Today is Fed day, when we get the 75 bps increase that dramatically increases the odds of a recession. The main storyline is inflation, but the overlooked subplot here is Wages. I have detailed over the past decade or so the lagging nature of wages in America — deflationary in economic terms — and how that had begun to change in the late 2010s pre-pandemic.

Consider these columns going back to 2013 pointing out the foolishness of tax-payer subsidized corporate welfare queens (2013), and why median wages were rising (2016, 2017, 2018, 2018, 2019). Then came the pandemic, and a huge federal worker subsidy. Workers upskilled and launched new businesses. The balance of power had shifted. After decades of wages being deflationary, they not-so-suddenly became inflationary.

The so-called “Great Resignation” — a very specific and uniquely American response to those complex compensation circumstances — is over. The data suggests it peaked over a year ago, slowly falling back towards pre-pandemic levels.

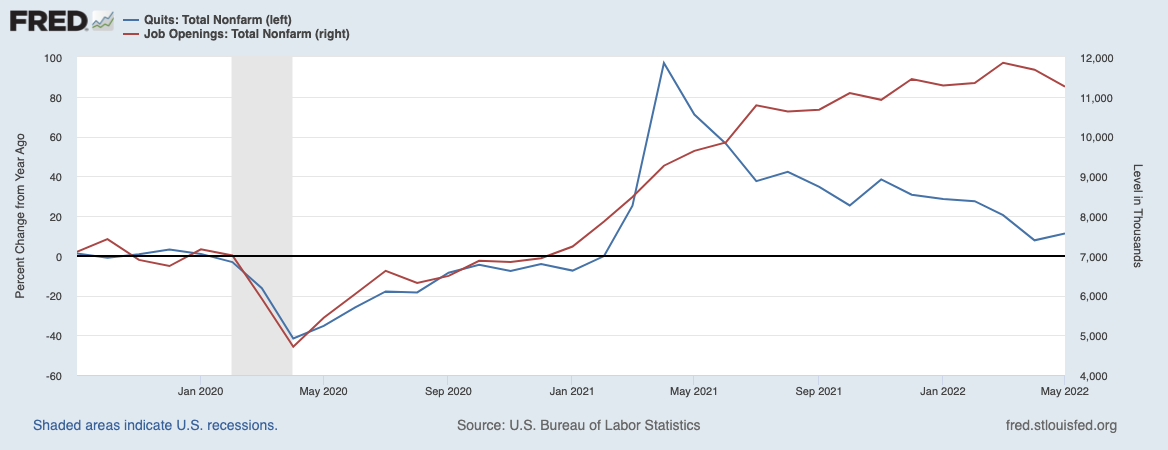

Consider the chart up top (it’s from an RWM client-only quarterly call). The FRED database shows both Quits Rate in percentage change and Job Openings in 1000s. By any measure, we still have an enormous number of unfilled positions. It’s just off the peak, but still extremely high by any measure. This attests to the robustness of the labor economy, recession or not. Yes, I understand just how ridiculous that sentence is.

But also look at the year-over-year change in the Quits Rate: It spiked in percentage terms to all-time highs in early 2021, before slowly easing back towards (more or less) flat to 2019 over the ensuing 12 months. In other words, the Great Resignation was mostly in 2021, but the after-effects are still being felt today even after Quit rates normalized.

It is easy to forget how this happened: Lagging wages from the 1960s through the 2000s not only led to a pressured middle class, but they also helped set the stage for the Great Financial Crisis. Nobody wants to see their standard of living fall, but that was what happened in the U.S. The broad post-war boom (1946-66) slowed, then stopped, then began to contract. It got worse through the 1970s, 80s, 90s. Rather than accept their fate, Americans used free money offered by the private unregulated banking system in the form of Home Sales, HELOCs, and Refinancings. This was the raw fuel to Wall Street, who lit it on fire to drive great profits in securitized mortgages right up until the moment it all went to hell. (I wrote a book about this).

The post- 2008-09 era saw wealth inequality, already substantial in the United States, explode. The 2010s monetary rescue plan benefitted anybody who owned capital assets: Stocks, Bonds, and Real Estate. But the pandemic was a massive reset, with a huge fiscal stimulus rather than just a monetary one.

Now we have inflation. If you had to guess who gets to pay for that with blood and tears and dollars, who do you think loses: Capital or Labor?

The Federal Reserve has little control over the supply issues that have driven most of the inflation we see — in the underbuilt number of new Homes, in the semiconductor-impacted shortage of automobiles, I’m the Russian war-driven increases in energy and food. Rather than acknowledge this, they are going to destroy demand by throwing 3-5 million people out of work.

That ought to show inflation who is in charge!

Today’s disastrous FOMC decision will be released at 2:00 pm

See also:

Millions of Americans Regret the Great Resignation (Bloomberg, July 12, 2022)

Sahm: A Fed-induced recession is a medicine worse than the disease (Financial Times)

Previously:

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

$1.395 Trillion Peak Unemployment Insurance (March 4, 2022)

Elvis (Your Waiter) Has Left the Building (July 9, 2021)