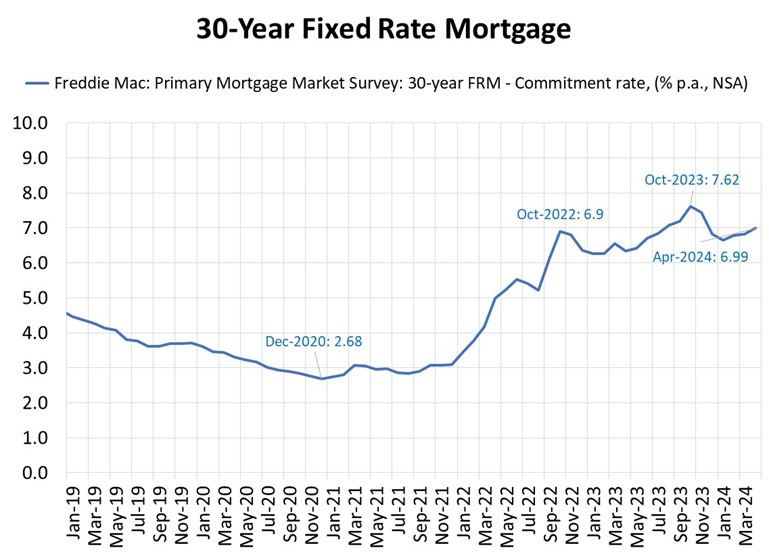

Mortgage rates have increased on a monthly basis, according to data from Freddie Mac. As of end of April 2024, the 30-year FRM – Commitment rate, increased by 17 basis points (bps) to 6.99 percent from 6.82 percent in March. This was a 35 bps increase from the beginning of the year (6.64 percent), and 65 bps from last year (6.34 percent). However, rates remain lower than the cycle peak of 7.62 percent last October. The latest weekly data from Freddie Mac shows that a trend of elevated rates is likely to continue, as the average weekly 30-year mortgage rate for this month is reported to be above 7 percent.

The 30-year mortgage rate is influenced by the 10-year Treasury rate, which rose by 33 basis points to 4.54 percent between the end of March and the end of April. This increase reflects investor reactions to persistent inflation and the Federal Reserve maintaining the federal funds rate at 5.5 percent while retracting some indications of late 2024 monetary policy easing.

Per the NAHB forecast, we expect mortgage rates to stay elevated at around 6.66% at the end of 2024 and eventually to decline to under 6% by the end of 2025. The NAHB outlook is for the federal funds rate to be cut at the December meeting and six rate cuts in 2025.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.