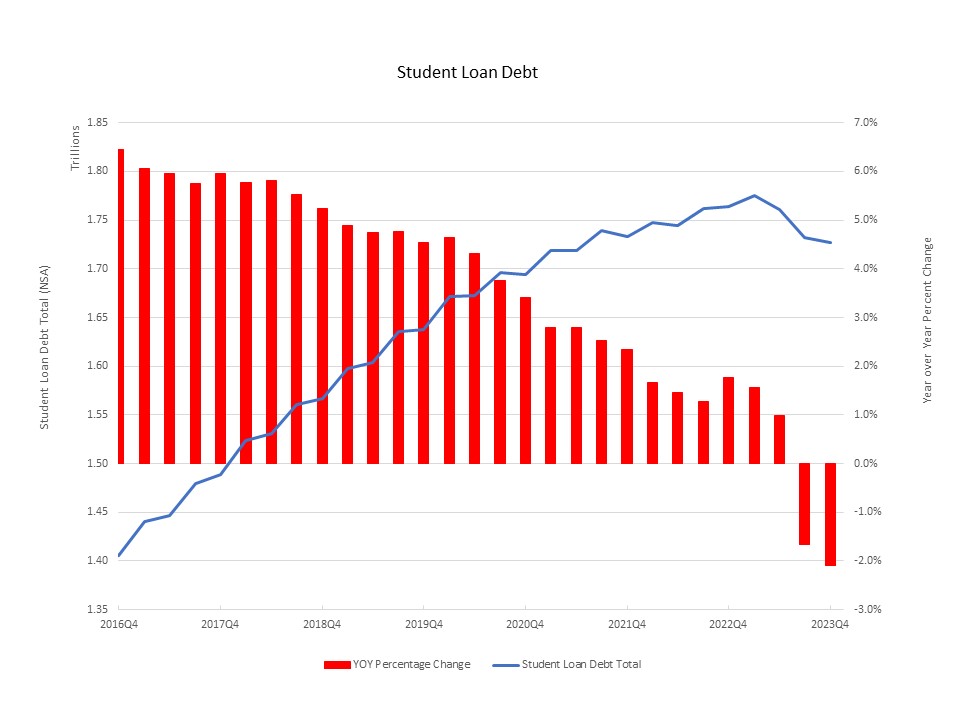

According to the Federal Reserve’s G.19 Consumer Credit Report, student loans in the fourth quarter of 2023 totaled $1.73 trillion (non-seasonally adjusted), reflecting a decrease of 2.1% over the year and following an annual decrease of 1.7% in the previous quarter. The third quarter of 2023 marked the first year-over-year decrease for student loan debt the data collection began. This consecutive decrement is shown in the graph below illustrated by both the levels and year–over–year rates.

