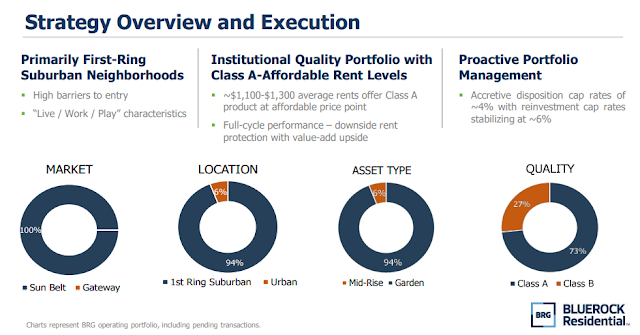

Starting with the left side of the balance sheet, Bluerock has interests in 60 multi-family properties, mostly in the low class-A, high class-B range, think $1300-$1400/month garden and midrise style apartments in the first rung of the suburbs in sun belt cities like Phoenix, Austin, Atlanta, Raleigh, etc.

Of those 60, 35 are consolidated properties where BRG owns the vast majority and operates the property like a normal multi-family REIT and the remaining 25 are more credit style investments where they have a preferred equity, mezz loan or ground lease interest in the multi-family property (some of these are new developments).

This second credit investment bucket can cause issues when trying to screen BRG as you need to back out these investments to determine an implied cap rate for the operating portfolio when coming up with a sum-of-the-parts valuation. The credit investments bucket also has the potential to make a sale trickier, the operating portfolio should have plenty of buyers, but if they insist on including the miscellaneous other credit stuff it would shrink the buyer pool. The credit investments are also often tied to related party developments that management has an outside interest in (obvious question would be if these are truly market/arm’s length terms), in a sale, management might have to take this pool and buy it into one of their other vehicles or sell it to a commercial mREIT like entity.

On the right side of the balance sheet, Bluerock has a heavy slug of preferred stock in their capital structure essentially making the common stock an equity stub. There are currently four separate series of preferred stock outstanding, the series C and D preferred are pretty traditional in that they have a $25 liquidation preference and are exchange traded. The series B (still outstanding, but discontinued) and T are non-traded and placed through RIA channels with investors (similar to a non-traded REIT) via an affiliate of management, Bluerock Capital Markets LLC, where management receives a 10% commission/fee (broken up into a 7% and 3% component) of the total money raised. The B/T also have a strange feature where after 2 years, the company can redeem the preferred shares for common stock, so naturally management pitches this as an attractive capital raising method where they can continuously issue the preferred and then convert the preferred to common at opportune times. There’s some validity to that, but clearly some conflicts of interest too. The problem is the stock has continued to trade at discount to peers and a theoretical NAV, they’ve converted some preferred over to equity this year, but where private assets are being valued after this recent spike in rent growth, it’s probably value destructive to continue to convert the preferred stock.

The the bull case is why management might actually be looking for an exit, they do own a lot of the stock (technically units in the operating partnership) thanks to their incentive plan and the 2017 internalization transaction, the capital structure is stuffed full of preferred stock, how much more can they realistically issue? From the Q2 conference call (tikr.com):

We have a buyback in the market that provide support for the stock. So I wouldn’t be surprised if you saw us redeem part of the B cash. I wouldn’t be surprised if we take a break from redeeming the B, to a lot of stock — the common to absorb and recover. We have — as you know, we own north of 30% of the equity — common equity here as management. So we’re very sensitive to the stock price, making sure that we deliver value for the shareholders.

Since the capital structure is so levered to the common, the upside if someone is willing to pay top dollar could be pretty huge. On the bear side, management could keep issuing preferred stock, earn their 10% levy, continuously convert those shares after two years in perpetuity and drain a lot of value from minority shareholders. Again, this is technically internalized structure but still feels externally managed. Here is BRG mapped out in my typical back-of-envelope style, this is for a sale scenario so doesn’t include overhead or some of the other accounting noise in BRG’s financial statements, and there could be errors:

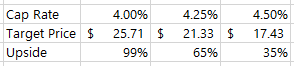

Then a super basic scenario analysis based on potential transaction cap rates and assuming the credit investments are valued at book value:

The combination of high upside in a sale scenario with the uncertainty that management would actually sell even if a great deal presents itself pushes me to like call options in this case. I can participate in the upside if a deal happens and limit my downside if it ends up being an unfounded rumor or something management planted to get the stock price up so they could convert the preferred at more advantageous terms.

Other thoughts:

- REIT M&A activity is above or near all-term highs as a result of a combination of low rates, PE money sloshing around the system, plus it seems like private values for real estate didn’t fluctuate nearly as much as publicly traded REITs did during the pandemic. Some of that mispricing is being fixed through take private transactions. One example, Condor Hospitality’s (CDOR) proxy statement came out, as expected there were plenty of buyers and they all coalesced around the same value (I’m also anxiously waiting for a similar result at CorePoint Lodging (CPLG)). If BRG is indeed running a similar process, I’d expect similar results, plenty of buyers and offers coming in at or below a 4.5% cap rate.

- BRG has a value-add component to their portfolio, similar to the Nexpoint Residential Trust (NXRT) thesis, they can earn 20% IRRs on their capital by doing some surface upgrades to things like kitchens and bathrooms or adding smart-locks to their doors. About 4,300 of their 11,500 operating units are still unrenovated, providing some additional growth levers, or it could be part of the thesis of a new buyer that makes paying a low 4s cap rate palatable.

- Another odd related party transaction that is probably nothing, but BRG does have an Administrative Services contract with other Bluerock entities where BRG pays another entity the expenses to the run the REIT, it is done at cost, but just another strange arrangement for a supposedly internally managed REIT.

- In 2018/2019, Harbert Special Opportunity Fund offered $12.25/share (below where it is trading today) but got the cold shoulder from management, likely another reason the market seems to be discounting the Bloomberg sale report.

- Management consistently talks about getting into the MSCI US REIT Index (RMZ in ETF form), they’re currently outside the index, one of management’s stated reasons they’ve converted the Series B preferred stock to common is to increase the float/market cap to meet index inclusion parameters. I do sympathize with this thesis, I believe (don’t have any real data) that REITs are over owned/represented in ETF/indices because retail investors like REITs and their yields. It’s another possibly reason other than the clear conflicts why BRG is undervalued, its also part of my NexPoint Strategic Opportunities (NHF) thesis, which should be officially converting soon to a REIT and shortly after will be eligible for the index.

Disclosure: I own call options on BRG (along with shares in CDOR, CPLG and NHF)