Angelic was a licensed certified speech-language pathologist for 34 years until emotional trauma forced her into early retirement. It was the perfect storm when her mother passed away, her father was diagnosed with Alzheimer’s, her husband became very ill, and the pandemic shut down the world.

While used to bringing home a paycheck, she quickly became overwhelmed when she couldn’t cover her bills.

A compounded burden

As if the stress of being in debt wasn’t enough, creditors began threatening her with lawsuits or taking something as collateral. According to Angelic, “I said, I cannot have these people threatening me. And I didn’t know that they couldn’t. At the time, when you’re overwhelmed, you believe them. Because I’ve never walked that way before.”

Angelic’s debt became detrimental to her mental health. “It was very emotional to go through those constant phone calls and threats. It wore me down. There was a lot more than just the debt. It’s just the debt compounded the burden of what I was going through,” she explains.

Shame led her to hide how poorly the debt made her feel. Angelic describes that time in her life this way, “It was a feeling of ultimate sadness. I didn’t have the money to pay my debt or travel anywhere. There were so many mixed emotions, but I would say it evolved into depression.”

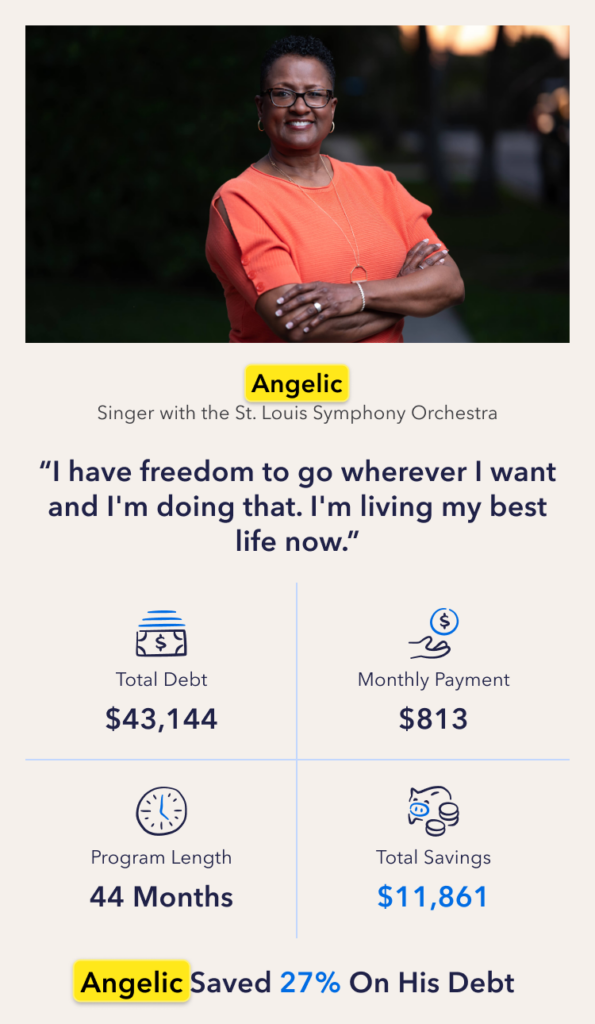

The longer she paid the minimums on her credit cards, the higher the interest and late fees kept creeping up. When she tried to form a payment plan with creditors, the conversation essentially ended before it began. “One of the debts was maybe $8,000. By the time I was missing, it was up to $9,000 and $10,000, she exclaims.” By the time she called NDR, her total debt had accrued to more than $44,000!

Facing the music

While working on the computer one day, Angelic spotted a National Debt Relief ad and took it as a sign. This was the path she was meant to walk to resolve her unsecured debt.

As she describes, “When I saw it, I called immediately. I just wanted to know what it was about. I shared my story, and the person that I was talking to, the first thing she said was, ‘Congratulations, you qualify to be a part of the National Debt Relief Program.’ That was a great feeling.

I was overwhelmed, ashamed to tell my story. But she assured me that what I was going through was what a lot of people were going through. And that shame left. I cried. She could tell. She said, ‘Are you okay?’ I said, it is so much to have that kind of relief, knowing I’m not the only one. It was just freeing. I trusted her. And wow, I can’t thank national debt relief enough.”

