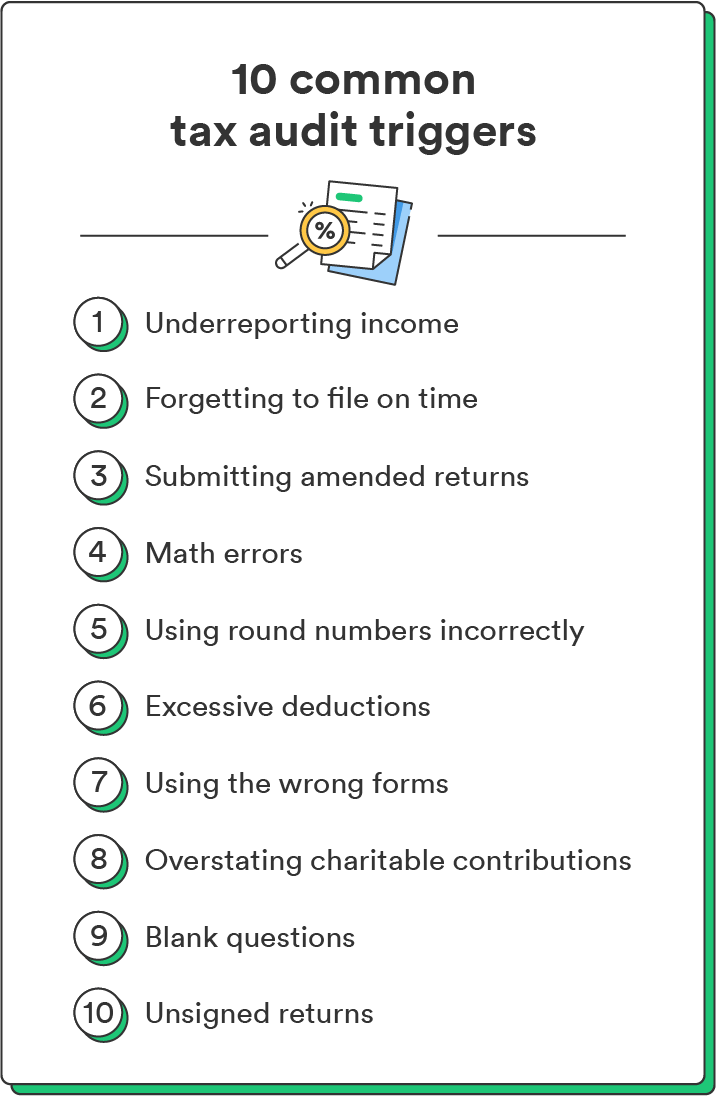

If you’ve ever wondered what can lead to a tax audit, below are 10 of the most common causes.

1. Under-reporting income

You must report all the income you earned throughout the year on your tax return. Underreporting your income is a common trigger for tax audits. Examples include consistently reporting a net loss or a significant decrease in income without any clear explanation.

2. Forgetting to file on time

Routinely filing taxes late can raise the IRS’s eyebrows. Consistently submitting your tax return on time helps build a positive track record, which can reduce the chances of an audit.

If you’ve ever wondered what can lead to a tax audit, below are 10 of the most common causes.

3. Submitting amended returns

The only way to correct errors on your tax return is by submitting an amended return. This won’t automatically trigger a tax audit unless you’re requesting significant changes without any documentation to back them up.

4. Multiple math errors

Math errors are some of the most common tax return mistakes taxpayers make. In 2021, the IRS corrected roughly 9 million math errors on filed tax returns.³ Miscalculations could happen on anything from your deduction amounts to the amount you list for your total income.

While it’s a common mistake, multiple math errors could increase the risk of an audit. Always check your calculations before submitting your return to avoid simple errors. Another easy way to avoid mistakes is by filing your taxes online instead of by hand.

5. Using round numbers incorrectly

The IRS wants the most accurate information possible on your tax return. Excessively rounding up your financial numbers (like rounding up by tens or even hundreds of dollars to get a cleaner number) can raise suspicion.

The IRS allows you to round off cents to whole dollars, but you have to drop cent amounts under 50 cents and increase cent amounts over 49 cents to the next dollar (i.e., $1.29 becomes $1.00, and $1.59 becomes $2.00).4 If you choose to round your numbers, be sure you round all numbers in the same way for consistency.

6. Unrealistic or excessive deductions

Honesty is the best policy with tax returns – especially with tax deductions (the same is true for tax credits). While deductions are a legitimate way to reduce your taxable income, be sure they’re accurate and you have documentation like receipts to verify them.

For example, you should be able to prove how much you spent on your home office and list this number on the return – don’t estimate.

7. Using the wrong forms

Completing the wrong forms in your tax filing could trigger a tax audit, as inaccurate forms can lead to discrepancies in the financial information you provide to the IRS.

For example, you’ll typically fill out a W-2 form to report your income if you’re a salaried employee. But, small business owners or freelancers should fill out Form Schedule C to report income.

Using the correct form is crucial to accurate tax filing – and minimizing the chances of an audit. You can review the available forms on the IRS website and determine which ones apply to you.

8. Overestimating charitable contributions

Overestimating or inflating your charitable contributions (a type of tax write-off) is a quick way to trigger an audit – and if you get caught, the IRS can penalize you with the Accuracy-Related Penalty.

This penalty is 20% of the part of your taxes that you underpaid due to exaggerating your charitable contributions.5

Have your receipts or statements readily available when claiming any charitable donations you made during the tax year. You can attach them to your return as additional supporting documents for credibility.

9. Blank questions

Leaving fields on your tax return blank can lead to unnecessary scrutiny, even if you have nothing to report. If you have $0 to report in a field, write that on your form. Filling out every section can help you avoid problems.

10. Unsigned returns

Forgetting to sign your tax return is more common than you’d think. Unfortunately, unsigned tax returns aren’t considered valid. Always check that you’ve signed and dated where required before you submit your return.

This simple (but crucial) step will reduce any chances of being flagged for an audit – and help you avoid the hassle of resubmitting your return. Bonus: It’ll also ensure you get your tax refund quickly.