Let’s see if I can find something to counter and/or undercut each of these 10 items listed in this morning’s tweet above:

1. Only 5 stocks driving markets?!

Then why are Equal-weighted indices doing so well?

Equal-weighted Nasdaq100 up 17% since the June lows for the market because “it’s only 5 stocks”? How bad at math do you need to be to think that it’s only 5 stocks driving this market?

via @allstarcharts https://t.co/xHid2ZuqMf pic.twitter.com/8r3eAIlmsN— Barry Ritholtz (@ritholtz) May 16, 2023

2. Recession is inevitable?

If you interpret that literally, then yes, one day there will be a recession. But people have been forecasting an imminent recession for 18 months — and we still have yet to have one.

This tweet by Steve Rattner — who I consider a better-than-average, rational market analyst — was exactly a year ago today:

— Barry Ritholtz (@ritholtz) May 19, 2023

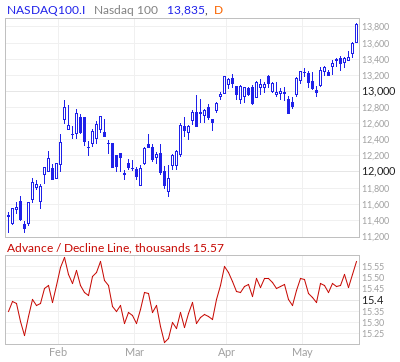

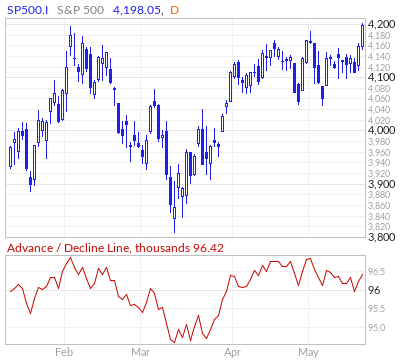

3. Breadth is terrible

There are many ways to depict how broad market participation is, but the simplest is the ADVANCE/DECLINE line. It measures how many stocks are going up versus down.

Here are the NDX & SPX (Redlines at bottom). Both seem to be doing fine

4. AI is a bubble!

The top 3 AI companies?

Microsoft $MSFT PE is 33, about its 10-year avg

$GOOG PE 27, below its 10-year avg

And Facebook? $META is giving away their AI, making it open-source.

None of that sounds bubblicious…

5. Debt ceiling = disaster

I like Jim Bianco’s comments that the media seems to think it’s a 50/50 proposition, but the implied probability of default according to market prices is 3%.