When Angelic shared the exciting news with her husband, he rolled his eyes. Angelic assured him, “They promise me if I stay with the plan, if I do exactly what they tell me to do, I would be debt free within so many years. And I was told if with those same debts, with the interest rate that I had, if I pay the minimum payment, it would be about 59 years to pay off.”

From marital woes to bliss

Angelic’s debt caused a major strain on her marriage. When she retired and couldn’t cover her share of the household expenses, her husband Charles temporarily picked up the slack. But after doling out an extra $3,000 in one month, he gave an ultimatum.

As Angelic says, “We weren’t as kind to each other because we both were frustrated for the same reason. And then finally when he was threatening, ‘I’m gonna leave if you don’t take care of this,’ that was the catalyst to saying, I need to do something.”

Angelic and Charles went from marital woes to bliss. “We got through all of it together. It was a major strain, but we were determined. I said, he’s my forever husband. I’m his forever wife. And now it’s, wow. It’s changed back to the way better because there’s a lot of freedom in not having debt, exclaims Angelic”

Making a plan

National Debt Relief created a plan that worked for Angelic’s financial situation, suited her timetable, and addressed her comfort level. When her Debt Coach discussed what she could afford every month, they landed on $813 a month.

But what Angelic liked most about the program is, “There was a plan, there was a goal. Then after that you get this done, you’ll get a settlement. It was communication all the way through the process. I need to know what’s the goal. I need to know how much; how long it’s going to take. And National Debt Relief does all of that.”

Sticking with the plan

Initially, Angelic was apprehensive. After suffering for months, she didn’t see an end in sight. “The moment I realized I could do the plan that National Debt Relief was offering me was when I made my first payment. After I paid that amount for maybe two or three months, I said, they’re not asking for more money. They didn’t change anything about what I had to pay,” exclaims Angelic.

Once she experienced that pivotal moment, she realized that since National Debt Relief was sticking to the plan, she could too. According to Angelic, “It was surreal because I’d been living about five or six months struggling with my husband, the finances. So, when I realized this is it, it was euphoric. Not help from my family, not help from my husband, not help from a friend.”

A pleasant surprise

After a while, Angelic didn’t give her monthly payments a second thought. So, when she received a phone call saying that she was almost done, it came as a pleasant surprise. As she explains, “I got a phone call saying, ‘You’re almost there. You only have so many more payments.’

It was just one of those surprising moments because I forgot about it. The team, they were taking care of everything. So, when I got that phone call and that email saying, congratulations, you graduated. I’m thinking from what, I kid you not.

I know it didn’t happen just like that. But it felt like that because I felt more freedom now that that part was out of the way. The debt was the big burden. And when I was told I graduated, I cried,” shares Angelic.

Before National Debt Relief, Angelic’s tears were from frustration and sorrow. But once she graduated, the tears she cried were those of joy. “It was an overwhelming freedom that I’d never felt before. I’m 61 years old and had never been debt free in my life. So that feeling of graduating, that is an amazing feeling.”

Singing a different tune

Angelic is now living the life debt once put on hold. Ironically, now that she is debt free, she gets bombarded with credit offers. She finds it easy to resist because, “There was no temptation whatsoever. Once I felt like I can get whatever I want, pay cash if I need to.

Now that I’m debt free, I do whatever I want to do. I’m free to be me. And I gained some courage. I auditioned to sing with the St. Louis Symphony Orchestra in Unison Chorus. And I got in because I was relaxed. So, I did something I never thought I would do. And it is amazing.”

Angelic is also fulfilling her bucket list through extensive travel. She went to the Grand Canyon for a second visit and spent precious time with her brother and son. One highlight was driving across the country with her sister to see Mount Rushmore.

Her other favorite experience was when her sister celebrated her accomplishment by treating Angelic to a Broadway show. “I’m in a different place in my life. I have freedom to go wherever I wanna go,” claims Angelic.

Living her best life

Angelic ends her story this way, “My heart reaches out to all of those people who need that kind of help. I’ll tell my story to anyone that wants. I have no shame whatsoever. National Debt Relief saved me so I can live my best life now!”

Let the people at National Debt Relief help you write your success story. We have supported over 500,000 people nationwide every step of the way to help them resolve their debt, regain financial independence, and adjust their spending habits to remain debt free.