It’s Wednesday and I have looked at the US CPI release overnight that has set alarm bells off in the ‘financial markets’ and among mainstream economists. My assessment is that there is nothing much to see – annual inflation less volatile items is still falling and the lagged impact of shelter (housing) is still evident even though that component is also in decline. I also examine an argument that the trend towards increasing self-reliance among nations is likely to precipitate renewed global conflict. My own view of this trend is that it must accelerate to allow us to shift to a degrowth trajectory. And I finish with some fine concertina music.

US inflation data – no reason to assume it is accelerating again

The Bureau of Labor Statistics released its latest CPI data overnight (March 12, 2024) – Consumer Price Index Summary – February 2024.

The BLS reported that:

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in February on a seasonally adjusted basis, after rising 0.3 percent in January …

Over the last 12 months, the all items index increased 3.2 percent …

The index for shelter rose in February, as did the index for gasoline. Combined, these two indexes contributed over sixty percent of the monthly increase in the index for all items. The energy index rose 2.3 percent over the month, as all of its component indexes increased. The food index was unchanged in February, as was the food at home index.

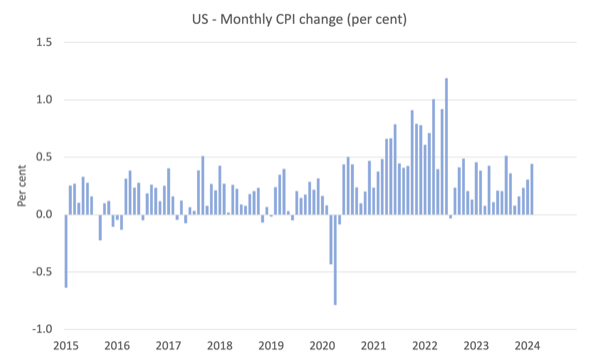

Here is the monthly CPI change (per cent) since January 2015 to February 2024.

One might conclude that inflation is accelerating again.

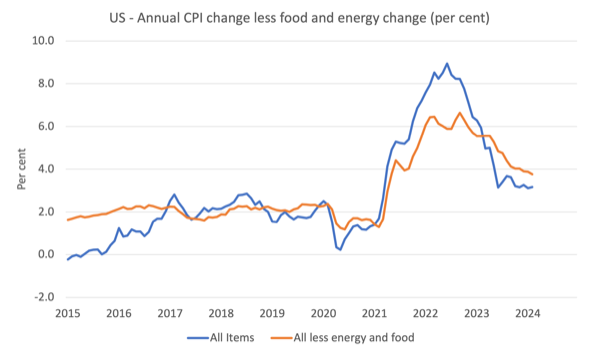

However, if we take the longer view (annualised) and consider the trajectory of the ‘core’ CPI inflation measure (which removes energy and food trends) then it is clear that the US inflation rate is still heading down.

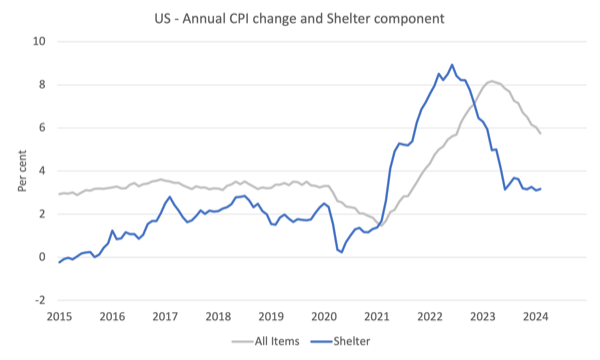

Further, as I noted recently, the BLS have an eccentric way of calculating housing cost changes.

Housing (in BLS speak – shelter) represents about one-third of the total basket weight of the goods and services that are included in the CPI.

So movements in ‘shelter’ always significantly influence the overall CPI outcome.

This explanatory note – Measuring Price Change in the CPI: Rent and Rental Equivalence – explains how the BLS simplifies the calculation of movements in housing costs.

The BLS consider the ” shelter service that a housing unit provides to its occupants is the relevant consumption item for the CPI”.

For “renter-occupied housing”, it is the rent paid that reflects the “cost of housing”.

However, in the case of owner-occupied housing:

… most of the cost of shelter is the implicit rent that owner occupants would have to pay if they were renting their homes, without furnishings or utilities

So the BLS does not attempt to estimate the value of the housing units but instead calculates what it calls the Owners’ Equivalent Rent (OER), which is simply how much it would cost to rent that property.

And we know that rental charges always lag other cost movements and interest rate increases, which means that we always see a lagged rise in the shelter component of the CPI well after the rest of the CPI components are declining.