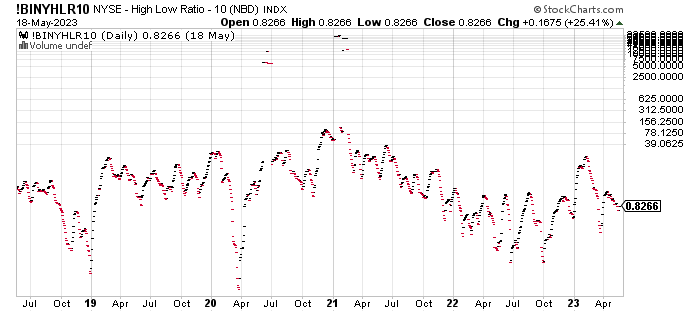

6. New lows are problematic

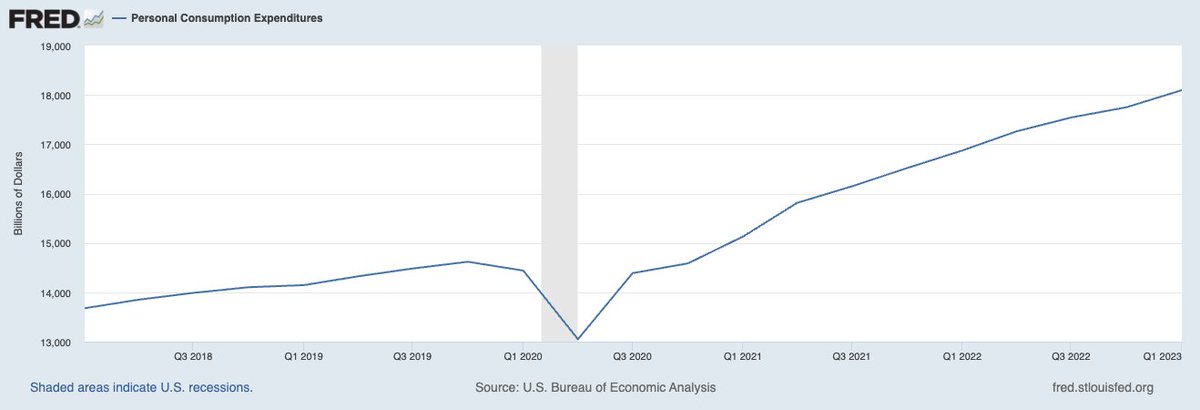

6. Consumers are running out of money (unless we look at their spending)

Personal Consumption Expenditures ( (Seasonally Adjusted Annual Rate)

