Objective and strategy

The fund seeks capital appreciation by investing in the stocks or preferred shares of U.S. small-cap companies. The manager pursues a sort of “quality value” strategy: he seeks high-quality firms (strong balance sheets and strong management teams) whose stocks are undervalued (based, initially, on price/earnings and price-to-cash flow metrics). Because it is willing to hold companies as their market cap rises, the portfolio has about 9% invested in mid-cap stocks that it bought when they were small caps.

In general the portfolio holds 45-60 names (currently 50) and stays fully invested. That said, the manager notes that while “we like to keep the money invested, we don’t want to make bad investment decisions. If there aren’t names that meet our criteria, we will let cash build.” The fund’s current (3/31/2024) cash allocation is 10%.

Adviser

FPA (aka First Pacific Advisors) is the fund’s advisor, providing administration, marketing, and distribution services for the fund. As of March 31, 2024, FPA manages approximately $26 billion across multiple strategies. Independently owned FPA has 78 employees, with 21 investment professionals. They are an exceptional firm with unwavering commitments to quality, value, and their investors. In 2020, they entered into a strategic partnership with Bragg Financial Advisors. Bragg Financial Advisors is the subadvisor, responsible for the day-to-day management of the portfolio. The firm is headquartered in Charlotte, NC. Bragg has been around since the early 1970s, provides investment services to institutions, charities, and individuals, and has about $3.4 billion in assets under management. They advise the two Queens Road funds and 1500 or so separately managed accounts. The firm is now run by the second generation of the Bragg family.

Manager

Steven Scruggs, CFA. Mr. Scruggs has worked for BFA since 2000 and manages this fund and Queens Road Value (QRSVX). That’s about it. No separate accounts, hedge funds, or other distractions. He is supported by Matt Devries, who has been with Bragg Financial since about 2016, and Benjamin Mellman, who joined the firm in 2023 after a stint with International Value Advisors.

Strategy capacity and closure

Mr. Scruggs’ rule of thumb is that the strategy could accommodate 2.5 times the market cap of the largest stock in the Russell 2000. He translates that to a soft close at about $2 billion.

Active share

95.24%. “Active share” measures the degree to which a fund’s portfolio differs from the holdings of its benchmark portfolio. High active share indicates management which is providing a portfolio that is substantially different from, and independent of, the index. An active share of zero indicates perfect overlap with the index, 100 indicates perfect independence. The “active share” research done by Martijn Cremers and Antti Petajisto finds that only 30% of U.S. fund assets are in funds that are reasonably independent of their benchmarks (80 or above) and only a tenth of assets go to highly active managers (90 or above).

QRSVX has an active share of 96.8, which reflects a very high degree of independence from the benchmark assigned by Morningstar, the Russell 2000 Value ETF.

Management’s stake in the fund

As of the most recent Statement of Additional Information, Mr. Scruggs has invested over $1 million in each of the FPA Queens Road funds.

Opening date

June 13, 2002.

Minimum investment

$1,500 for investor class accounts, and $100,000 for the institutional share class. At Schwab, which holds about 50% of investor-class assets, the minimum investment is $100.

Expense ratio

0.96% for investor shares and 0.79% for institutional shares, on assets of $712 million.

Comments

In “The Quality Anomaly” (May 2024), we explored what’s been called “the weirdest market inefficiency in the world.” The evidence is compelling that high-quality stocks purchased at reasonable prices (Mr. Buffett’s “wonderful companies at fair prices” ideal) are about the closest thing to a free lunch in the investing world. In general, in general, the price of abnormally high returns is abnormally high volatility … except in the case of quality stocks purchased at a reasonable price (call it QARP). QARP stocks offer both higher long-term returns and lower volatility than run-of-the-mill equities. The general pattern for such portfolios is consistent: solid in normal markets, great in declining ones but laggards in rapidly rising frothy markets.

Queens Road Small Cap Value is the very model of such a portfolio, one of the most consistently successful small-cap funds of the 21st century. As a simple summary of that claim, here are the fund’s Morningstar ratings (as of 3/24/2024):

Current: Five-star rating, Gold analyst rating

Three years: Three stars, average return, low risk

Five years: Five stars, above average return, low risk

Ten years: Five stars, above average return, low risk

Overall: Five stars, above average return, low risk

The Queens Road – FPA Partnership

Despite its success, the fund remained quite small. In November 2020, Bragg Financial entered into a strategic partnership with FPA in order to provide high-quality administrative support and more sophisticated marketing. That arrangement allowed the manager to focus more exclusively on portfolio management.

This has turned out to be a happy marriage. The fund has grown dramatically in size over the past four years from about $140 million to about $710 million. Investor expenses have fallen. Turnover remains exceptionally low. Performance has remained exceptionally strong. The portfolio’s active share, a measure of independence from the index, has remained very high, which suggests that the new fund inflows have not impaired the manager’s ability to execute.

The Four Pillars

Queens Road Small Cap Value shares an investment discipline with its larger-cap sibling, Queens Road Value. The strategies for both funds are easily explained, sensible, and repeatable: buy a reasonable number of well-run companies (signaled by their strong balance sheets and management teams) when their stocks are substantially discounted (signaled by their price-to-earnings and price-to-free-cash-flow ratios). Then hold them until something substantially changes, which leads to a relatively long, relatively tax-efficient holding period. They summarize it this way:

- Look for companies with strong balance sheets, manageable debt, and strong free cash flow.

- Attempt to normalize economic earnings over full market cycles.

- Evaluate management’s track record of defining effective strategies and executing their stated objectives.

- Strive to own companies in growing industries with favorable economics.