The next graph shows this very clearly.

The overall message today is that US inflation continues to fall and at 3.2 per cent overall is hardly out of control.

Is self-reliance a harbinger for increased global conflict or an essential condition for degrowth?

The other day I read an article in the Japan Times (March 10, 2024) – Economic self-reliance is a dangerous delusion – which recognised the increased focus by nations on insulating themselves from global supply chain shocks such as we have seen in the Covid-period.

The “vulnerabilities stemming from deep global economic integration” have spawned all sorts of strategies aimed at “shortening supply chains, rebuilding domestic production capacity and diversifying suppliers”.

The author claims, however, that while these trends are ongoing now, they are dangerous and will result in possible war between nations.

He differentiates between “self reliance” which is designed to “build domestic resilience in a less secure world” and “protectionism”, which is specifically designed to negate ‘competetive’ pressures on industry.

However, in his assessment, self reliance is an illusion, which will fuel “even greater systemic instability”.

The argument is about American exceptionalism, which he claims is waning.

Apparently, American democracy, which is contrasted to authoritarian regimes such as China, has long been essential to “keep the global market economy open”.

But that capacity is now fading because of the rise of China and its partnerships with other authoritarian regimes that evade the global rules and order.

It is a pretty extraordinary rendition of reality.

First, I don’t see America as being particularly democratic.

Second, the US is the most martial nation in history and solves its problems with weapons and invasions – and if it doesn’t invade it resources other armies who inflict chaos (for example, the current massacres in Gaza).

Third, these so-called global rules and market order are really oppressive frameworks that have allowed the richest nations to plunder the resources of economically-poor, but resource-rich nations while maintaining ‘aid’ systems via the World Bank and the IMF that have ensured these nations stay poor.

China has adopted a different model and is now more attractive to the poorer nations because it has been willing to develop local infrastructure – although not without its own ‘price’.

The author’s division between nations along so-called “democratic and authoritarian lines” is also an illusion.

Poisoning every electoral system is the lobbying power of capital and the underground corruption that occassionally seeps into the public domain.

He believes that “the inward-looking nature of self-reliance inevitably clashes with the desire for larger economic areas or unavailable goods”.

Solution: Not to seeks ways of diminishing military capacity etc.

Rather he wants the maintenance of a fully integrated global market economy under free trade agreements.

He doesn’t mention the poisonous investor dispute mechanisms that are central to all these agreements and set up corporations to challenge the legislative intent of nations if private profit is impeded.

For those who dream of a global economy with a single currency etc – the ‘internationalists’ – who dominate the progressive politics, there is another element that is usually not considered which will be discussed in greater detail in my upcoming book.

That is, self reliance, localisation of production and distribution systems and the related aspects are not only essential to insulate nations from trade vulnerabilities.

We need reminding of how Australia struggled to get protective clothing for our medical staff during the early months of Covid because we had off-shored all the production to China.

But apart from these reasons for pursuing shorter supply chains, an overwhelming justification for such a strategy is to be found in the climate issue.

Whether we like it or not, the deterioration in our climate prospects, will soon enough require a major shift in our production and consumption patterns.

I consider degrowth strategies will be necessary if not too late.

But as part of the degrowth agenda we need to pursue much more local thinking in creating goods and services.

This does not mean that all trade will disappear.

I understand how some regions of the world have existing climate constraints on food production and require imported products, although technology is quickly coming up with large-scale agricultural schemes within sheds etc.

So self reliance can be justified not in terms of insuring against increased global uncertainty (political etc) but in terms of reducing the carbon footprint.

And if nations around the world converge on an understanding of the climate peril we all face, then there might be a greater incentive to cooperate rather than plunder.

However, on that last point, I am deeply concerned that as the food bowl areas of Europe diminish due to global warming and the failure of the local flora to adapt quickly enough, the armies of Europe may head south into Africa etc.

In that sense, I have some sympathy for the author’s concern that conflict is coming.

Music – The concertina

This is what I have been listening to while working this morning.

I was driving home the other day from the airport listening to the Music Show on ABC Radio National and there was a segment featuring the Irish musician – Cormac Begley.

He was discussing the history of the concertina, the different types – from the bass to the piccolo – and the mechanics of the instrument.

It was a really interesting piece of radio and I learned so much from it.

He then finished the interview by playing one of his signature pieces – To War – which he explained was a memorial to his past family members who went to war against the British invaders in days gone by.

It is a virtuoso demonstration of how a relatively simple instrument based on the vibration of reeds can produce such an evocative sound.

It made my long road journey much more palatable.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.