Days, months, years change. One question that doesn’t is – Should I buy or sell now? Of course, the reference is to the equity markets.

I have to confess there is no way to get a perfect answer on this one. And so every time I am asked about it I am at a loss of words. Well, no more.

Starting May 2021, I decided to get a hang of this problem and see if there was some way I could clear up the confusion. I said, “Can I at least give an asset allocation guidance?”

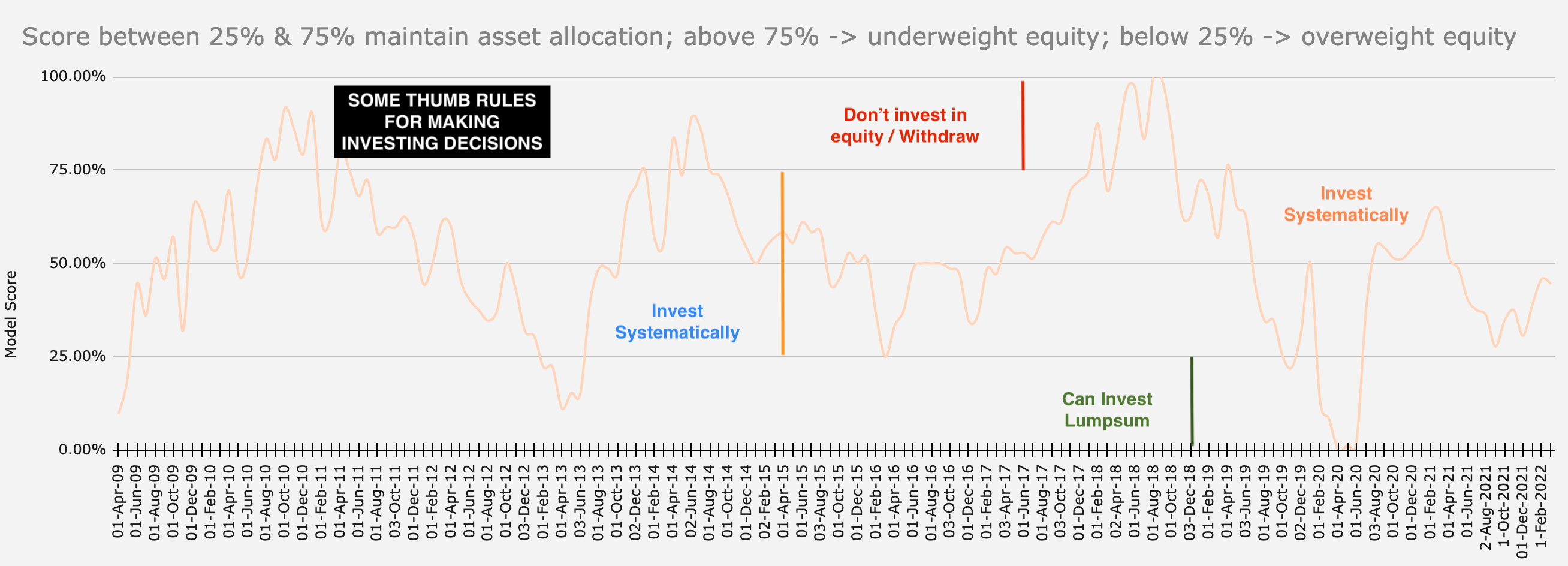

As a result, the Asset Allocation Indicator came into existence. A simple, rule based understanding of what’s happening now and what is a good course of action.

This is the indicator as on May 2, 2022. It is simply saying –

“No need to panic. Continue with your asset allocation. Rebalance to bring it in line with your original.”

The model uses rolling 3 year ranking for Nifty 200 PE and 10 year G-Sec rate. Read this post to know more about how it was done.

So far, the model works as expected.

Note, this is not a crystal ball. It is simply a way to ensure that we don’t go overboard or stay out of markets, unnecessarily.

Buying high and selling low is a real risk for investors.

The model will likely help you avoid it and take the opposite course. If we can achieve even this much, your portfolio is unlikely to disappoint you over a period of time.

There are no magic pills in investing and, for that matter, most endeavours in life.

Even in investing, asset allocation matters far more than this fund or that stock.

If you have the best stock in the world but only with 1% allocation, you get only bragging rights. It is unlikely to move the needle on your portfolio. On the other hand, a 20% portfolio allocation to a simple equity index fund over a few decades has the potential to be life changing.

Yet, if you are looking for a portfolio that follows the indicator while also offers specific investment options, check this out.

Put it to test

What if you applied the above model and simulate a portfolio to see what the results would be?

Follow your asset allocation, rebalance, go overweight/underweight and choose your own funds. You can use the new simulation tool here to do all this.

I can tell you that it is not just going to be fun but also help you build some muscle memory on “behaving right.

If you end up using the tool and share your test details, you might just end up winning a surprise reward.