College students have a lot on their plate already, including the need to study to get good grades, participating in any number of on-campus activities and potentially working part-time to have some spending money.

That said, college students should also focus on their financial future, including steps they can take to build credit before they enter the workforce.

After all, having a credit history and a good credit score can mean being able to rent an apartment, finance a car or take out a loan, whereas having no credit at all can mean sitting on the sidelines until the situation changes.

Fortunately, there are all kinds of ways for young adults to build credit while they’re still in school. Some strategies require a little work on their part, but many are hands-off tasks that you only have to do once.

Teach Them Credit-Building Basics

Make sure your student knows the basic cornerstones of credit building, including the factors that are used to determine credit scores. While factors like new credit, length of credit history and credit mix will play a role in their credit later on, the two most important issues for credit newcomers to focus on include payment history and credit utilization.

Generally speaking, college students and everyone else can score well in these categories by making all bill payments on time and keeping debt levels low. How low?

Most experts recommend keeping credit utilization below 30% at a maximum and below 10% for the best possible results. This means trying to owe less than $300 for every $1,000 in available credit limits at a maximum, but preferably less than $100 for every $1,000 in credit limits.

Add Your Child as an Authorized User

One step you can personally take to help a child build credit is adding them to your credit card account as an authorized user. This means they will get a credit card in their name and access to your spending limit, but you are legally responsible for any charges they make. Obviously, this move works best when you have excellent credit and a strong history of on-time payments and you plan to continue using credit responsibly .

While this step can be risky if you’re worried your college student will use their card to overspend, you don’t actually have to give them their physical authorized user credit card.

In fact, they can get credit for your on-time payments whether they have access to a card or not. If you do decide to give them their credit card, you can do so with the agreement they can only use it for emergency expenses.

Encourage Them to Get a Secured Credit Card

Your child can build credit faster if they apply for a credit card and get approved for one on their own, yet this can be difficult for students who have no credit history. That said, secured credit cards require a refundable cash deposit as collateral are very easy to get approved for.

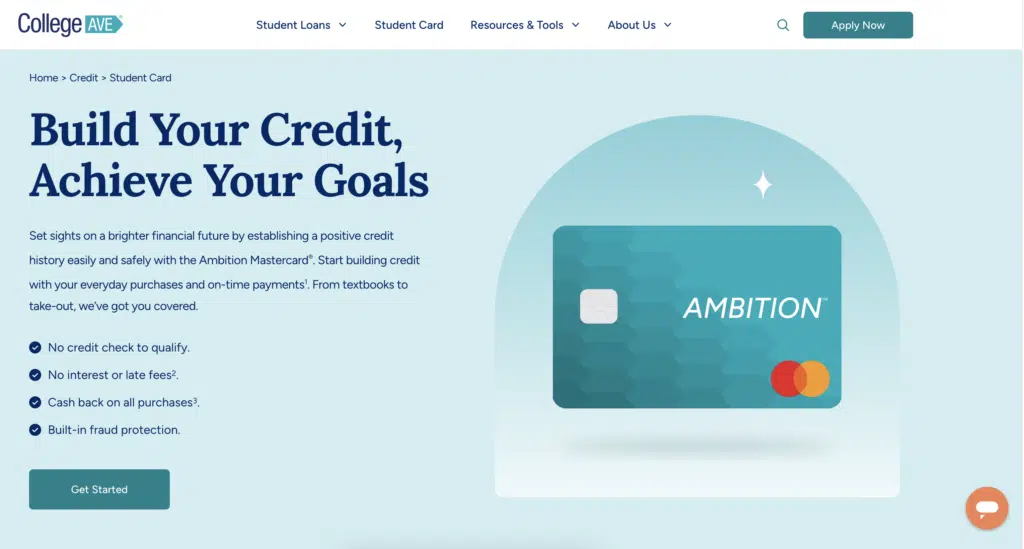

Some secured credit cards like the Ambition Card by College Ave even offer cash back1 on every purchase and don’t charge interest2. If your child opts to start building credit with a secured credit card, make sure they understand the best ways to build credit quickly — keeping credit utilization low and paying bills early or on time each month.

Opt for a Student Credit Card Instead

While secured credit cards are a good option for students with little to no credit get started on their journey to good credit, there are also credit cards specifically designed for college students. Student credit cards are unsecured cards, meaning they don’t require an upfront cash deposit as collateral, but charge interest on any purchases not paid in full each month.

Many student credit cards offer rewards for spending with no annual fee required as well, although these cards do tend to come with a high APR. The key to getting the most out of a student credit card is having your dependent use it only for purchases they can afford and paying off the balance in its entirety each billing cycle. After all, sky high interest rates don’t really matter when you never carry a balance from one month to the next.

Help Your Child Get Credit for Other Bill Payments

While secured cards and student credit cards help young adults build credit with each bill payment they make, other payments they’re making can also help.

In fact, using an app like Experian Boost can help them get credit for utility bills they’re paying, subscriptions they pay for and even rent payments they’re making. This app is also free to use, and you only have to set up most bill payments in the app once to have them reported to the credit bureaus.

There are also rent-specific apps and tools students can use to get credit for rent payments, although they come with fees. Examples include websites like Rental Kharma and RentReporters.

Make Interest-Only Payments On Student Loans

The Fair Isaac Corporation (FICO) also notes that students can start building credit with their student loans during school, even if they’re not officially required to make payments until six months after graduation with federal student loans.

Their advice is to make interest-only payments on federal student loans along with payments on any private student loans they have during college in order to start having those payments reported to the credit bureaus as soon as possible.

“Making interest-only payments as a student will not only positively affect your credit history but will also keep the interest from capitalizing and adding to your student loan balance,” the agency writes.

Of course, interest capitalization on loans would only be an issue with private student loans and Federal Direct Unsubsidized Loans since the U.S. Department of Education pays the interest on Direct Subsidized Loans while you’re in school at least half-time, for six months after you graduate and during periods of deferment.

The Bottom Line

College students don’t have to wait until they’re done with school to start building credit for the future, and it makes sense to start building positive credit habits early on regardless. Tools like a credit card can help students on their way, whether they opt for a secured credit card or a student card. Other steps like using credit-building apps can also help, and with little effort on the student’s part or on yours.

Either way, the best time to start building credit was a few years ago, and the second best time is now. You can give your student a leg up on the future by helping them build credit so it’s there when they need it.

1Cash back rewards are subject to the Ambition Rewards Terms & Conditions.

20% APR. Account is subject to a monthly account fee of $2, account fee is waived for the initial six-monthly billing cycles.

College Ave is not a bank. Banking services provided by, and the College Ave Mastercard Charge Card is issued by Evolve Bank & Trust, Member FDIC pursuant to a license from Mastercard International Incorporated. Mastercard and the Mastercard Brand Mark are registered trademarks of Mastercard International Incorporated.