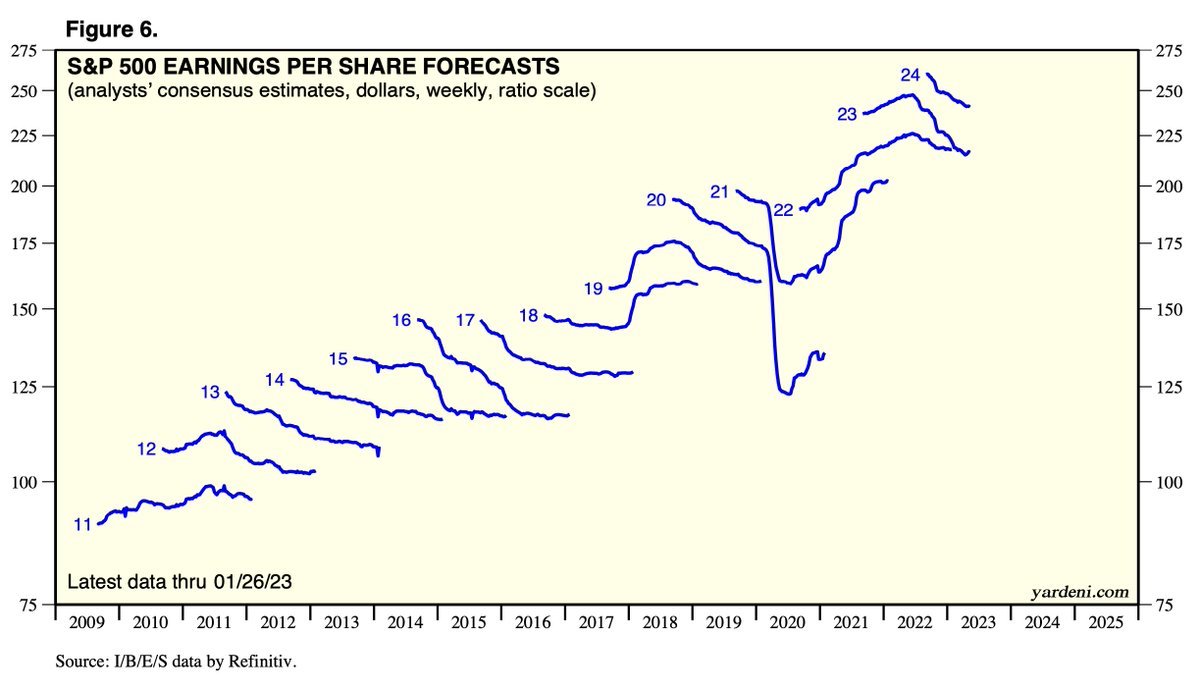

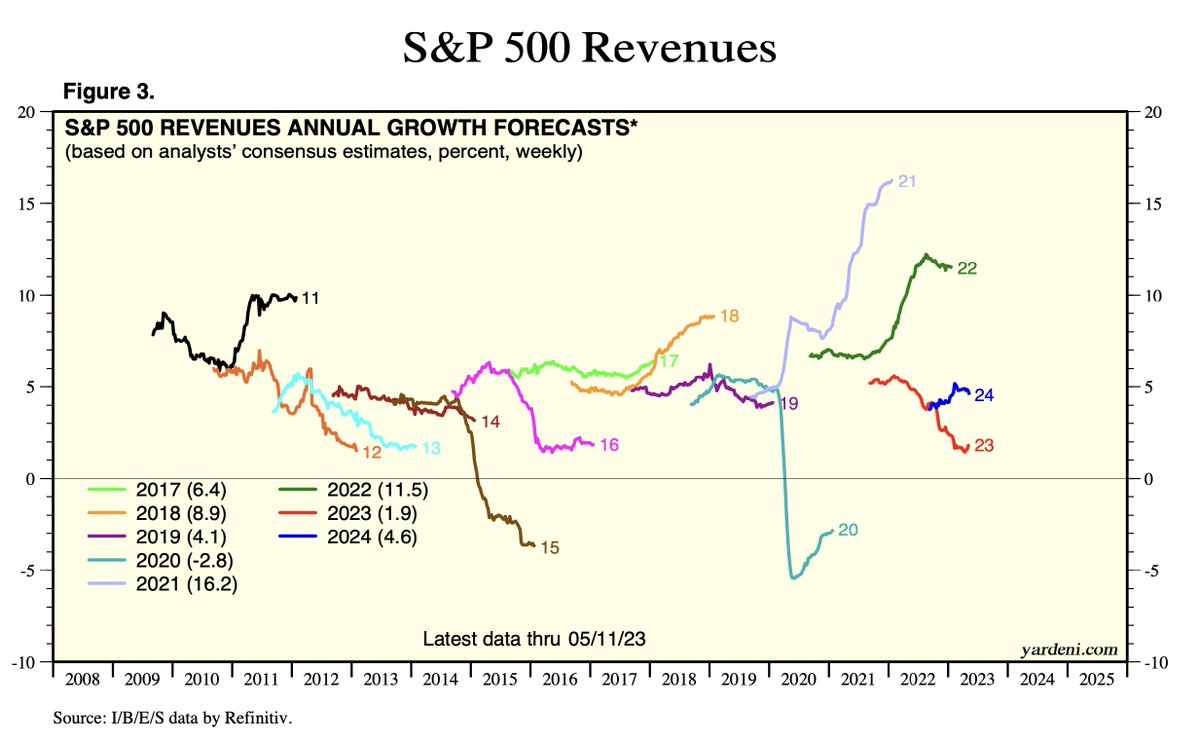

7. Earnings will fail THIS Q

Earnings forecasts are hilariously wrong most of the time, as are revenue forecasts…

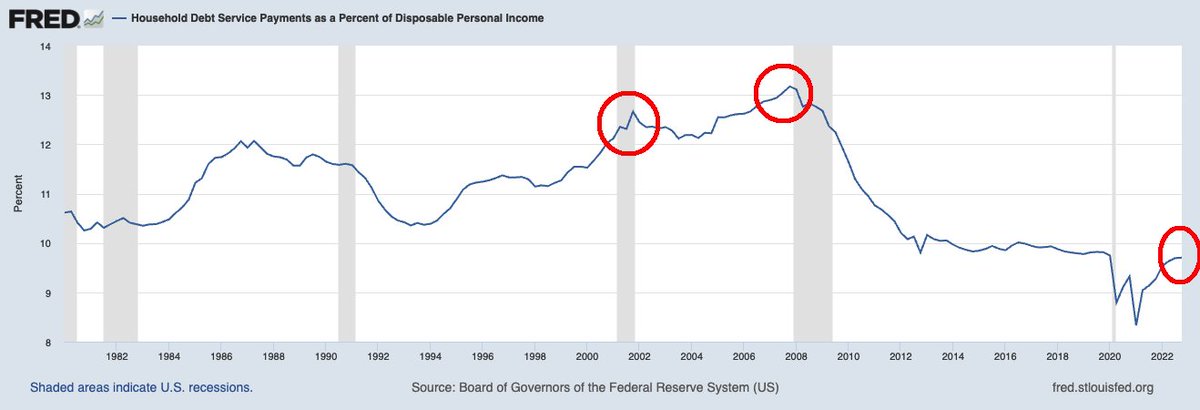

8. HH Debt!

American household debt may be at record highs, but so too are Assets and Incomes + the ratio between debt + income is near record lows.

It’s not the total debt but rather the ability to service those debts that matters most…

As I keep saying, one day, this cycle will end, a recession to worse will occur, and the secular bull market that began in 2013 will end. That day is not here yet…

FinTV comments I keep hearing:

1. Only 5 stocks driving markets

2. Recession is inevitable

3. Breadth is terrible

4. AI is a bubble

5. Debt ceiling = disaster

6. Problematic new lows

7. Consumers running out of money

8. Earnings will fail THIS Q

9. HH Debt!

10. Rally faltering— Barry Ritholtz (@ritholtz) May 19, 2023