Exciting news! The Chase Sapphire Preferred card has temporarily increased its sign-up bonus. This card is a favorite of both my husband and me, and it’s perfect for anyone looking to dive into the world of travel rewards and points. Here’s why:

- Amazing limited time welcome bonus

- 2x points points on all travel purchases

- 3x points on restaurants, online groceries, and select streaming services.

- 5x points on travel booked through Chase’s portal

- $50 annual Chase Travel hotel credit when purchased through Chase travel

- Redeem your points in so many ways (you’re not limited like other cards).

- Travel protection perks such as trip cancellation insurance, bag delay insurance, rental car collision protection, and lost luggage reimbursement

Right now you can earn 75,000 bonus points when you spend $4,000 on purchases in the first 3 months of opening your Chase Sapphire Preferred Card. If you’re new to using points to travel for nearly free, then this might be the card for you!

Check out the 15-minute video below where I break down how to travel next to nothing thanks to credit card points.

How The Bonus Works

Alright, let’s break down how this awesome bonus works with the Chase Sapphire Preferred card. Imagine this: you sign up for the card, and if you spend $4,000 on purchases within the first 3 months, voila! You earn a generous 75,000 bonus points.

When my husband and I were planning our family trip to Canada a few years ago, we needed a way to make our travel budget stretch. That’s where our Chase Sapphire Preferred card shined! Here’s my husband and I standing in front of the beautiful Lake Louise.

We were able to book round trip tickets for our family of four for next to nothing! And let me tell you, seeing the kids’ faces light up as we explored Banff National Park and saw a grizzly bear for the first time made every point worth it.

Now, here’s the best part: those 75,000 bonus points? They’re worth over $900 when you redeem them through the Chase Travel portal.

So whether you’re dreaming of a weekend getaway, a cross-country road trip, or an epic international adventure, these bonus points can help make it happen.

Redeeming Your Points

Whether you’re a frequent traveler or someone who enjoys unique experiences, there are many ways you can use your 75,000 bonus points.

Flights

Let’s start with flights, because who doesn’t dream of flying away to an exciting new destination? With the Chase Sapphire Preferred card, your points can take you further.

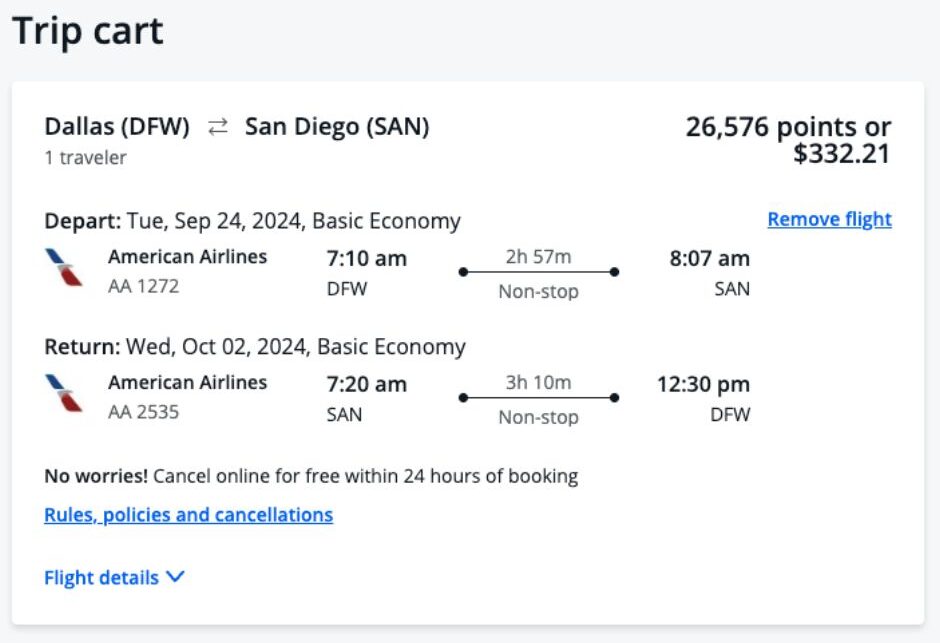

For instance, those 75,000 bonus points you’ve just earned could potentially cover a round-trip ticket from Dallas to San Diego, California for two people for just 26,576 points per person. This leaves you with extra points to spare!

Want to explore New York City? I found round trip flights from Dallas to La Guardia (NYC) for only 13,841 points per person! This means you could take a family of four to NYC with your welcome bonus!

When redeemed through Chase Travel℠, your points gain 25% more value, making each point worth about 1.25 cents. It’s like turning those 75,000 points into $937.50!

Our family personally racks up points to help cover the cost of flights for family vacations. For instance, we recently booked four domestic round trip flights on Southwest Airlines and only had to pay $44.80 in fees!

Hotels

Next up, hotels. One of the best ways to get the most value for your points is to transfer your Ultimate Rewards points to your World of Hyatt account. Then, you can book your hotel stay using your Hyatt points!

