In the last week, as the Federal government comes towards next Tuesday’s annual fiscal statement (aka ‘The Budget’ although we don’t use that terminology around here, do we?) and the State Government’s are progressively delivering their own Budget Statements (they being financially constrained) we have witnessed the absurdity of the system of public finances that pretends the Federal government is a big household and that somehow monetary policy is the most effective way to deal with an inflation that is sourced in supply side constraints. Earlier this week, the Victorian government released a fairly shocking fiscal statement, which cut expenditure programs in many key areas such as health care (while the pandemic is still killing many people), public education, essential public infrastructure maintenance and upgrades, and more. Why? Because it built up a rather large stock of debt during the early years of the pandemic and is now in political jeopardy because the state debt is being weaponised by the conservatives who claim the government is going broke. Similar austerity agendas are being pursued by other state and territory governments although Victoria leads the way because it provided more pandemic support to offset the damage that the extensive restrictions caused. Meanwhile, the federal government is boasting that it is heading towards its second consecutive surplus, as unemployment rises, hours of work fall, and the planet requires massive investment to attenuate climate change. The madness compounds when we realise that around 85 per cent of all state and federal debt that was issued between March 2020 and July 2022 was purchased by the Reserve Bank of Australia – that is, effectively, by the federal government itself. If citizens really understood the implications of that they would never agree to the swingeing cutbacks in public expenditure and the user pays tax hikes etc, that have been justified by an appeal to the debt build up. Its just madness.

The following graph shows the RBA holdings in total federal government debt since January 2017 to April 2024.

At the peak (July 2022), the RBA held 32.69 per cent of total outstanding federal debt.

As at April 2024 it holds 28 per cent.

During the first few years of the pandemic, the RBA bought most of the federal and state/territory debt that was issued.

In effect, the federal government buying its own debt up as well as hoovering up the debt issued by the next level of government down.

Thinks about what that means.

The RBA just typed numbers into bank accounts and took possession of the debt instruments that it bought in the secondary bond market (after the governments had issued the debt in the primary market).

At the federal level, this was just a right-left pocket sort of deal.

The right pocket issues the debt and pays the yield to the left pocket.

The left pocket then pays the yield back to the right pocket (in the form of the dividend payments the RBA provides to Treasury).

A charade.

In the case of the state/territory governments, the arrangements have seen a significant transfer of funds from the states to the federal government.

Why?

The RBA buys the state government debt.

The states and territories have to service that debt by paying the RBA the yield and the principal on maturity.

The RBA then includes those payments in its dividend payment to the Treasury.

The states and territories are forced by media pressure then to cut back on essential spending programs because of its outstanding debt but none of the media reports note that the RBA holds a significant amount of that debt.

The Sky News headline yesterday was ‘Dead set broke’: Sky News host slams the State of Victoria’s debt’ and wheeled out a commentator as an ‘expert’ who just lied to the public.

It followed up with video content ‘Victoria’s debt from ‘decade’ of Labor’s ‘catastrophically bad’ economic management’

The Right-wing Melbourne Sun newspaper carried headlines: ‘Dire Debt Loop’.

One of the big TV stations carried the story “Major projects scrapped in brutal Victorian state budget”.

And so it went, the media outlets were having a field day talking up some confected sense of catastrophe and calling for even harsher fiscal cuts than the Victorian Labor government actually announced.

As a matter of fact, the Victorian Opposition conservatives are a total rabble – dysfunctional, incompetent and without any merits that would suggest they are ready to govern the state when the next election is held.

Yet all the ‘debt’ talk is providing them with a surge in the polls.

And spare the thought if they were actually elected.

Take a moment.

Imagine if someone in the RBA offices accidently typed some zeros in the accounting system against the RBA holdings of federal government and state and territory government debt.

In other words, just wiped the huge RBA holdings off.

Nearly a third of the Federal government debt would disappear, while a significant slice of the semis debt (state and territories) would vanish.

Would the media still be able to claim there was a major fiscal crisis at all levels of government?

Unlikely, the graphs that they carefully manipulate the vertical scales to show government debt going through the roof would look like Mt Everest.

Their lurid headlines would look pretty stupid.

And ask yourself whether your world would look any different the day after the RBA officer typed in the zeros.

Not a single person would see any difference.

Yet, when the governments then start cutting essential expenditure programs, including delaying investment in abating climate risk and improving the hospital system that is failing (as I noted on Monday), our worlds do change significantly – for the worse.

Yet all that could be avoided if the RBA just wiped off the debt.

No negative consequences would flow from such an action.

It’s madness for them to pretend otherwise.

But the madness doesn’t end there.

On Tuesday, the RBA decided to keep interest rates on hold but the governor as is her wont paraded before the media threatening tough action.

This is in the context of the inflation rate continuing to decline and posing no threat of acceleration.

Why did the inflation rate fall so rapidly since September 2022?

Because the factors that led to the inflationary pressures have abated – pandemic restrictions and sickness, Putin, OPEC+.

The 11 RBA rate hikes since May 2022 have not been necessary and have caused a massive redistribution of income from the poorer mortgage holders to the wealtheir financial asset holders.

That alone is disgraceful.

But as Modern Monetary Theory (MMT) economists have duly noted, the interest rate hikes have actually started driving the inflationary pressures themselves.

