What is the Historical Interest Rate of Sukanya Samriddhi Yojana (SSY) – 2015 to 2023? Let us see how the SSY interest rate evolved from the launch date of 22nd Jan 2015 to today.

Sukanya Samriddhi Yojana (Account) is a Small Savings Special Deposit Scheme for girl child. This scheme is specially designed for girls’ higher education or marriage needs. To know more about Sukanya Samriddhi Yojana or SSY Account, refer to my earlier posts:-

As you may be aware the Government will announce the interest rate of Sukanya Samriddhi Yojana interest rates on a quarterly basis, which you may find difficult to track. Hence, I am compiling the interest rate movement and bringing it in a single post for your reference.

The Government launched the Sukanya Samriddhi Yojana on 22nd January 2015. Hence, first, let us understand the historical returns of the Sukanya Samriddhi Yojana Account from 2015 to FY 2023-24.

Historical Interest Rate of Sukanya Samriddhi Yojana (SSY) – 2015 to 2023

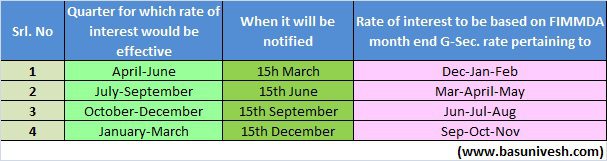

As I told you, this plan was launched by the Government Of India on 22nd January 2015. At that time for FY 2014-15, the interest rate was fixed at 9.1%. The interest rate for FY 2015-16 was fixed at 9.2%. However, from FY 2016-17, the rate of interest will be fixed on a quarterly basis. I already wrote a detailed post on this. I am providing the link below to understand this important change.

Below is the timetable for change in interest rates for all Post Office Savings Schemes.

Below is the Sukanya Samriddhi Yojana (SSY) Interest Rate 2015 to 2023.

| Historical Interest Rate of Sukanya Samriddhi Yojana (SSY) – 2015 to 2023 | |

| Financial Quarter | Interest Rate |

| 22nd Jan 2015 to 31st March 2015 | 9.10% |

| 1st Quarter of 2015-16 | 9.20% |

| 2nd Quarter of 2015-16 | 9.20% |

| 3rd Quarter of 2015-16 | 9.20% |

| 4th Quarter of 2015-16 | 9.20% |

| 1st Quarter of 2016-17 | 8.60% |

| 2nd Quarter of 2016-17 | 8.60% |

| 3rd Quarter of 2016-17 | 8.50% |

| 4th Quarter of 2016-17 | 8.50% |

| 1st Quarter of 2017-18 | 8.40% |

| 2nd Quarter of 2017-18 | 8.30% |

| 3rd Quarter of 2017-18 | 8.30% |

| 4th Quarter of 2017-18 | 8.10% |

| 1st Quarter of 2018-19 | 8.10% |

| 2nd Quarter of 2018-19 | 8.10% |

| 3rd Quarter of 2018-19 | 8.50% |

| 4th Quarter of 2018-19 | 8.50% |

| 1st Quarter of 2019-20 | 8.50% |

| 2nd Quarter of 2019-20 | 8.40% |

| 3rd Quarter of 2019-20 | 8.40% |

| 4th Quarter of 2019-20 | 8.40% |

| 1st Quarter of 2020-21 | 7.60% |

| 2nd Quarter of 2020-21 | 7.60% |

| 3rd Quarter of 2020-21 | 7.60% |

| 4th Quarter of 2020-21 | 7.60% |

| 1st Quarter of 2021-22 | 7.60% |

| 2nd Quarter of 2021-22 | 7.60% |

| 3rd Quarter of 2021-22 | 7.60% |

| 4th Quarter of 2021-22 | 7.60% |

| 1st Quarter of 2022-23 | 7.60% |

| 2nd Quarter of 2022-23 | 7.60% |

| 3rd Quarter of 2022-23 | 7.60% |

| 4th Quarter of 2022-23 | 7.60% |

| 1st Quarter of 2023-24 | 8.00% |

| 2nd Quarter of 2023-24 | 8.00% |

| 3rd Quarter of 2023-24 | 8.00% |

If we draw the same using a chart, then Sukanya Samriddhi Yojana (SSY) Interest Rate 2015 to 2023 looks like below.

Just to make sure that you identify the financial year, I have used a different colour for each financial year.

Who can use the Sukanya Samriddhi Yojana Account?

Even though it is giving us wonderful tax benefits, and returns exactly like PPF, I suggest you consider this as a debt product for your kids’ education goal. Hence, don’t use or rely on this product completely to accumulate the corpus for your kids’ education goal. You must combine debt (PPF, Sukanya Samriddhi Yojana, or Debt Mutual Funds) and equity Mutual Funds to reach your financial goals.