Today morning I received one interesting WhatsApp message from my old client. I thought to share that and at the same time my replies to that message.

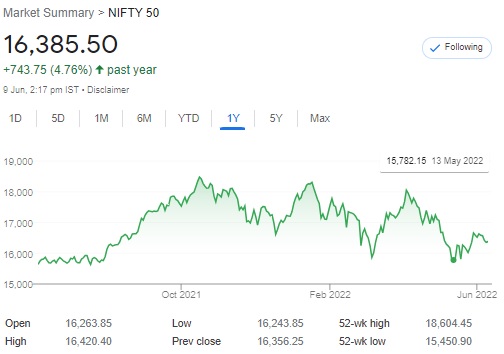

Many new equity entrants are in frustration mode nowadays and especially if they entered the post-Covid crash. Look at the below chart of Nifty of last one year. The market is in sideways for a year and many may feel that it’s better if we invested in Bank FDs.

However, the beauty of equity is up and downs and sideways. If we do not keep our cool, then failure is guaranteed.

Look at the below chart of Nifty to understand the sideways journey of Nifty for a year.

This situation along with his commitments made him feel frustrated and he sent the below message to me. I am sharing his message exactly like how he shared it.

Hi Basavraj,

Hope you are fine and doing well. It’s been the last 1 year, and I have started following ur recommendations. To a major extent, I have tried my best to achieve the monthly savings number of XX lakhs since last year. I have cut down on cost, even changed my job. But was not able to reach out at that level. Because the costs have also gone up over the period. I feel, in order to find financial freedom in the future, I have put myself and my family’s happiness in prison. Not much of growth in investment due to the market situation. I wanted to check, if we can have a discussion on this sometime at your convenience or if I need to come back to u only after achieving the savings number.

Sorry, I was speaking my heart out. There is no intention of criticism you. I know I am in this position because of my past actions. Just in a mental agony state. Need it helps to overcome this.

My answers to his message are as below.

# Concentrate on upgrading your skill, so that you are a NEED to your employer.

# That’s the reason creating long-term wealth is not a short-term or instant action. It requires long-term, boring and consistent effort.

# Im not saying you have to sacrifice your current life. But balancing both and spending which is a NEED is more important.

# If we feel each of our WANTS as NEEDS, then obviously we end up with less money.

# Earning more and spending less is the only way.

# Regarding investment returns, such sideways are the time that tests our behavior, frustration, and commitment where the majority fail.

# I’m not saying that you commit XX Lakhs, but the truth is if you are dreaming about financial freedom, these short-term sacrifices are a must. Choose which one you wish as your priority.

# Concentrate on spending and have a watch. Rest invest rigorously for the long term are the key secrets.

These are all known facts to us. However, sometimes we reach the exhaust level where handholding is required and especially in the behavior aspect of investors. After my replies and discussion on each of the above-said points, he felt happier and agreed to our next year’s journey and hoping that he will reach his financial freedom at the earliest and wishing him that he be his own financial planner at the earliest.