Welcome to the February 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

This month’s edition kicks off with the news that financial planning software platform RightCapital has launched a workflow management tool called RightFlows to help advisors manage and assign steps in the financial planning process to team members and clients – which on the one hand capitalizes on advisor demand for workflow solutions tailored to the financial planning process without using a separate third-party tool, but on the other hand raises questions about how many different workflow support tools advisors will want to manage, given that many already use workflows within their CRM software (and other individual software tools may follow RightCapital’s lead by offering their own embedded workflows).

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including:

- Dispatch (formerly OneAdvisory) recently raised $8 million in seed funding as it seeks to provide a centralized data warehousing solution for advisory firms and eliminate the need for point-to-point data integrations between individual software solutions – which although a relatively new category for AdvisorTech, seems poised to pick up steam as advisors increasingly seek better integration among their constantly-expanding tech stacks

- Flourish has launched a new annuities platform, aiming to not only provide a marketplace of fee-based annuities for fiduciary RIAs but also to solve for the operational challenges of implementing annuities (and their notoriously burdensome paperwork) through streamlining and automation of the application process

- Estate planning software provider Vanilla has announced a partnership with Vanguard’s Ultra-High-Net-Worth (UHNW)-focused Personal Advisors Wealth Management, as Vanguard seeks to improve its estate planning offerings to better compete with other UHNW-focused firms and shows that the market for estate planning technology remains strong even as fewer and fewer people are actually subject to estate tax

Read the analysis about these announcements in this month’s column, and a discussion of more trends in advisor technology, including:

- Income Lab has released Life Hub, its holistic “financial dashboard” tool, as a standalone software offering where it will compete with Asset-Map – which underscores the growing popularity of tools that can clearly visualize a client’s current financial situation, while highlighting how different software companies have approached the question of whether to split off popular features as their own standalone solutions or to leave them “bundled” with their other offerings

- At the annual T3 Technology Conference, Artificial Intelligence (AI)-related vendors were present, but overall the tone towards AI was more measured than expected given the hype surrounding AI over the past year – suggesting that even though AI may prove transformative for AdvisorTech in the long run, it has a long road ahead for gaining trust and adoption in the advisory industry

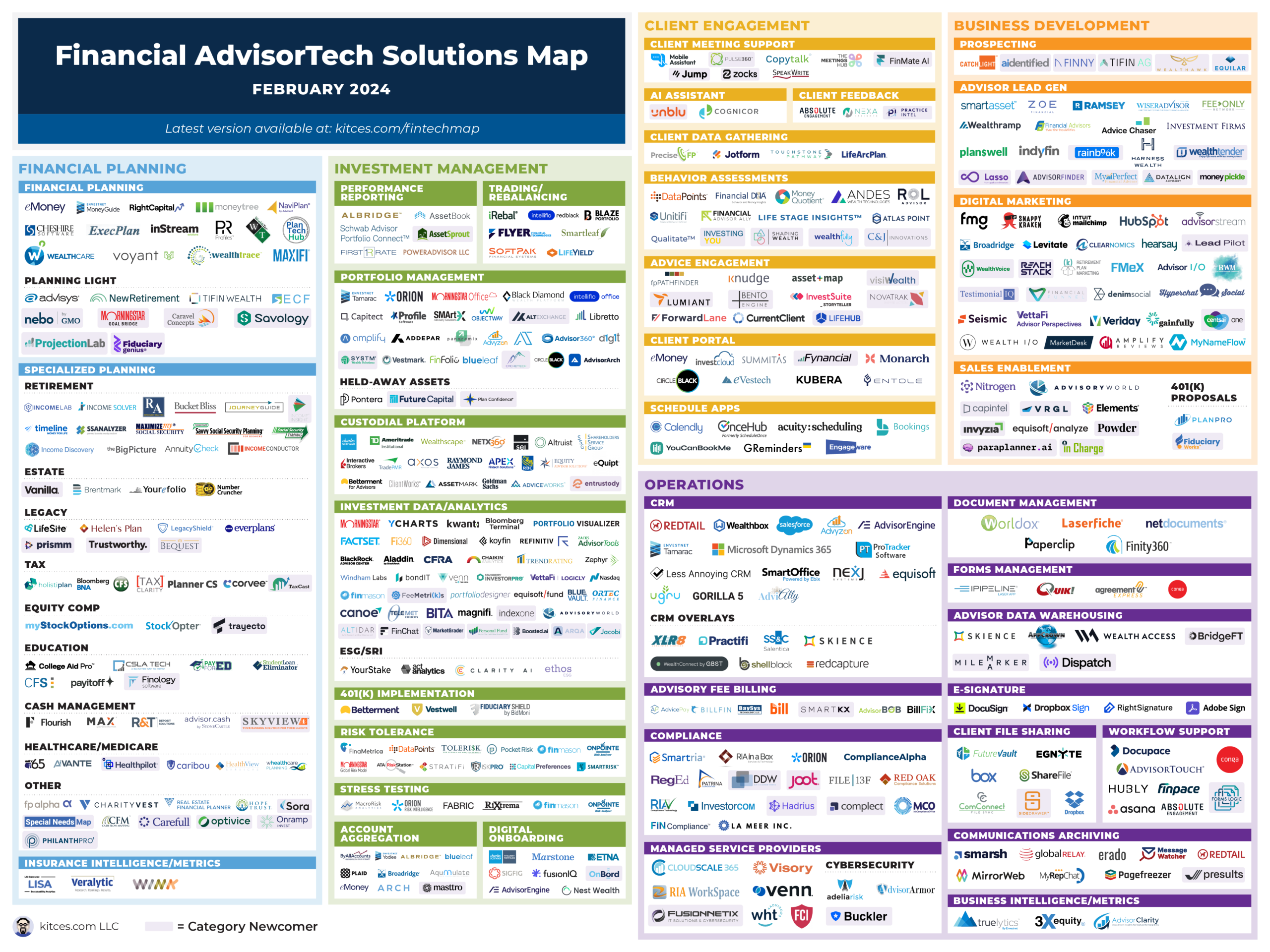

And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” (and also added the changes to our AdvisorTech Directory) as well!

*And for #AdvisorTech companies who want to submit their tech announcements for consideration in future issues, please submit to TechNews@kitces.com!