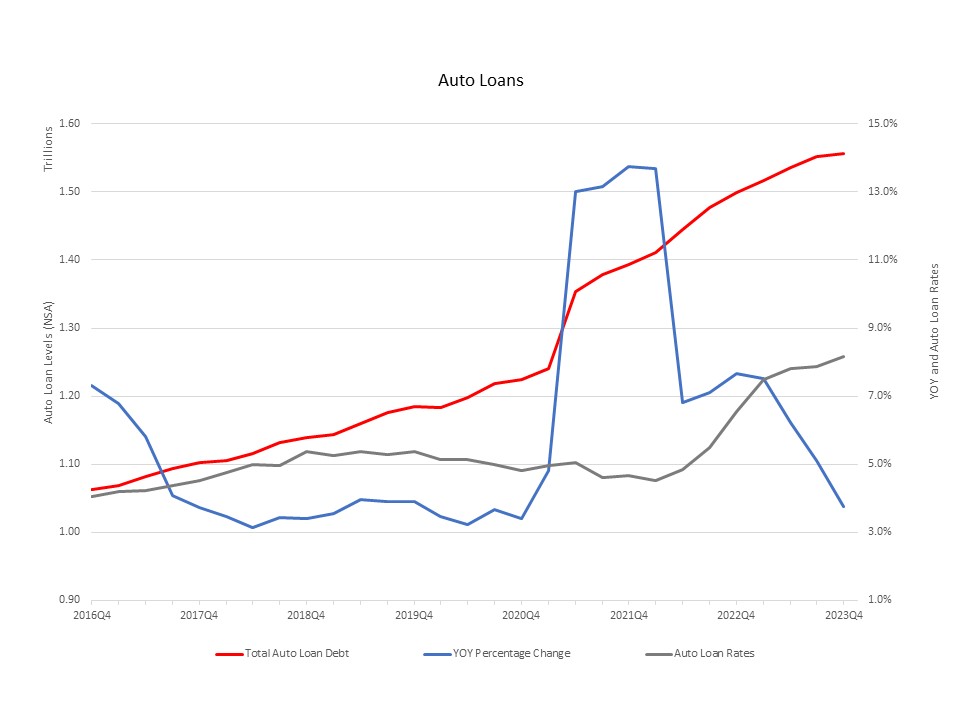

Contrastingly, auto loans continue to increase, and have surged to a level of $1.56 trillion (NSA). However, similarly to student loans, we are seeing a steady deceleration in growth rates (see graph below). The fourth quarter of 2021 saw a high of a 13.7% YOY growth compared to the fourth quarter of 2023 rate of 3.8%. This deceleration partially reflects higher financing costs with auto loan rates rising from 4.5% in of 2021 to 8.2% in the fourth quarter of 2023.

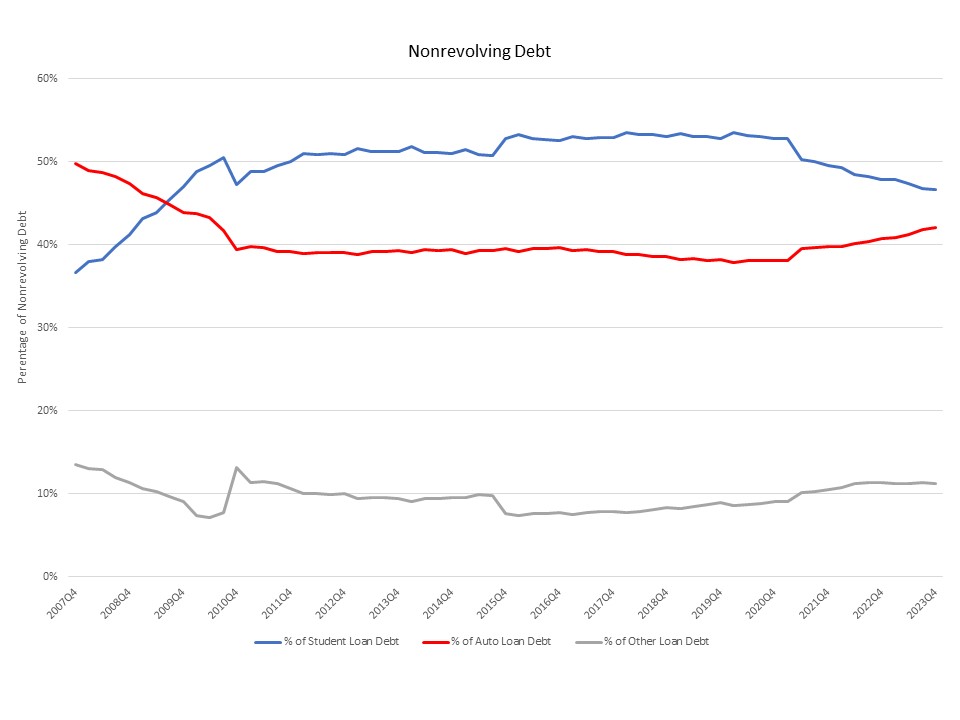

mponents of nonrevolving debt (the G.19 report excludes real estate loans), accounting for 46.7% and 42.0%, respectively. The collective other loans make up the remaining 11.3% of nonrevolving debt. Since data became available in 2006, auto loans accounted for the highest share until 2009, when student loans took the lead, as depicted in the graph below. With the current trend of student loans decreasing and auto loans increasing, it is likely that auto loans will again have the higher percentage.

The total for nonrevolving debt stands at 3.7 trillion (SA) for the fourth quarter of 2023, an annualized rate (SAAR) of 1.6% increase from last quarter. Revolving debt, which is primarily made up by credit card debt, stands at $1.3 trillion, an 8.3% increase from the third quarter (SAAR).

Of the total outstanding US debt in the fourth quarter of 2023, nonrevolving is 73.7%, revolving is 26.3%. The total debt stands at $5.0 trillion for the quarter, a 3.3% increase from the third quarter (SAAR). This is slightly higher than the increases for the second and third quarters but is lower than the growth rates for all of 2022 and 2021.