I am covering a few topics today, given that I used yesterday’s post space to analyse the national accounts release. There is a further point I wish to make about the latest national accounts data. A focus on real household disposable income shows the full extent of the impacts of monetary policy (rate hikes) and fiscal policy (tax bracket creep) on household prosperity. The Australian government is overseeing one of the largest falls in household prosperity in recent history aided and abetted by the RBA. And the only thing the Treasurer has announced this week is his intention to alter the RBA Act to rescind his power to change monetary policy if it acts against the national interest. Meanwhile, the British Labour Party leader was out there praising Margaret Thatcher and equating her shock therapy to his own purges within the Labour Party of anything that resembles a progressive voice. After all that, I have some spiritual jazz for our listening pleasure.

Real household disposable income

The title of yesterday’s blog post – Australian national accounts – growth falls to 0.2 per cent in September – and only because of fiscal support measures (December 6, 2023) – told the story.

The contribution of household spending to the latest GDP growth result was zero and the only reason the economy grew at all was because of special (terminating) federal government cost-of-lving support schemes for households.

Household spending growth was flat and the household saving ratio fell dramatically towards zero.

So households are trying to maintain their spending levels (not growth) by consuming more and more of their disposable income, which means they are undermining their wealth accumulation by cutting saving.

That process is finite – and the saving ratio is now down to 1.7 per cent and falling fast, which means we should not be surprised to see it plunge into negative territory in the coming months – and that means household wealth is being eaten up in the quest to survive.

Clearly, the top-end-of-town are not facing the same problems given that their incomes are booming as a result of the interest rate returns they are receiving as the RBA hikes rates and the share of profits they receive from their share portfolios.

So when we calculate outcomes for the household sector as a whole, the deteriorating trend we are now talking about is hitting the lower income households severely.

Once the saving ratio plummets below zero, then we can expect a major spending collapse, which will drive the economy into recession.

I investigated the state of households a bit further this morning and this is what I found.

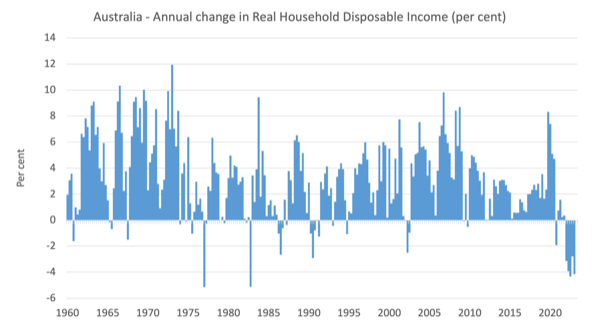

The following graph shows the annual change in real gross household disposable income since the September-quarter 1960 to the September-quarter 2023.

Real household gross disposable income fell by 5.14 per cent in the September-quarter 1977 and in the June-quarter 1983, it fell by 5.13 per cent on an annual basis.

They are the worst quarters since the modern national accounts were first published in the September-quarter 1959.

In the current period we see:

| Quarter | Annual Change (per cent) |

| September-quarter 2022 | -3.14 |

| December-quarter 2022 | -3.93 |

| March-quarter 2023 | -4.33 |

| June-quarter 2023 | -2.79 |

| September-quarter 2023 | -4.16 |

This is the worst period for households in terms of their real disposable income in the history of the national accounts.

Since the March-quarter 2022, real disposable income for households has declined by 5.4 per cent.

The reasons are several:

1. The inflation rate accelerated up to the September-quarter 2022 and remains higher than usual.

2. There have been 11 interest rate rises since May 2022, which have increased the average monthly mortgage repayment by 52 per cent.

3. The nominal inflation has pushed many workers into higher income tax brackets – so-called ‘bracket creep’ – which has increased the amount of tax households are paying.

Since the March-quarter 2020, we observe:

1. Interest payments on dwelling debt have risen by 123.9 per cent (nominal).

2. Interest payments on consumer debt have risen by 12.7 per cent.

3. Income tax payments have risen by 47 per cent.

Part of the problem is that the government is refusing to alter the tax scales to eliminate tax bracket creep.

It prefers to wax lyrical and boast about how it is achieving a fiscal surplus and acting responsibly, when in fact, its current policy parameters are setting the nation up for an economic collapse and punishing low income households disproportionately.

The other point is that its boast will backfire because if the current situation persists – the twin wedge of households from RBA rate hikes and the fiscal drag from the bracket creep – then household spending will decline significantly and that will drive the economy into recession.

The temporary fiscal measures from the government which were the difference between low and no growth in the September-quarter will end and the impact of the decline in household spending will really bit.

Then the federal government will be pushed into a large deficit as income tax payments decline as a result of the rising unemployment and welfare spending is increased to support more unemployed workers.

The problem then is that the government will not be able to brish that off after they have conditioned everyone to believe that fiscal deficits are bad and surpluses are good.

Then they will have to take the political flack that they should be getting now for forcing the economy into this parlous state.

