We are currently in a market where one week seems to be already a long period of time. One week ago I wrote about Silicon Valley Bank and the different cycles in a typical banking crisis (First liquidity, then credit troubles).

Last week: SVB

In between, the bank run accellerated and SVB was then closed and rescued by the FDIC. In the age of social media, there is now a lot of coverage on this event available, personally I found this Odd Lots Podcast Episode helpful as well as Matt Levin’s take. Matt Levin also has an answer on why SVB was not sold over the weekend: In the wake of the GFC, many of the banks who bought failing lenders were then punished with lawsuits and it seems that something like this could happen to SVB as well.

Current consensus is that SVB failed both, because of very unwise interest rate bets on its asset side as well as an unhealthy concentration of its depositor base connected by a few big VCs on its liability side. According to many stories, SVB was a very active member of the Silicon Valley VC ecosystem and somehow the VCs (and startups) basically killed the Goose who laid them golden eggs with this bankrun. In the current difficult funding environment, It would have made more sense fot the VCs to support the bank but I guess they were all in panic mode.

This week: Credit Suisse

This week, the comment of a representative of the Saudi Investment fund led to the implosion of the share price of Credit Suisse. One day later, the SNB and FINMA released a statement that they will backstop 50 bn of liquidity requirements which for now seems to have stabilized things to a certain extent.

Credit Suisse – Rogue Bank

CS was a slow moving train wreck ever since the former McKinsey “Wunderkind” Tidjane Tiam took over as CEO in 2015. When he was fired in 2020, not only it was revealed thaty he used private investigators to spy on fellow board members, but more importantly, Credit Suisse was involved in almost every major fuck-up in the last few years. A few examples:

- 5,5 bn USD loss with Archegos/Bill Kwan in 2021

- 1,7 bn USD loss with Greensill

- Pushed 1 bn of Wirecard bonds into Clients portfolios shortly before the collapse

- Was a creditor to Chinese fake coffee chain Luckin Coffee

- CS is supposed to hold at least 80 bn USD assets of criminals and corrpupt politions

Only in the past few months, the Swiss regulator openly critisized CS’s weak controls and in addtion, CS found “material weaknesses” in their financial reporting. For more bad stuff, just googling “Credit Suisse scandal” gives more results on money laundering, Bulgarian Cocaine rings and other “juicy” stuff, it is really incredible.

Looking at the CS share price, it is pretty obvious that there is literally no bottom:

Although it is always very difficult to make predictions, I personally think that a true and lasting turn-around for CS is very unlikely. There are very few cases in banking history where a financial institution survived such a “clusterfuck”. Credit Suisse would not be the first big name in Banking that just disappears. Besides Leahman and Bear Stearns, who remembers Salomon Brothers, DLJ, Bankers Trust, Barings, Smith Barney, Chemical Bank, Dresdner Bank and all the others ?

The most likely scenario in my opinion will be that the ring-fenced Swiss operation will somehow survive. What that means for Bondholders and shareholders on Group level is open, but in my opinion the CS shares are at best a “far out of the money option” on a very optimistic scenario. Of course anything can be traded profitably in the short term, but mid- to longterm, a complete loss of capital is very likely for CS shareholders.

Today: First Republic Bank

First Republic, a “mid sized” 200 bn plus US bank with ~21 that banks to “High net worth clients in costal regions” continued its plunge and said it would be open to almost anything, including a fire sale in order to survive.

