At the time of writing this post, Nifty touched the mark of 20,780 – an all-time high. Should I invest lump sum when market is ALL TIME HIGH or wait for fall?

Refer to my latest post – “Top 10 Best SIP Mutual Funds To Invest In India In 2024“.

There is a fear among investors especially if you are trying to invest your lump sum when the market touched an all-time high. Fear of MISSING or fear of LOSING both are high during such levels. What do we have to do? What steps to follow and what caution do we have to take?

Should I invest lump sum when market is ALL TIME HIGH?

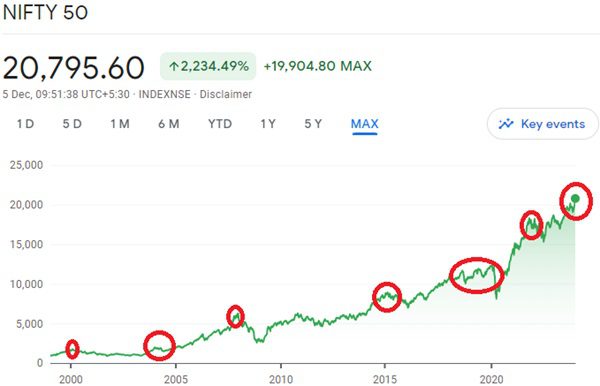

Let us try to look back at the history of the Nifty.

If you have a look at the above chart, you will notice that there are many such all-time high periods in the past. Hence, this is not new and this is not going to be an end also. In such a situation what should be our strategy to invest lump sum when market is ALL TIME HIGH?

# Identify your financial goal

Before jumping to choosing an asset class, it is of utmost importance to identify your financial goals. They may be your kid’s education, kids’ marriage, or retirement goal. Once you identify your financial goal, the next step is to identify the time horizon left to achieve this goal and the amount required to achieve this goal.

Before investing a single penny (whether monthly or lump sum), having clarity about this is very important. Once you have done this exercise, then the next step is understanding your RISK appetite.

Sadly this is the most tricky and changing task. It all depends on your past financial life, current financial life, and how you look at the risk. Risk-taking ability changes based on person to person, age, financial status, and type of goals.

If you can’t judge this, then better to take the help of a fixed fee-only financial planner who offers conflict-free advice (just someone is SEBI RIA does not mean they offer conflict-free advice. Even if someone planning to retain his clients forever for his income, then this also as per me is a conflicting relation). Hence, be cautious while choosing a planner for this exercise for you.

# Asset Allocation

Once you identify your financial goals, time horizon, amount required, and your risk appetite the next step is to allocate your money towards various asset classes based on your knowledge and understanding of those assets like Gold, Debt, Equity (direct or through MF), or Real Estate.

Ideally, if your goals are less than 5 years, then never enter into the equity market (whether direct stocks or mutual funds). However, if your goals are around 6-10 years, then allocate around 40% to 50% in equity and the rest in debt (or other assets with which you are comfortable). However, if your goals are more than 10 years, then you may allocate around 60% in equity and the rest in your comfortable non-volatile assets like debt.

Why asset allocation? Because no asset class is PERFECT for you. All assets have their positives and negatives. More than that, we don’t know which asset class will perform best in the future. Hence, when we are living in such an uncertain world, it is always better to diversify our investment.

# If you are already a goal-based investor

If you have already done this exercise of identifying goals, risk analysis, asset allocation, and doing the investment, then cross-check your current asset allocation. If there is any deviation in the defined asset allocation to the current, then fill the gap with this lump sum money to align as per your targetted asset allocation.

Having a lump sum is an advantage as without altering the existing asset classes, you can easily bring it back to the suggested asset allocation. Otherwise, withdrawing the money from a higher allocated asset class means you have to bear certain costs like tax (or sometimes exit load).

Hence, do this exercise as a priority and sleep calmly.

# If you still have to invest a lump sum in equity

After doing the above exercise, if you still have to deploy a lump sum to bring it to the suggested asset allocation, then you have to now think of how to invest lump sum when market is ALL TIME HIGH?

Ideally, in this finance world, there is no such standard or defined answer to say that this is a FOOLPROOF strategy to invest lump sum when the market is all-time high. However, to avoid mental trauma (in case the market falls drastically in the future), you can follow the below strategy.

- Do remember that you are entering the equity market for your medium-term and long-term goals but not for short-term goals. Hence, even if there is a market crash post your entry (which NONE can predict), then mentally prepare yourself for this, and as I mentioned you are not relying on this single asset class to achieve your financial goal.

- If you are bringing in the lump sum from equity and moving to equity (maybe for various reasons like trimming your funds, cleaning your portfolio mess, or due to prolonged underperformance of active funds), then in my view, no need to wait. Just move as a lump sum. Mainly because you are not entering freshly to equity. Instead, the movement is from equity to equity. Hence, you can invest in one go.

- However, if you are bringing in the lump sum freshly from your other sources or the debt, then you must not follow the lump sum that goes to equity.

- As I mentioned above, there is no such standard rule to say or define what is LUMP SUM. For few the monthly investment is Rs.5 lakh and for few lump sum means Rs.5 lakh (a big amount if someone is doing a monthly investment of Rs.50,000).

- Hence, define how much BIG the amount is on your OWN (without looking at what the financial world will preach to you with certain standardized rules). If you can’t identify the same, then take the help of your planner (if you have any).

- If you feel the lump sum amount you are deploying to equity is big, then stagger it for 6 months, 12 months, or 24 months (if the amount is too big). Few follow weekly or once in a 15-day strategy too. However, I usually do not suggest this. Mainly because for many investors, doing this is not a PRIMARY profession. You have to deal with your profession and family too. Hence, don’t think too much. Also, don’t bother too much during this phase about fear of missing out, lower exposure to equity, or market downfall. Neither you are aware nor even the god also. Hence, just deploy it slowly into the equity.

- Now the question is how to deploy this monthly. Can we do STP or keep the money in the bank and deploy it manually? Even though it looks easy for few to keep it in the bank and deploy it manually, in real-life scenarios it is very difficult to do it strictly by managing your profession or family. Hence, you can automate it by parking in the same AMC liquid fund and setting up the STP. I am suggesting this looks easy for many. I am recommending this just purely based on the easy of deploying without any human intervention. You can choose the one which is comfortable for you. I am neither a middleman nor earn a single penny directly or indirectly from any mutual fund companies by recommending any strategy for you.

Is it a FOOLPROOF strategy?

NO…As I mentioned above, none are aware of what may be the future. The only way is by doing such a type of deployment into equity, you will not panic, you will not lose hope on equity, and more than that with proper asset allocation, you are just allocating a certain portion of your portfolio to equity but not fully.

Whether you are investing in a lump sum or monthly, this will not create downside protection to your money. Instead, a proper identification of your goals with the right asset allocation is a MUST.

Finally, to conclude my points, sharing with you the story of Mr.Bob, The World’s Unluckiest Investor. Enjoy reading !!