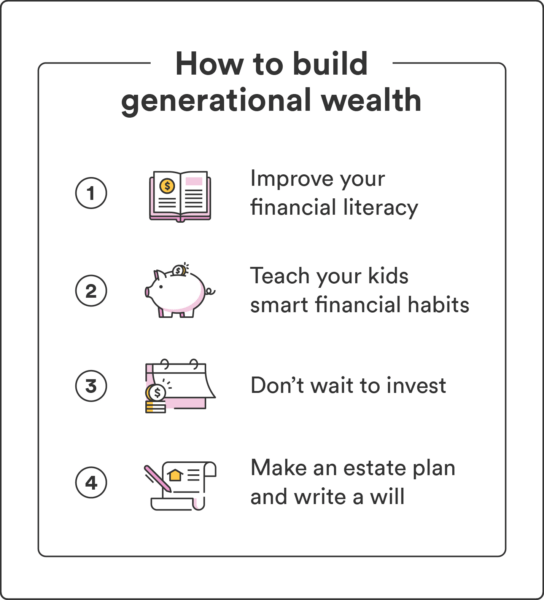

Building generational wealth can look different for everyone, but there are a few time-tested strategies.

Improve your financial literacy

Successfully building generational wealth starts with improving your own financial literacy. With a solid understanding of personal finance, making informed decisions about saving, investing, and passing on wealth to future generations can be easier.

Your day-to-day money habits also largely dictate your ability to grow long-term wealth. To begin, familiarize yourself with basic financial concepts, such as budgeting, saving, credit, and investing. Eventually, you can move on to more advanced topics such as estate planning (we’ll cover this more below) and tax laws to maximize your savings and investments.

Take advantage of the many resources available to improve your financial literacy. Read books and articles, watch YouTube videos, or take free courses on personal finance basics. To get started investing, you can deepen your understanding of topics like stocks, bonds, mutual funds, and retirement accounts.

Teach your kids healthy financial habits

Ensuring a financially secure future for your children and future generations requires passing down more than just wealth. You should also teach healthy financial habits for your kids while they’re young.

You could be the savviest investor, but if you pass that wealth to your children without ever teaching them how to preserve and grow it, there’s a slim chance that wealth will last.

One of the best ways to improve your kids’ financial literacy is by encouraging open and honest conversations about budgeting, saving, and other finance topics.

That could mean discussing the difference between wants and needs when it comes to spending, the idea of paying yourself first, or how to delay instant gratification for bigger goals in the future.

By promoting financial education and responsibility within your family, you can help ensure that your children and future generations have the skills necessary to eventually take what you’ve started and continue to build it with confidence.

Invest as soon as possible

Investing is crucial in building long-term wealth because of the potential of earning higher returns than traditional savings accounts. The sooner you invest, the more time your money has to grow and compound over time.

Contrary to popular belief, you don’t need a ton of money to begin investing – even small investments made early on can grow significantly over time, resulting in substantial wealth accumulation. The earlier you start investing, the more time you have for compounding to work its magic and generate significant returns.

There are a variety of beginner-friendly investments you might consider:

For beginners, start by researching different investment options and consider working with a financial advisor or using a robo-advisor to help make informed decisions.

Establish an estate plan

Without an estate plan, your assets may be subject to probate court (the court that oversees the handling of wills and estates), which can be costly and time-consuming. With clear instructions on distributing your assets, your estate may pass down your wealth according to your wishes.

Estate planning can also help minimize taxes and other expenses of transferring wealth. Proper planning allows you to use tax-efficient strategies such as gifting and trusts to pass down the maximum amount.

An estate plan can also help prevent family disputes over your wealth after death. By clearly outlining your intentions and instructions for how you want your wealth distributed, you can reduce the likelihood of arguments among family members and ensure that your legacy continues in a positive way.

Write a will

You should write a will even if you’re not ready to create a full-blown estate plan. A will is a document that outlines how your assets should be distributed after your death. It’s also where you would include your wishes for the care of any young children you may leave behind.

Without a will in place, you have no say in how your property or assets are handled once you’re gone – instead, it’s up to the state to decide (which can lead to an expensive and stressful legal process for your loved ones).

Consider factors such as your assets, beneficiaries, and potential tax implications when writing a will. A will can also include provisions for trusts, which can help protect your assets and ensure they’re passed down in a tax-efficient manner. Working with an estate planning attorney can help you create a comprehensive will that meets your needs and goals.