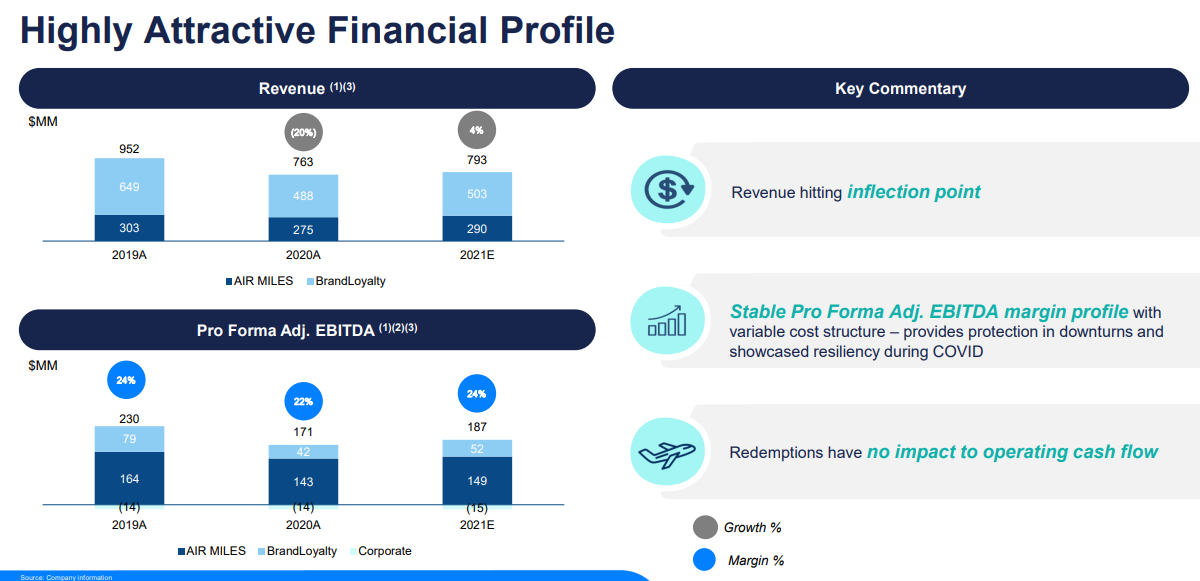

The AIR MILES segment was just about back to normal when covid hit which reduced the appeal of a travel awards program and due to travel restrictions, mile redemptions (and thus revenue/earnings) dropped significantly in 2020 and 2021. In Q2 2021 business is potentially inflecting, miles created is up (+8%) and redemptions (+32%) are following, albeit against an easy comparable Q2 2020. The company is anticipating $187MM in adjusted EBITDA in 2021, but a normalized number is probably something closer to $200-210MM, this is something of a leisure travel recovery story.

There is not a great public peer for Loyalty Ventures currently public, Aimia previously owned Aeroplan (spun from Air Canada and repurchased by the airline a couple years back for $370+MM) and AeroMexico’s loyalty plan that was sold for 9x EBITDA. The U.S. airline carriers used their loyalty programs as collateral to raise financing for themselves last year, for example United raised financing with a 12x EBITDA multiple valuation on their rewards program. Probably not apples-to-apples. I have no clue where LYLT will trade, but I’m going to throw a 9x multiple on it as a guess.

When issued trading was supposed to start today under the symbol LYLTV but I didn’t see any trades, regular way trading is set for 11/8. As always, I’m very open to hearing from those more knowledgeable about the situation, especially those more comfortable with the accounting and piecing out the true cash flow of this business.

Other thoughts/notes:

- This spin seems a bit off the radar, ADS has been kind of quiet about it too, the investor deck is about as sparse on details as the Trump/DWAC one, there hasn’t been an investor call made public (guessing there’s one for the debt or will be one). Most pitches for ADS (previously was a bit of a hedge fund hotel, some potential investor fatigue here) have always been focused on the card business and the loyalty segment has been a throw away afterthought.

- The company likes to tout that 2/3rds of Canadian households have an AIR MILES account, but many collectors are probably only loosely active in the program, the top 15% of collectors make up 70% of new miles created. This is both good and bad, collecting miles seems like a habitual exercise, it gamifies shopping, you need the power users but you also need to keep them active and happy.

- BMO is their largest sponsor with 15% of revenue, I believe this is their primary credit card partner, their contract comes up again in 2023.

- ADS is retaining a 19% stake in LYLT, like other recent spins, they’ll divest the retained amount over the next year or so to reduce debt. ADS calls out that 27% of their shareholders are index funds that might be forced to sell LYLT, so there could be a bit of an overhang. The distribution ratio is 1 share of LYLT for every 2.5 shares of ADS, if LYLT is worth $50 then its about $20 of ADS’s $100 stock price.

- I don’t know the full history, but LYLT pays a 1% royalty fee to Diversified Royalty Corp (DIV in Canada) for the use of the AIR MILES brand name, rather insignificant but also kind of odd.

- LYLT invests the “float” rather conservatively, mostly cash equivalents and some corporate bonds (most miles are redeemed after 2-3 years, so the portfolio probably matches the duration). While their miles never expire if an account is active, miles do expire if an account is abandoned and not used for two years, so there is some breakage still despite the 5-year policy being reversed.

- It wouldn’t surprise me if we see a goodwill write-down on the BrandLoyalty business, it accounts for $542MM of goodwill and is expected to generate $52MM of EBITDA, so that would value the segment at 10x EBITDA. They acknowledge the risk in the Form 10 noting that the fair value is less than 10% above the goodwill carrying value. Or one could spin it that if BrandLoyalty’s intrinsic value is 10x, the overall company should be at least that as the AIR MILES segment is a more valuable business model.

Disclosure: I have a tiny position in ADS $100 Jan 2022 calls, basically just a FOMO trade in case LYLT takes off out of the gate similarly to CCSI (seems like one of those situations where both parent and spin will trade up), look to add LYLT directly once it starts trading.