Because Mr. Scruggs’ view of “value” is less mechanical than many of his peers’, he tends to own some stocks that are somewhat “growthier” than average. As a result, the two major ratings services – Morningstar and Lipper – classify the fund somewhat differently. Morningstar places it in the “small value” peer group, while Lipper assigns it to “small core.”

The Performance Test

Since Mr. Scruggs targets outperformance over the full market cycle rather than trying to “win” every quarter or every year, we used the screener at MFO Premium to measure the fund’s long-term performance against both small-value and small-core peers. The fund is just over 20 years old, so we examined its 20-year record.

By every measure, across time and against both peer groups, Queens Road Small Cap Value produced competitive returns with virtually unparalleled downside protection.

QRSVX performance over 20 years, 05/2005 – 04/2024

| Small-cap value peers | Small-cap core peers | |

| Annual returns | 8.0%, identical | 8.0%, trails by 0.1% |

| # peer funds / ETFs | 37 | 162 |

| Sharpe ratio | #4 | #10 |

| Maximum drawdown | #4 | #8 |

| Ulcer Index | #3 | #1 |

| Standard deviation | #3 | #2 |

| Downside dev | #2 | #2 |

| Down market dev | #3 | #2 |

| Bear market dev | #3 | #2 |

| S&P 500 downside capture | 90%, #3 | 90%, #2 |

Data from Lipper Global Data Feed, calculations from MFO Premium, as of 4/30/2024

How do you read that table?

Annual returns simply measure the fund’s gains which is a bit above the average small-value fund’s and a bit below the average small-core fund’s.

Sharpe ratio weighs the gains against the risks investors were exposed to. They rank in the small-value elite and in the top tier (top 18%) of the growthier small-core group.

All of the other metrics are different ways of measuring the risks that investors were exposed to: largest decline, day-to-day volatility, downside or “bad” volatility, volatility in months when the market fell even a little, volatility in months when the market fell more than 3% and amount of the S&P 500’s losses that the fund “captured.” In each case, against both groups, QRSVX is among the elite performers.

What explains the steady outperformance?

First, Mr. Scruggs keeps his eye on the long-term drivers of returns and actively screens out the short-term noise. While he recognizes and worries about, the “severe and uncertain crisis” created by the Covid-19 pandemic and the “unprecedented” involvement in markets by central banks, he also acknowledges that we don’t know the near- or long-term economic effects of either, so neither can drive the portfolio. He remains focused on finding individual stocks that “provide a reasonable expected return and an adequate margin of safety.”

Second, he has a less mechanical view of “value” than most. He argues that the appropriate measures of a firm or industry’s valuations evolve with time. That evolution requires some rethinking of the importance of both physical capital (reflected in price-to-book ratios) and intellectual capital in assessing a firm’s value. That’s led him, he reports, to buy some value stocks that purely mechanical metrics might describe as growth stocks.

Third, he maintains a portfolio of higher-quality companies. In general, the small-cap universe is littered with junky companies: companies with limited market reach, untested business models and management, and a history of … hmm, “negative earnings.” Mr. Scruggs assiduously avoids companies that haven’t met both his quality and valuation criteria.

… we have a preference for long-term compounders that we hope to own forever. These are high-quality franchises with strong balance sheets, proven management teams, and attractive industry dynamics. Compounders don’t usually come cheap, and while we are always valuation-conscious, we are generally willing to pay a little more for higher-quality companies.

So, what do we mean by quality? At the most basic level, quality means we can have confidence that a company’s earnings and cash flows will be greater in three to five years than they are today … at the end of the day, we take a holistic look at our companies, identify their risks, try to remain conservative and judicious, and compare their current prices to our confidence in their futures.

Quality companies are good long-term investments, but they tend to lag during frothy markets – periods when investors are often checking their portfolios daily and gleefully – while excelling in down markets. The “make money by not losing money” mantra is a bit tame for some but works beautifully for long-term investors. Mr. Scruggs notes,

Historically, quality has been a large contributor to our outperformance during market downturns. Low leverage allows companies to survive and reinvest when the business cycle turns. Strong management teams can be trusted to shepherd their companies through headwinds and seek out new growth opportunities. Entrenched competitive positions and industries with favorable outlooks mean that the passage of time is our friend. In practice, it is never this easy.

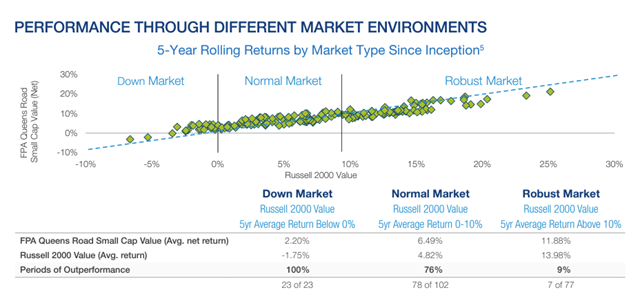

The folks at Queens Road have carefully tracked the long-term (that is, five-year rolling) performance of their fund in three different types of markets: down, normal, and robust. Below they provide both a visual representation (being above the blue line indicates above-average performance) and their batting average.

Bottom Line

Equity investors, wary about high valuations, untested business models, and volatile markets have cause to be more vigilant than ever about their portfolios. Queens Road Small Cap Value has a record that makes it a compelling addition to their due diligence list.

Morningstar recognizes Queens Road as a five-star fund, an assessment of their past performance, and a Gold-rated fund, a recognition offered to “strategies that they have the most conviction will outperform a relevant index, or most peers, over a market cycle.” We concur.