For instance, you can stay the night at the Hyatt Place in downtown Nashville for just 20,000 points each night.

Experiences

If unique experiences are what you’re after, then you’ll love this card. Imagine using your points to secure tickets to a Broadway show, a major sports event, or a private dining experience.

Cash Back

Prefer to keep it simple? Your points can also be redeemed for cash back, giving you direct deposits into most U.S. checking and savings accounts, or you can opt for a statement credit.

I’ve known people personally who save up their credit card points all year and use them to cover all of their holiday shopping in December. That’s flexibility at its finest!

Travel Partners

I personally like that with the Chase Sapphire Preferred card you transfer your points at a 1:1 ratio to several airlines and hotels. This is another way to make sure your points stretch further.

Airline partners include:

- Aer Lingus

- Air Canada

- British Airways

- Emirates

- Air France KLM

- Iberia

- JetBlue

- Singapore Airlines

- Southwest

- United Airlines

- Virgin Atlantic

Hotel partners include:

- IHG Hotels & Resorts

- Marriott Bonvoy

- Hyatt

The Chase Sapphire Preferred offers so many ways to redeem points (which is why I personally love the card). This means that you are stuck using these points to only fly on one airline. Can you tell I love this card and its perks so much?!

Chase Sapphire Preferred Card: Other Perks

The Chase Sapphire Preferred card is packed with perks that make it an excellent choice for travelers and everyday spenders alike. Here are some of the features that make this card my favorite.

Travel Protection

The Chase Sapphire Preferred card comes with a long list of travel protection benefits that give you peace of mind while on your next trip:

- Trip Cancellation Insurance: If sickness, severe weather, or other covered situations affect your travel plans, you can be reimbursed up to $10,000 per person and $20,000 per trip for prepaid, non-refundable expenses.

- Baggage Delay Insurance: For baggage delays over six hours, get reimbursed for essential purchases like toiletries and clothing up to $100 a day for five days.

- Auto Rental Collision Damage Waiver: Decline the rental company’s collision insurance and charge the entire rental cost to your card to get primary coverage for theft and collision damage for most rentals in the U.S. and abroad.

- Trip Delay Reimbursement: Delays more than 12 hours or requiring an overnight stay are covered for unreimbursed expenses such as meals and lodging, up to $500 per ticket.

- Lost Luggage Reimbursement: Coverage up to $3,000 per passenger if you or an immediate family member’s luggage is lost or damaged by the carrier.

5X Points on Travel

Earn big when you book your travel through Chase Travel. With the Chase Sapphire Preferred, you get 5x points on travel purchases, including flights, hotels, cruise lines, and car rentals. This is an amazing way to (literally) multiply your points.

3X Points on Restaurants

Foodies will rejoice with the Chase Sapphire Preferred card! You earn 3x points on all dining expenses, whether you’re trying out a new local restaurant or ordering in. This includes everything from fancy sit-down restaurants to your favorite takeout and delivery services.

I try to exclusively use this card any time we grab takeout or go out to dinner because I know it means I’m racking up points for my next vacation faster!

3X Groceries Online

In today’s digital age, more and more people are opting for the convenience of online grocery shopping. With the Chase Sapphire Preferred, you earn 3x points on online grocery purchases. Note that this excludes purchases made at Target®, Walmart®, and wholesale clubs, but it’s a great way to rack up points on a regular expense.

$50 Travel Hotel Credit

Each account anniversary year, you can earn up to $50 in statement credits for hotel stays purchased through Chase Travel. This perk alone can help offset the card’s $95 annual fee.

No Foreign Transaction Fees

Travel internationally without the extra costs. With no foreign transaction fees on purchases made outside the United States, you save money that would otherwise be spent on fees. For instance, spending $5,000 internationally could typically incur about $150 in fees with other cards, but not with the Chase Sapphire Preferred.

The Annual Fee

The Chase Sapphire Preferred card comes with an annual fee of $95. While this fee might seem like an additional cost, it’s important to weigh it against the value you get from the card.

For most users, the benefits and potential savings easily outpace this cost. Just the $50 annual hotel credit and the lack of foreign transaction fees can nearly cover the fee.

And when you add the value of the points you can earn through regular spending and especially through bonus categories, the fee becomes a worthwhile investment for anyone serious about maximizing their travel rewards or everyday spending.

The Bottom Line

The Chase Sapphire Preferred card is my go-to card. With a $95 annual fee, it easily pays for itself if you’re like me—someone who loves earning rewards on travel and dining.

The sign-on bonus alone is a game-changer, offering a potential travel credit worth over $900. Whether it’s booking flights, grabbing dinner out, or simply shopping online, this card turns everyday activities into rewards that fund my next adventure.

If you’re looking to get serious about maximizing your rewards, the Chase Sapphire Preferred could be the perfect fit. It’s not just about spending; it’s about making every dollar work towards your next big trip or goal. Why not let your everyday spending take you somewhere extraordinary?