There has been a lot of chatter about magazine covers lately; I thought I might clarify some of the with this post, originally published in Bloomberg on December 27, 2017, along with commentary from Ben and Josh addressing the sdame issue.

The key takeaway: The value of the signal here is just about zero.

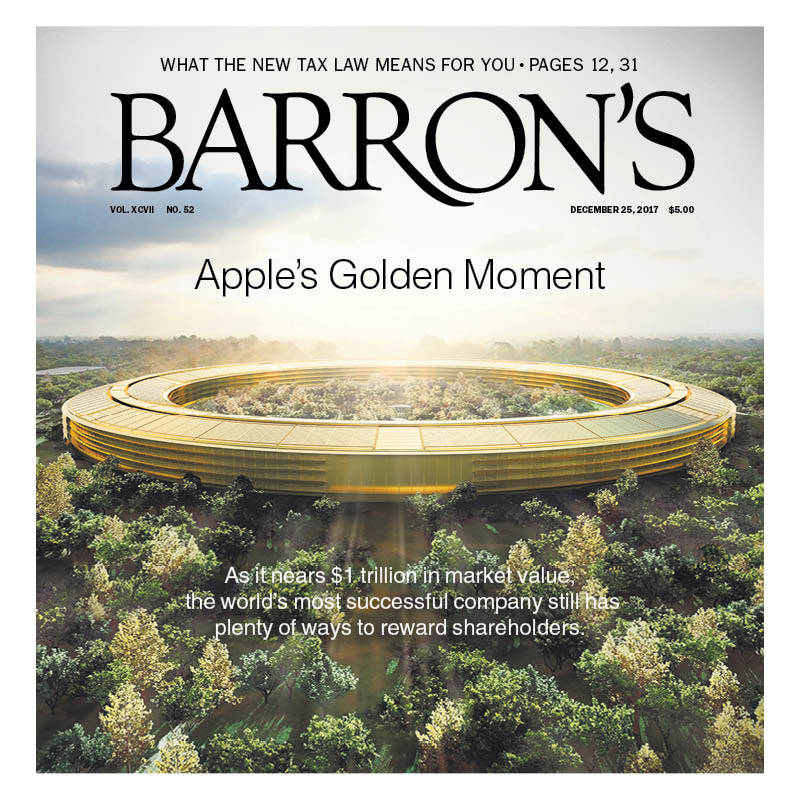

The 2017 Barron’s cover (above) showing Apple’s extravagant new headquarters and suggesting that the company’s market value would reach $1 trillion in 2018 generated some chatter from the usual suspects. An issue like this touches on several previously debunked ideas. Let’s use this as an opportunity to discuss the significance of magazine covers and what they might mean for investors.1

Magazine covers are the ultimate anecdote — it is too easy to cherry pick the ones that are memorable, and even easier to forget all the rest that had no special significance. This is a topic I have been tracking for 20 years; I have yet to see a comprehensive analysis of every magazine cover ever produced. Instead, the tendency is toward a combination of selective perception and hindsight bias. This is an especially pernicious way of fooling ourselves into believing something of great weight is occurring when in fact something of quite limited significance has happened.

This is important. Why? Because separating reality from silliness is the key to making better-informed and more intelligent investment decisions. No less an authority than Bridgewater Associates chief Ray Dalio advocates that all investors become “hyperrealists”; risking capital based on a fundamentally false understanding of reality is dangerous and expensive.

Which leads us to the general confusion that big splashy magazine covers create for wannabe contrarians. To help separate the signal from the noise, consider some of these factors:

• Headquarters Indicator: First, the lavish corporate headquarters as a sign of a stock or market top is just so much spurious and intellectual back-dating. Selecting a few random examples of companies that built fancy headquarters followed by a corporate flop of some kind is simply junk analysis. And yet it persists.

The plural of anecdote is not data.2 Choosing the 10 most correlated headquarters out of the many thousands that have been built during the past century actually are the exceptions that prove the point; the vast majority of headquarters that were built signaled precisely nothing. You can always cherry-pick spurious correlations as examples, but analyzing the full gamut of corporate headquarters yields a non-signal.

• Magazine Cover Indicator: Originally created by money manager Paul Macrae Montgomery, this remains a widely misunderstood market signal. The basic premise of the cover indicator is that of a contrary sign of societal sentiment, reflecting when an investment theme has reached a crescendo. Said more plainly, by the time the editors of mass-media publications find out about some hot new investing trend, it has reached every corner of society and is ripe to end.

According to Montgomery, there are three main rules for the classic magazine-cover indicator:

- It must be a mainstream publication, not a business or financial periodical

- We are looking for a well-understood concept that is reaching a climax

- There must have been significant asset-price gains leading up to the cover

Let’s use some examples from the past 30 years of Time magazine covers as they relate to the stock market (an admittedly self-selected and incomplete list). Time named Amazon.com Inc. chief Jeff Bezos as Person of the Year in December 1999 as the dot-com bubble was about to burst (true, Amazon stock went nowhere for a decade, but since then the shares have increased roughly 15-fold). Housing was featured on the cover in 2005, which was near the top of the housing boom and bust. It isn’t just Time magazine, but any non-business publication — consider the New York Times magazine cover on gold3 in 2011 as yet another example.

But no, there isn’t much of a contrarian signal in a financial weekly putting the largest market capitalization company on its cover.

• Single Company Magazine Cover Indicator: Here is where people really go astray — any individual company on any cover generates little in the way of usable signal. I have discussed this repeatedly, but one graphic settles the argument. It is from Kuo Design, and it shows all 138 magazine covers that have Apple and/or co-founder Steve Jobs on the cover from 1981 until today.

Can you identify which of those 138 covers is the actual sell signal?

Yeah, me neither.

The bottom line about magazine covers is that maybe they can be helpful in identifying when a broad trend reaches a top; they are much less helpful in telling investors when to unload the shares of any particular company.

See also:

Five Reasons to Ignore Magazine Cover Commentary (Josh Brown, March 16, 2024)

So Much Money Everywhere (Ben Carlson, March 17, 2024)

Previously:

That Magazine Cover Doesn’t Make Apple Shares a ‘Sell’ (December 28, 2017)

Misunderstanding the Magazine Cover Indicator (October 27, 2014)

Magazine Cover Indicator (Archive)

____________________

1. Barron’s cover coincided with reports that demand for the new iPhone X may be weaker than expected.

2. I would love to identify the original author of this quote; the history seems inconclusive.

3. Gold was more $1,500 an ounce during the week of the cover story in May 2011; during August and September of that year, gold almost hit $1,900; by December, it was back down to $1,500. It spent most of the next six years below that level and as of this writing is about $1,285.