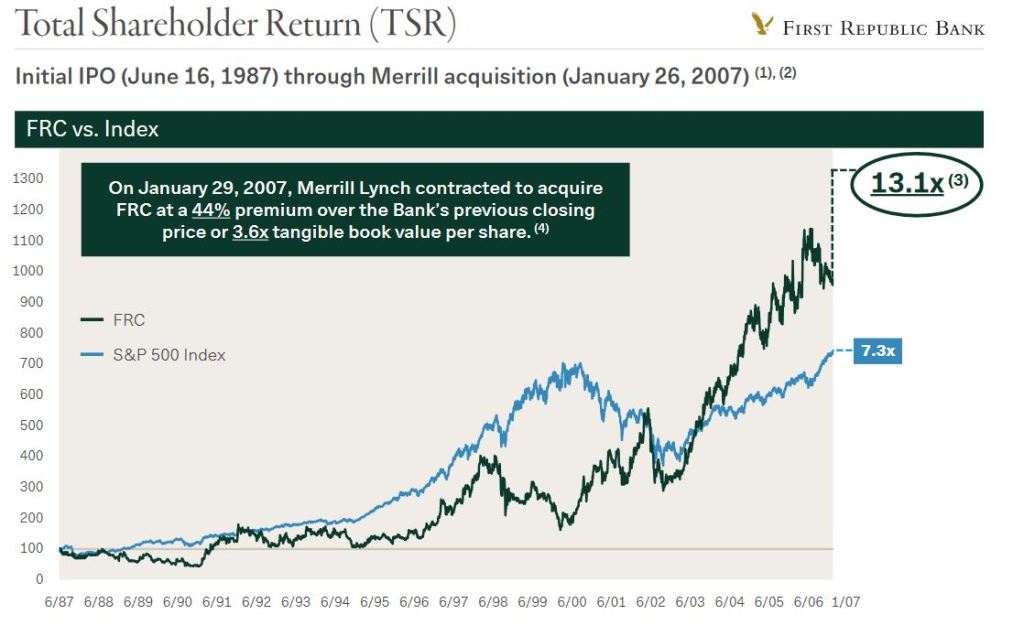

When reading the January invetsor presentation, First Republic looks like an absolute success story, among others, their share price went up 13x since 1987, almost 2x the level of the S&P (i guess ex dividends) which is remarkable for a bank:

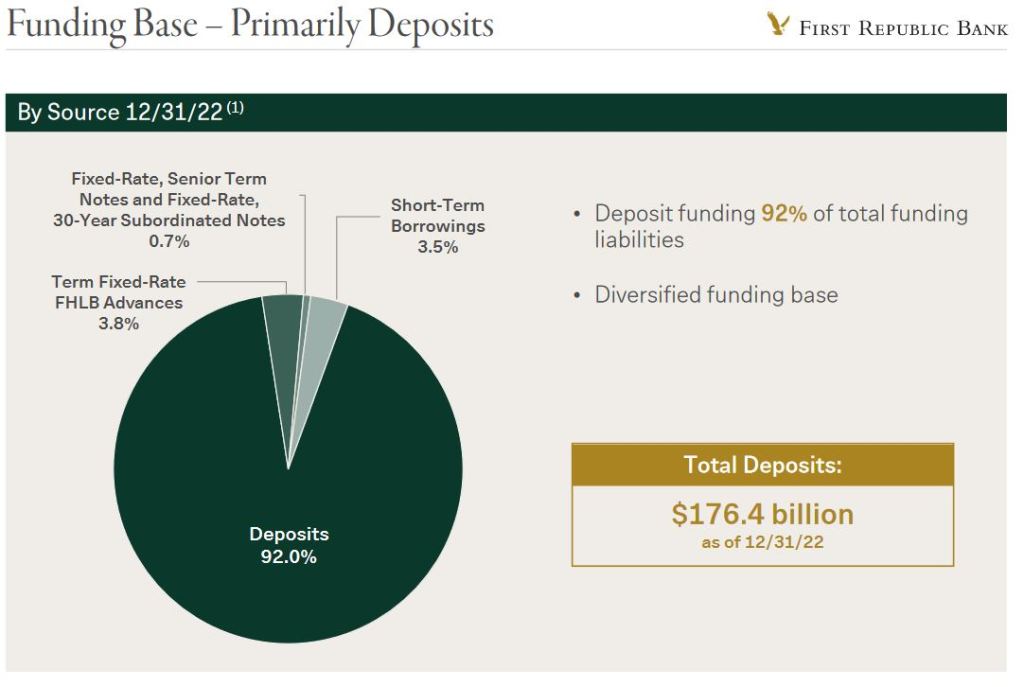

However, looking at these slides, it becomes relatively clear where the problems of Republic are: Funding is mostly via deposits:

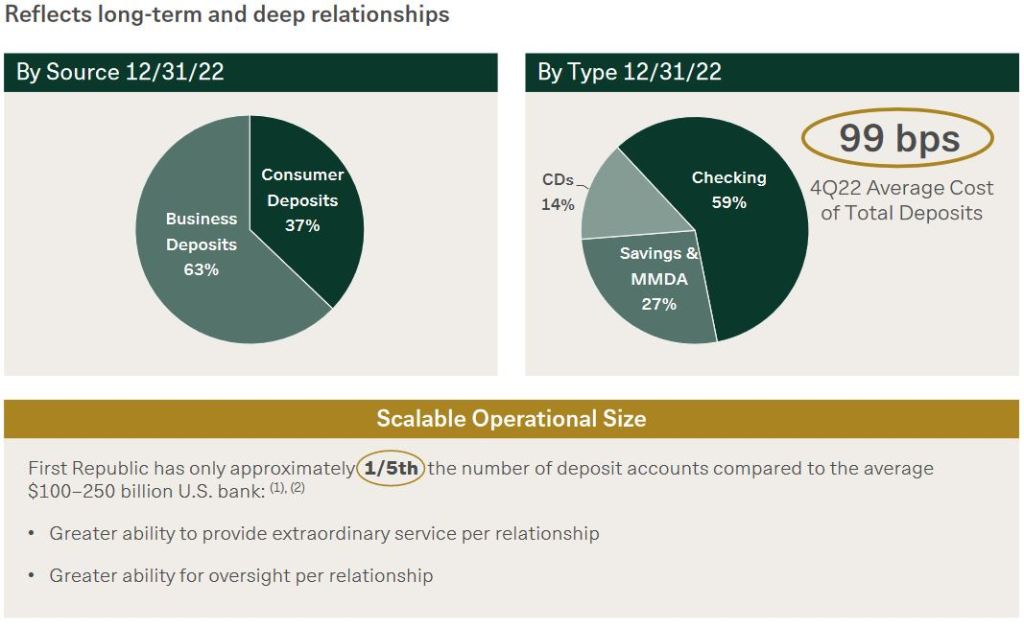

The deposits are mostly business accounts and larger size:

