Post Office Saving Schemes by India Post (a government-backed organization), are one of the most popular savings and investment schemes in India. It is estimated that nearly Rs 9.9 Lakh crore of small savings deposits and around Rs 170 lakh crore of total deposits are with the Indian postal department.

Given the huge popularity and the massive funds lying with the India post, the Govt has started implementing tighter KYC norms at India Post. Earlier in the month of April 2023, the Finance Minister had notified that Aadhaar and PAN numbers are compulsory for investing in post office savings schemes.

As per that notification, all the existing Post Office subscribers who have invested in post office small savings schemes should submit their Aadhaar numbers by 30 September 2023, if they have not submitted their Aadhaar numbers while opening the small savings scheme accounts.

If the existing customers do not submit their Aadhaar numbers by 30 September 2023, their accounts will be frozen on 1 October 2023.

The Govt has went one-step ahead and decided to implement even stricter KYC and re-KYC norms with immediate effect.

The government has now made it mandatory for those investing over Rs 10 lakh in post office schemes to provide PROOF OF SOURCE OF FUNDS. It has also brought all investments in post office schemes under stricter KYC/PMLA compliance rules to prevent misuse for terrorist financing/money laundering activities.

Post Office Saving Schemes & New KYC Norms

Below are the key points given in the latest Circular issued by the Postal department on May 25, 2023.

Categorization of Customers based on Perception of Risk

As per the circular issued, customers are being categorised with the perspective of risk involved. All customers according to the amount involved at the time of opening of account or purchase of Savings Certificates or credit into an existing account have been categorized with the perspective of risk involved.

- Low Risk Category : Where the customer is having account(s) and certificates with having balance in all accounts and certificates not exceeding Rs 50,000.

- Medium Risk Category : Where the customer is having account(s) and certificates with having balance in all accounts and certificates exceeding Rs 50,000 and up to Rs 10 Lakh.

- High Risk Category : Where the customer is having account(s) and certificates with having balance in all accounts and certificates exceeding Rs 10 Lakh.

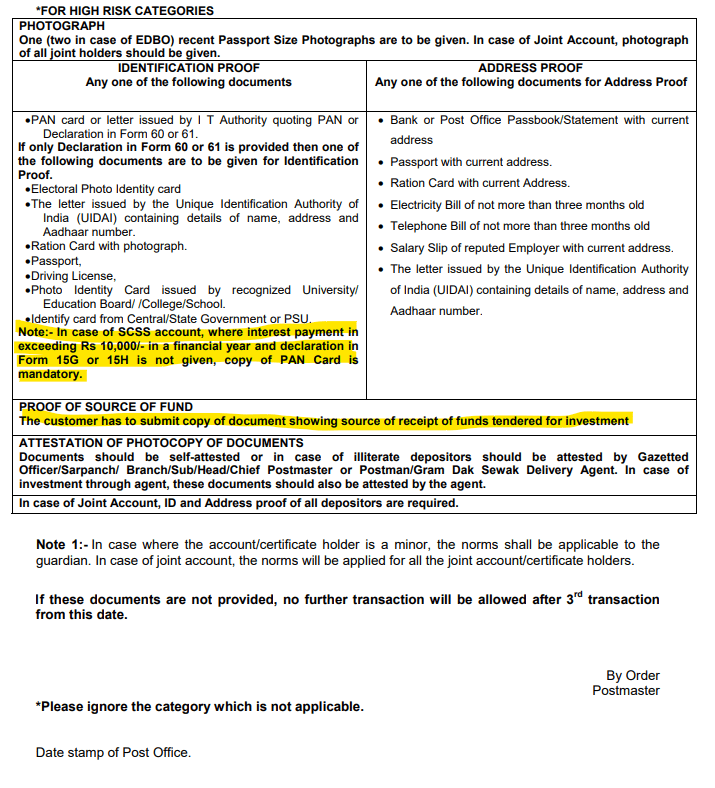

The rule of mandatory submission of Aadhaar and PAN numbers for small savings schemes is now part of the Know Your Customers (KYC) process. However, the KYC norms for the customers who fall under the ‘high-risk’ category profile, have been made even more stringent.

- The government has now made it mandatory for those investing over Rs 10 lakh in post office schemes to provide Income Proof (Source of Funds). The customer has to submit copy of document showing source of receipt of funds tendered for investment.

- As per the circular, the customer has to submit a copy of a document showing the source of receipts of funds for making investments. Any of the following documents can be submitted as proof of the source of funds :

- Bank/Post Office Account statement, which reflects the source of funds.

- Any one of the income tax returns filed during the last three financial years, which co-relates the investment in the gross income.

- Sale deed / Gift deed / Will / Letter of Administration / success certificate.

- Any other document which reflects the income/source of fund

- In case of SCSS account (Senior Citizen Savings Scheme), where interest payment in exceeding Rs 10,000/- in a financial year and declaration in Form 15H is not given, copy of PAN Card is mandatory.

- When any depositor or certificate holder requests for credit of maturity value into existing savings account, it will be allowed only after ensuring that concerned savings account was opened with due KYC documents applying risk category as per balance in the account after credit of maturity value.

- The circular further specifies that re-KYC will be done depending on the risk of the customer. For high-risk, medium risk and low-risk customers, the re-KYC must be done every two, five and seven years, respectively.

- In case where the account/certificate holder is minor, the norms shall be applicable to the guardian. In case of joint account, the norms will be applied for all the joint account/certificate holders.

- If the required documents are not provided, no further transaction will be allowed after 3rd transaction from the circular issue date (25-May-2023).

Monitoring & Reporting of High Value Cash / Suspicious Transactions

Henceforth, all post offices shall maintain the record of all transactions including the record of :-

- All cash transactions of the value of more than Rs.10 Lakh.

- All series of cash transactions which are less than Rs.10 lakh but are integrally connected and are carried out within one month period and totally exceed Rs.10 Lakh.

- Any transaction where cash is accepted and forged or counterfeit currency notes are used or where forgery of valuable Security or documents has taken place.

- Any attempted transaction involving forged or counterfeit currency notes, forged security or document.

- All suspicious transactions, involving deposit withdrawal, transfer of account, solvency certificate / Idemnity certificate etc. irrespective of the amount of transaction.

Continue Reading: