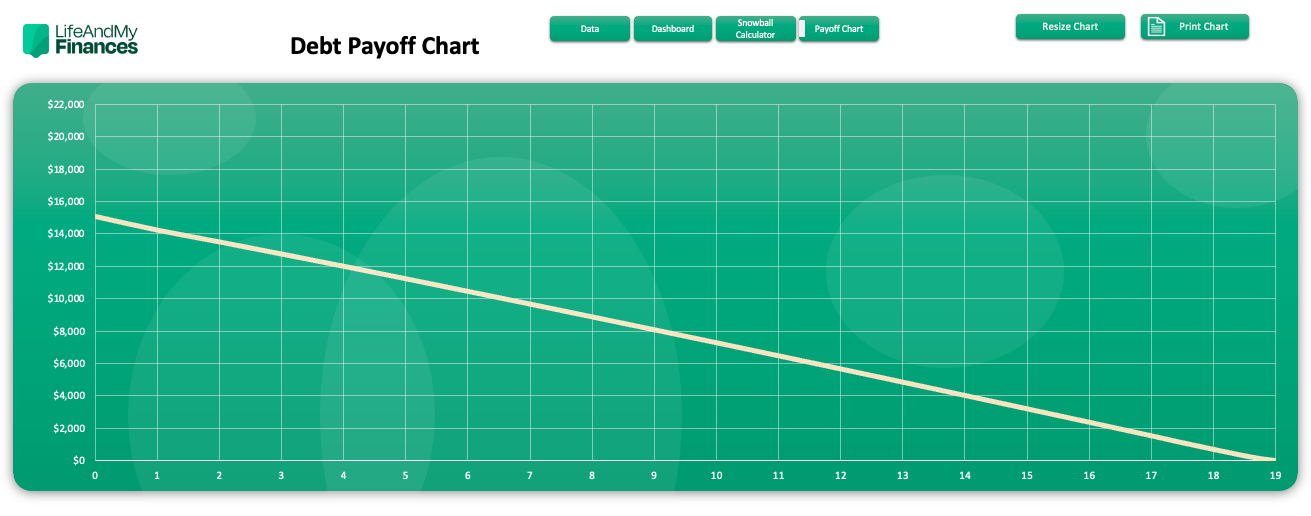

Review the Debt Snowball Chart and Table Results

Take a look at the chart and the table for your payoff cadence. What do you think?

- Are you satisfied with getting out of debt in that timeframe?

- Is there more that you can do to speed up your debt payoff journey?

If you’re not yet satisfied, take the next step very seriously. It could dramatically speed up your debt payoff timeline and quite possibly change your life forever.

Improve Your Debt Snowball Calculator With Extra Payments And One-Time Initial Payment

In our previous example, we discovered it was going to take 1.6 years to pay off our credit cards and student loans. I’m a rip-the-band-aid-off kind of guy, so I’d rather make that timeframe as small as possible.

- What if I sold a bunch of stuff?

- What if I cut my expenses down to nearly nothing and earned more money on the weekends?

- Could I get out of debt in six months? Maybe less?

This is the true beauty of this tool. Let’s find out what’s possible—

If I were able to come up with $2,000 by selling a few things, and if I could increase my disposable income to $500 a month, I could get out of debt in just 1.4 years. That’s significantly faster than the original 4.4 years!

Customize Your Snowball to Suit Your Needs

What could your debt payoff picture look like? I encourage you to download one of the debt snowball tools and play around with it. Chances are, you’ll discover that you’re not as far away from debt freedom as you originally thought.

How to Use This As a Debt Tracker Spreadsheet

People often use ‘debt spreadsheet’ synonymously with ‘debt tracker’, but the first is really for setting up your debt and making a plan. The latter is actually tracking your debt payoff progress along the way.

So, how can you use this sheet as a true debt tracker?

It’s pretty simple, really. First, if you hit your goals each month, note that you will not need to change your debt snowball.

If you come short of your goals or exceed them each month, you can simply hop into the cell for that specific month and debt and just add or subtract the difference. The calculation should still hold true.

With this method, you can update the debt snowball spreadsheet as you go and use it as a live tool for your entire debt payoff journey.

Time to Kill Your Debt With Your Debt Reduction Calculator

Are you ready to slay your debt? The first step is to download a simple debt snowball spreadsheet. The rest is up to you.

Choose from the options below and get after it—

Free Debt Snowball Spreadsheet Download (up to 8 debts)