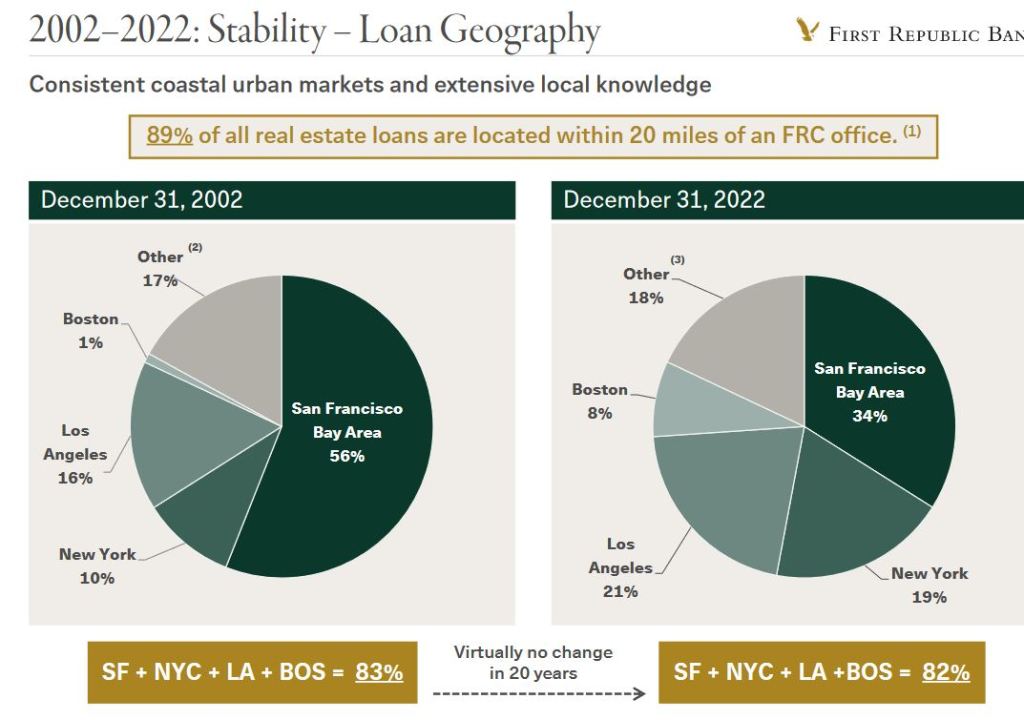

And, the Asset side consists mostly of “coastal real estate loans” and business loans to venturec Capital funds, both assets that might be in trouble:

It didn’t help that the Rating Agencies just downgraded First Republic to “junk” because of the vulnerable funding structure.

To be honest, If I would have known about First Republic earlier and read the investor presentation, I might have considered it as a potential investment. The bank also traded at unusual high P/E multiples in the range of 20-30 earnings, so very few investors

Next week and thereafter: What could be the more lasting effects of this episode ?

I guess that for the next two or more weeks, the market is “hunting” for further weak players and all of them will be backstopped by their respective Governments and Central Banks. A “Lehman moment” in my opinion still remains a very low probability scenario. However it is also clear that this whole development might have wider consequences.

For the banks, it will be even more difficult to transform short term deposits into longer term assets, which by definition is one of the main function of the banking system. For the US, more and tougher regulation is already on the way.

Among other side effects, overall the current development will most likely increase funding cost and limit borrowing capacity for the banking sector. This in turn will make it more difficult for borrowers to obtain or roll over bank loans. And if borrowers are able to obtain bank loans, they will need to pay higher credit spreads. A certain increase in Corporate Credit spreads was already observable in the past few days.

Overall this could have a siginficant impact on business activity as the availability of bank loans is a leading indicator for economic activity. This in turn could then lead to the second part of the cycle, the real credit cycle with more defaults etc.

Depending on how inflation rates are developing, the central banks might counter with lower interest rates, which however, do little to make lending easier for the banks. Of course, Governements and Central banks will try to counter a big credit squeeze, however without tighter credit conditions it is unlikely that inflation will cool off quickly.

I need to emphasize here that I am not a Macro guy at all, but overall, I think the probability for a real credit cycle has increased significantly. As a consequence, in my opinion one should limit exposure to exposed financial companies as well as businesses with near or mid term funding requirements.