The Treasurer was asked yesterday about the poor growth, the flat household spending growth and the rapid drop in the household saving ratio and he said:

… the Reserve Bank can explain what if anything today’s outcome means for their own forecasts …

So you see the active depoliticisation going on.

Blame the RBA not us!

And of course we can’t do anything about the RBA because its policy board is unelected and unaccountable.

So the ‘independent’ central bank diversion works a treat … for now.

That is, until recession hits.

Keir Starmer takes the British Labour Party further to the Right

On December 2, 2023, the British Opposition leader published an Op Ed piece in the Sunday Telegraph entitled ‘Voters have been betrayed on Brexit and immigration. I stand ready to deliver’.

I won’t link to it as it is behind a paywall.

But it was a most extraordinary commentary for a Labour leader to make in any country.

He correctly notes that Britain is in a state of chaos after 13 odd years of Tory rule (although he doesn’t mention the damage that the Blairites did when Labour was last in government).

The signs of social collapse are everywhere:

… crumbling public services that no longer serve the public, families weighed down by the anxiety of spiralling mortgage bills and food prices, neighbourhoods plagued by crime and anti-social behaviour. Any one of these individually would be cause for outrage. Taken together they merge into something more insidious: the idea that our country no longer works for those it is supposed to.

Then it went downhill:

Every moment of meaningful change in modern British politics begins with the realisation that politics must act in service of the British people, rather than dictating to them. Margaret Thatcher sought to drag Britain out of its stupor by setting loose our natural entrepreneurialism. Tony Blair reimagined a stale, outdated Labour Party into one that could seize the optimism of the late 90s.

It is no doubt that Margaret Thatcher oversaw ‘meaningful change’ for Britain but meaningful does not mean ‘good’ in the way that Starmer implies.

Thatcher’s era (and I live in Britain for part of it) was a disaster for the nation and set in place the sort of breakdowns in systems that we are now observing.

The privatisation, the outsourcing, the defunding of local councils and the attrition of the NHS.

Those initiatives are now being harvested by the British people and the products are sour, rancid and destructive.

He wrote about Brexit being a disaster but fails to mention the way that Thatcher undermined the British manufacturing system and oversaw a massive sell-off it manufacturing equipment to European competitors, while bolstering the fortunes and power of the financial sector through deregulation.

I guess he can rest easy that his praise for Thatcher will upset progressive British voters because he has largely disenfranchised that cohort by his ‘Stalin-like purges’ over the last few years.

He tied the ‘shock therapy’ that Thatcher exacted on the British people and the nation to his own current strategy:

It is in this sense of public service that Labour has changed dramatically in the last three years. The course of shock therapy we gave our party had one purpose: to ensure that we were once again rooted in the priorities, the concerns and the dreams of ordinary British people. To put country before party.

That is, expunging the progressive elements in the Labour Party and installing neoliberal, yes-people in their place was considered to be advancing the nation, when it is the voices of those yes-people that reflect the sort of policies that have crippled the country.

All the hallmarks of an ongoing destructive fiscal strategy were implied within the article:

– “taxpayer money to be spent wisely”.

– “The Tories have talked the talk on fiscal prudence while wasting untold billions, weighing the country down with debt and raising the tax burden to a record high.”

– “They will bequeath public finances more akin to a minefield than a solid foundation.”

– “Labour’s iron-clad fiscal rules will set this straight – but it will not be quick or easy.”

– “This is non-negotiable: every penny must be accounted for. The public finances must be fixed so we can get Britain growing and make people feel better off.”

I could say that it is nonsensical to talk about ‘fixing’ public finances.

What the Labour Party has to do is fix the nation and move it into a low carbon future.

As I understand the current fiscal rules that Shadow Chancellor Rachel Reeves has been touting, there is no way a Labour government will be able to accomplish that ‘fix’ and stay within the fiscal rule boundaries.

No way at all.

I expect to write more about that as the policy platforms become more specific.

Music – The Creator Has a Master Plan

This is what I have been listening to while working this morning.

As I was starting university in the early 1970s, I started to listen to a lot of jazz and I bought the 1969 album – Karma – by American tenor saxophonist – Pharoah Sanders.

Pharoah Sanders was one of the prominent contributors to the – Free Jazz – movement

This is Part 1 and Part 2 of the epic track from that album – The Creator Has A Master Plan – which is a masterpiece that I regularly listen to.

All 32 odd minutes of it.

The other players on this track are:

A review by Rolling Stone magazine (March 4, 2019) – Song You Need to Know: Joey DeFrancesco and Pharoah Sanders, ‘The Creator Has a Master Plan’ – referred to this classic as “spiritual jazz” – of which John and Alice Coltrane and Pharoah Sanders were the leaders.

The review describes the track as a:

… blend of blissed-out, meditative vamping and fiery abstraction — as well as some ecstatic yodeling from vocalist Leon Thomas.

I just think of it as some mighty fine playing.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.