In Australia, the behaviour of the rental component in the CPI, which is now responsible for the overall inflation rate falling more slowly than it might given the other fundamentals, is an example of this RBA effect.

The rate hikes add to the burden of the landlords, who take advantage of lax regulations regarding the rental market and gouge the tenants.

One just has to compare Japan with here.

In Japan the inflation rate is now much lower even though they faced the same supply constraints as any nation.

And the Bank of Japan did not increase interest rates during the inflation surge.

It tells us something.

Further, next week the Federal government will deliver its fiscal statement.

Another fiscal surplus is predicted on the back of a massive rise in tax revenue driven by so-called bracket creep.

In other words, the federal government is screwing wage and salary earners relentlessly and pretending that the surpluses are the result of responsible fiscal management.

In the last few days, the mainstream economists who often are platformed in the national media have been calling on the federal government to cut spending and increase taxes to push the surplus in even larger numbers.

Apparently this is to help the RBA in its inflation fight.

Yet, all the economic data is suggesting that the economy is on the precipice of a recession.

Here is the monthly hours worked graph up to March 2024.

It doesn’t look healthy and we are now observing the unemployment rate starting to rise.

Of course, the RBA wants the unemployment rate to rise as long as none of the top officials don’t join the dole queue.

This is because they claim the NAIRU (the unemployment rate supposed to be associate with stable inflation) is above the current rate of unemployment.

But I have pointed out before, their logic is absurd.

The glaring inconsistency in the RBA’s narrative – particularly the new governor’s speeches leading up to taking the position and since is the justification for interest rate rises based on the NAIRU estimate of the RBA which was 4.5 per cent last June then mysteriously dropped to 4.25 per cent more recently.

One of the problems with the New Keynesian approach is its glued-down insistence that the so-called Non-Accelerating-Inflation-Rate-of-Unemployment (NAIRU) should guide monetary policy.

The mainstream textbook garbage which says that if the unemployment rate is below the NAIRU then inflation accelerates, and, if the unemployment rate is above the NAIRU, then inflation will decline.

The RBA currently claims they had to hike rates because the unemployment rate of around 3.7 to 3.9 per cent was below their NAIRU estimate.

I note the NAIRU is unobservable but estimated through econometric methods and the sampling errors using generate wide confidence intervals – which make the concept impossible to use for accurate policy making.

But these characters persist.

In Australia’s case over the last 2 years, the situation is pretty clear.

The unemployment rate has been very stable over the last few year or so, fluctuating within a narrow band, but the inflation rate has been falling since September 2022.

Which means that logically, the NAIRU could not be above the current unemployment rate and must be below it.

Which means that the RBA’s insistence on putting 140,000 extra workers onto the unemployment scrap heap has no foundation even in the theoretical structure they believe in.

Other data such as retail sales, business bankruptcies etc – which all tell us about the state of the economic cycle are looking poor.

Conclusion

At a time when inflation is falling quite steadily and the economy is tipping towards recession, it is lunacy to be running fiscal surpluses.

But that is where we are at.

I am sure enlightened beings from other planets are looking down on this mess and thinking how stupid we all are for tolerating such idiocy.

Advance orders for my new book are now available

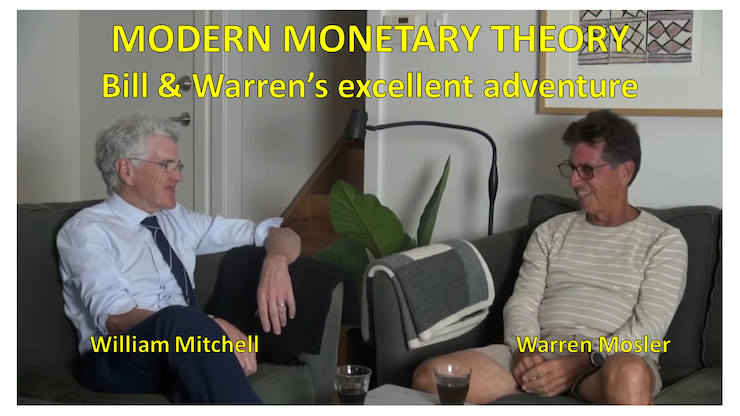

I am in the final stages of completing my new book, which is co-authored by Warren Mosler.

The book will be titled: Modern Monetary Theory: Bill and Warren’s Excellent Adventure.

The description of the contents is:

In this book, William Mitchell and Warren Mosler, original proponents of what’s come to be known as Modern Monetary Theory (MMT), discuss their perspectives about how MMT has evolved over the last 30 years,

In a delightful, entertaining, and informative way, Bill and Warren reminisce about how, from vastly different backgrounds, they came together to develop MMT. They consider the history and personalities of the MMT community, including anecdotal discussions of various academics who took up MMT and who have gone off in their own directions that depart from MMT’s core logic.

A very much needed book that provides the reader with a fundamental understanding of the original logic behind ‘The MMT Money Story’ including the role of coercive taxation, the source of unemployment, the source of the price level, and the imperative of the Job Guarantee as the essence of a progressive society – the essence of Bill and Warren’s excellent adventure.

The introduction is written by British academic Phil Armstrong.

You can find more information about the book from the publishers page – HERE.

It will be published on July 15, 2024 but you can pre-order a copy to make sure you are part of the first print run by E-mailing: info@lolabooks.eu

The special pre-order price will be a cheap €14.00 (VAT included).

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.