As always with my longer write-ups, I will attach the full PDF bewlo. In the post itself I will focus on the Exec summary, Pro’s and Con’s and the conclusion. And the Bonus Track of course at the end.

Executive Summary

Hermle AG is a typical “Hidden Champion” Mittelstand company from Southwestern Germany (Baden Wuerttemberg, the “Ländle”) that managed to carve out a very nice niche in 5- Axis CNC machines and connected production automation. The company is able to earn industry leading EBIT margins (>20%) and Returns on Capital (>30%), has a Fortress Balance sheet and trades only at a relatively modest valuation of around 7,7x EV/EBIT.

The business is exposed to the economic cycle, but a combination of competitive advantages, a flexible cost base and a structural tailwind (Automation) make the stock attractive in the mid- to long term

Full PDF can be read & downloaded here:

Pros/Cons

As always, a quick run down of positive and not so positive aspects of Hermle:

+ Industry leading margins and returns indicating significant competitive advantages

+ very reasonable valuation

+ Fortress Balance sheet & capital efficient business mode, highly flexible cost base

+ long term oriented family ownership and management

+ structural tailwind Automation

+ additional multiple mean reversion potential

+/- Reporting could be more granular, but no adjustments

+/- Business momentum has slowed down

+/- no share buy backs, only dividends

– significant exposure to business cycle

– upcoming full generational change

– only non-voting shares listed

Valuation /return expectation

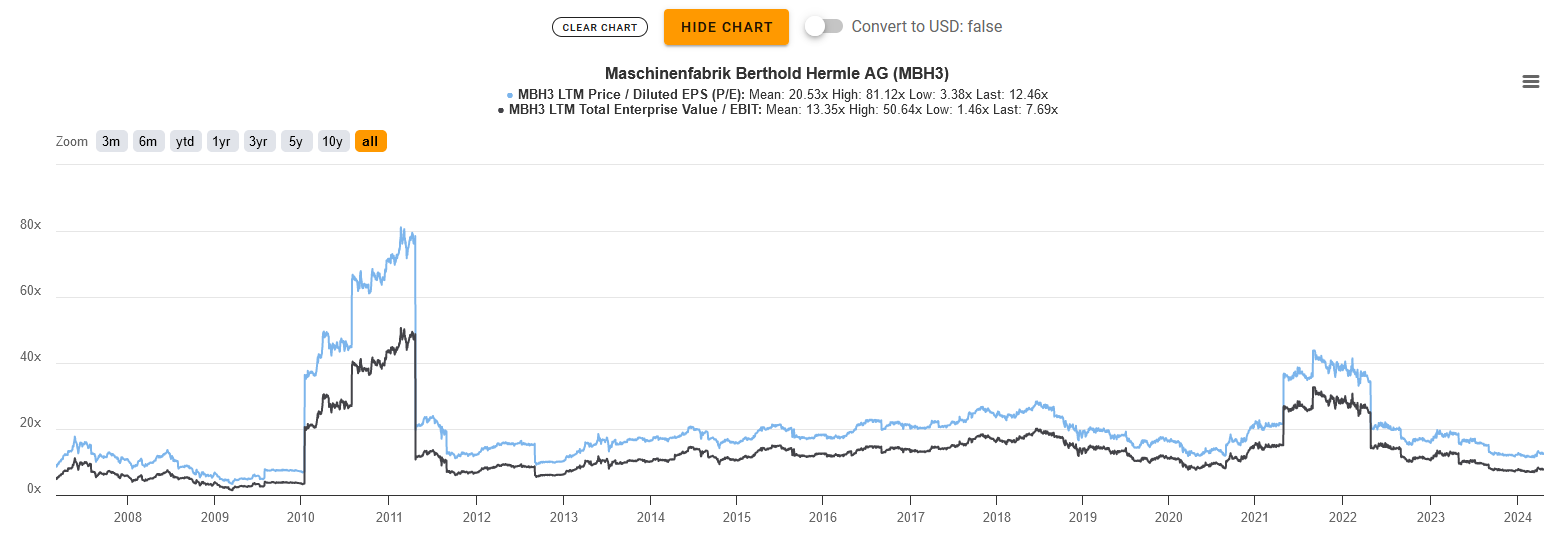

The current P/E of ~13 (or 11 ex Cash) and EV/EBIT of 7,7x is clearly below where Hermle has been trading over the past 17 years, where on average the P/E was around 20 and EV/EBIT at around 14x.

Compared to its peers, the stock is priced like the average, but the margins and returns on capital are much much better. Industrial companies with similar margins are usually valued much much higher.

The current dividend yield is quite high at 7%. Even if we normalize this to 5% and think over the next years Hermle should be able to grow at the historic 10 year CAGR of 7%. First, inflation is higher and second, the demand for automation will not go away.

Very roughly this would mean an expected return of 12%-14% p.a. plus any multiple mean reversion potential.

As we have discussed, the business as such is cyclical but Hermle has a very flexible cost basis, so I am actually more than OK with that expected return compared to the quality of the business and the “Fortress balance sheet”.

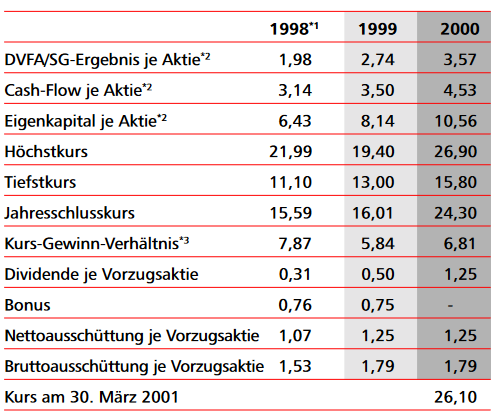

However we should not forget that a potential cyclical stock like Hermle can trade even lower. This is a table from the annual report 2000 showing that during the Dot.com boom in 1999/2000, Hermle traded at a PE of 6 and 8x despite doubling profits over a 2 year time span from 1998-2000.

Nevertheless, for my the cyclical risk is more than mitigated by the far below histaorical averages valuation of the stock.

Summary & Game plan

As outlined above, I do think that Hermle offers a decent risk/return profile for the patient investor. The current dividend yield is almost 7%, there is a good chance of some growth going forward and any multiple mean reversion comes on top.

On the other hand, the order book at year end 2023 was weaker than in 2022 and the company already mentioned that the first few weeks in 2024 have been more difficult. The big question is of course to what extent this is priced in or not.

Because of the current weak business momentum, I decided to start with a 3% position at an average price of 222 EUR/share. Based on its quality, Hermle would justify a larger position, but I am “speculating” here that I can maybe increase the position cheaper during 2024.

We will see if this works out our. Not. Funnily enough, in the last 18-24 months, my smaller positions have almost always performed better than my larger “conviction buys”.

Bonus Track: Don’t bring me down – Electronic Light Orchestra

As in my last few pitches, here is a Bonus track that in my opinion fits very well to a hidden German Mittelstand Champion like Hermle: Don’t bring me down from ELO.