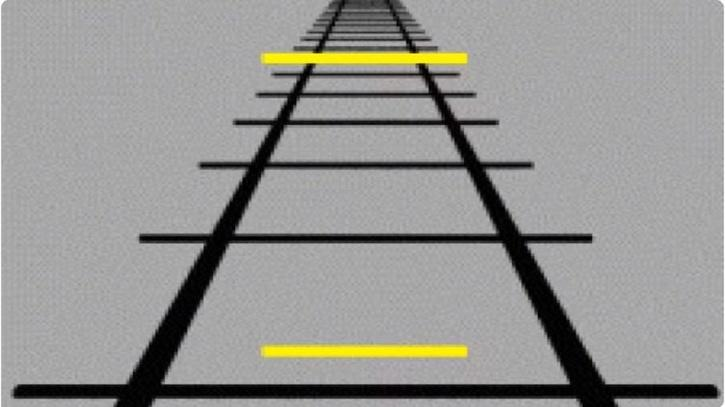

The picture below shows two yellow lines on a railway track.

Can you tell which one is longer? Is it the one closer to you? Or is it the one farther to you?

You just have 5 seconds to answer.

If you’re like the rest of us, the line which is farther to you will appear longer.

But here comes the surprise – both the lines are exactly the same length!

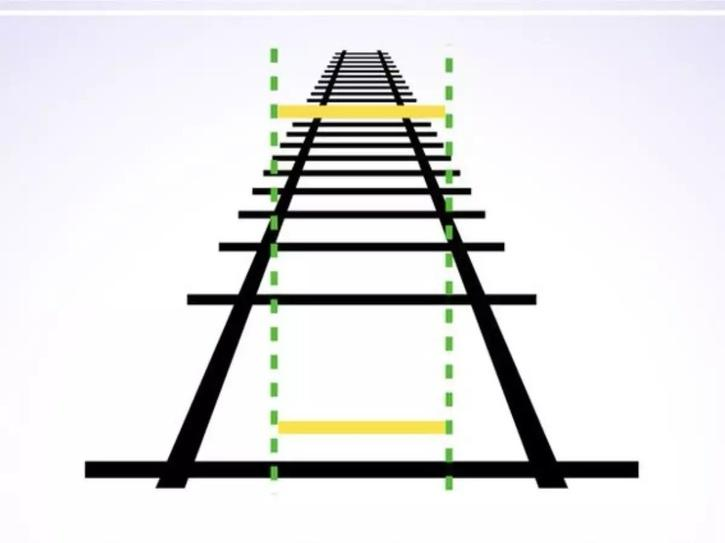

You can check the image below to verify.

While our intuition (read as gut feel) usually does a good job for most of our decisions, in certain contexts, they end up misguiding us. The above illustration is a classic case.

And here comes the tough part. Even if you know about this illusion, it’s difficult to unsee this illusion the next time.

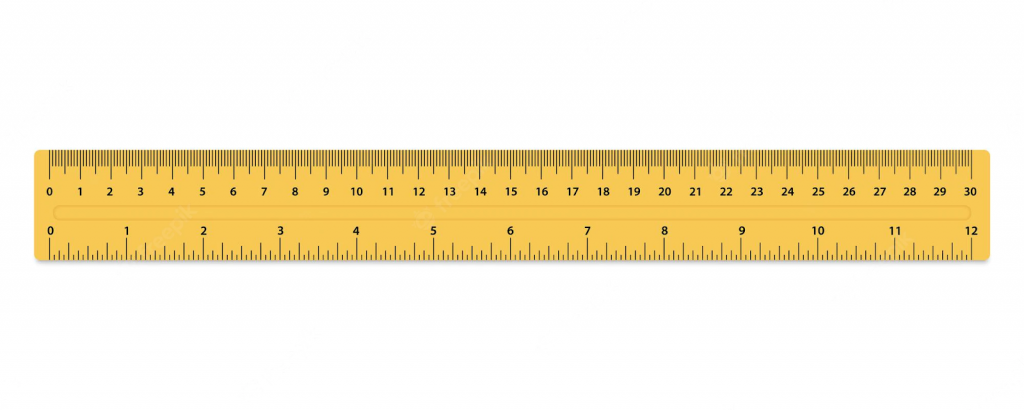

So what is the solution?

Simple. Don’t go by your intuition. Use a RULER.

Drawing a parallel, in investing there are a lot of situations where your gut feelings and intuitions misguide you to take the wrong decisions. These decisions while they ‘feel’ right in the short term have a significant adverse impact on your long-term investment outcomes.

While a lot has been written about behavioral biases (read as quick shortcuts used by the brain to make decisions) the actual problem is not about awareness or knowledge.

The real problem is that – it’s insanely difficult to implement counter-intuitive decisions on a regular basis especially when the stakes are high and money is involved!

This is where you need a RULER equivalent in investing to help you take the right investment decisions.

Enter “FRAMEWORKS”!!

The Power of Frameworks

Think about frameworks as a set of investment principles, strategies, or rule-based guidelines that will guide your investment decisions. They should be evidence-based, repeatable, and behaviorally aligned to your personality.

By organizing information better, helping you focus on the few key variables that matter (vital few vs trivial many), and reducing emotions and human biases, frameworks can help you make good investment decisions on a consistent basis.

Instead of me explaining the need for frameworks, let me take the help of the world’s greatest investor to do the job for me 🙂

“To invest successfully, one doesn’t need a stratospheric IQ. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework” – Warren Buffett

So the key idea is to start developing your own investment frameworks based on long-term evidence and behavioral insights. This can also act as a good defense mechanism against behavioral errors and emotional decisions.

6 Ps of Behavioral errors

While there are several behavioral errors, here are the 6Ps of Behavioral Errors that cause the maximum damage.

- Panic Selling

- Seen during equity market falls, Bear Markets

- Eg 2008 Covid Crash, 2020 crash

- Profit Booking

- Seen during equity market all-time highs

- Procrastination in Deploying Money

- Seen during all-time highs, amidst bad news (which somehow is always the case)

- When equity markets go up it feels like it’s bound to fall and when markets fall, it feels like it will fall further

- Panic Buying

- Seen in Bubble Markets, Fear of Missing Out, Chasing Fads

- Eg Crypto, Tech Stocks, etc

- Predictions From Experts

- At all points in time, some Expert is predicting a market crash

- Performance Chasing

- Buying and Selling funds only based on past performance – not understanding the cyclicality of outperformance

- Chasing Sector funds based on performance

Frameworks can be a good solution to address the above errors.

How to build your own investment frameworks?

Here are some important investment decisions for which you will need to build frameworks. While it’s beyond the scope of this article to explain all the below in detail, we have discussed most of the below frameworks in our earlier blogs and you can check them whenever you find time.

- Framework to Decide Long Term Asset Allocation (Blog Link)

- Helps you decide the asset allocation split across equity and debt

- Helps you decide the asset allocation split across equity and debt

- Framework to evaluate where we are in the Equity market cycle

- How to evaluate if you are in Bull, Bubble, or Bear Markets

- Refer to our monthly report – FundsIndia Viewpoint (sent to FI Gold Clients)

- Rebalancing Framework (Blog Link)

- When and How to Rebalance Your Asset Allocation

- Crisis Framework (Blog Link 1) (Blog Link 2)

- How to convert a market crisis into an opportunity

- How to convert a market crisis into an opportunity

- Bubble Market Framework (Blog Link)

- Bubble Market Indicator

- Plan to go underweight Equities in a Bubble Market

- Refer to our monthly report – FundsIndia Bubble Market Indicator (sent to FI Gold Clients)

- Framework to construct Equity Fund Portfolio (Blog Link)

- Active vs Passive

- How to diversify across investment styles and geographies?

- Fund Selection Process

- Framework to construct Debt Fund Portfolio (Blog Link)

- How to build debt portfolios managing credit risk and duration

- Framework to evaluate interest rate cycle?

- Fund Selection Process

- Framework to Invest lumpsum money (Blog Link)

- Framework to Invest via SIP (Blog Link)

- Framework to exit as you reach your goals

You can use the above list as a starting point to think through different investment decisions which require a framework. Once you finalise on your list, you can gradually start building your own frameworks and keep evolving them over time-based on feedback.

Summing it up

I want to leave you with 3 key action items

- Pre-Decide and put in place evidence-based investment frameworks for different investment decisions and scenarios

- Document the above using an ‘Investment Policy Statement’

- Keep the 6Ps of behavioral errors in mind

Other articles you may like

Post Views:

13