This has become a quite long and somehow rambling post. If you look for “actionable investment advice”, then you don’t need to read this.

Background: Handelsbankon on the blog since 2015

One of the great things of an Investment Blog/Journal is that one can easily revisit everything that one has written years ago when I want to look at a stock again.

Handelsbanken is a stock that I have covered quite often since 2015. Initially, I compared Handelsbanken to Deutsche Bank in 2015, claiming that Handelsbanken is a much better run “quality bank” compared to Deutsche Bank and that Deutsche Bank, despite the much cheaper valuation, most likely the worse investment. This is how Handelsbanken has performed against Deutsch Bank and the European Banking index.

The good news is that indeed, Handelsbanken has outperformed Deutsche Bank by a wide margin (in EUR) and until very recently, also the European Banking index. And this despite the fact that Handelsbanken was valued at around 17x Earnings and 2x P/P vs a P/E of 7 and P/B of 0,5 at Deutsche Bank. The relative performance can be easily explaned: Deutsche Bank made losses in 4 out of the past 8 years and earned cummulatve around zero EUR whereas Handelsbanken was profitable every year, increased EPS by ~40%.

This is what I wrote back then and still seems to hold:

“Buying cheap” with banks is mostly not a very good idea as shareholders often get massively diluted through regulatory required capital increases. Paying for quality in the long run is maybe the better and safer option.”

Learning 1: In this particular case and in many others, for financials, quality is more important over the mid- to long run than valuation. Especially low quality financial companies are almost never good long- to mid term investments.

Maybe Deutsche Bank was too low of a hurdle ? Swedish Peers:

However, compared to its Swedish peers, Handelsbanken underperfomed, especially since 2019

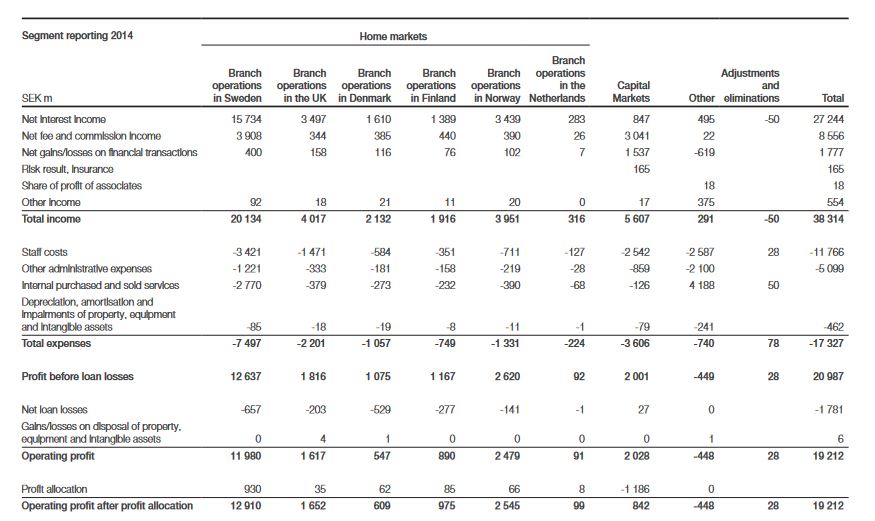

This was driven in my opinion by 2 main factors: Handelsbanken’s starting valuation was higher (17x P/E vs. 13-14) and profit growth was lower. Actually, Handelsbanken on an aggregate level had declining profits in 2019 and 2020 and only from 2021 on, profits started to increase. A deeper looks shows that the home market Sweden and even UK worked quite well between 2014 and 2022. The problem seems to be more the rest of the Nordics and capital markets:

So looking at the Segment reporting shows that Sweden has grown nicely with more than 55% over these 8 years and UK has more than doubled despite Brexit etc. Another bright spot has been Netherlands but they are still small. On the other hand, Norway, the second largest market in 2014 has stagnated and Finland and Denmark have basically disappeared. Both country operations have been put under “discontinued operations” with a slightly negative overall result. Denmark has been sold in 2022, the sale of the Finish operations seems to have been signed on May 31st for around 1,3 bn EUR, slightly above book value. Handelsbanken pulled out of Germany and Asia already in 2019.

The big question now is if that restucturing was sufficient to once again gain a lead vs. its competitors, but the problmes clearly explain why Handelsbanken now only trades in line with competitrs Swedbank and SEB.

Learning 2: Even a high quality company can have periods of operational underperformance. The big question is if they can come to greatness after that.

Learning 3: If you pay a premium for a company in comparison to its peers, this premium can disappear quite rapidly.

One good example for coming back is clearly American Express, one example for coninuous porblems is Wells Fargo.

Overall performance since 2015 clearly sucks

The overall bad news is that even Handelsbanken, before dividends, trades lower than 8 years ago.

If I am not mistaken, Handelsbanken paid out 38 SEK of dividends from 2016-2023, so the total return is slightly positive. This is the result of a massive mutliple compression for Handelsbanken from 17x earnings back then to ~8x right now. On top of that, in EUR, the Swedish Krona declined around -24% against the Euro, making things even worse for a EUR based investor.

Learning 4: Even if you pick the best company, in absolute terms the performance can suck because of structural problems in the sector which usually results in a declining P/E multiple.

Learning 5: Don’t underestimate currency risk. -24% over 8 years against the EUR was not really foreseeable in my opinon. Despite the bad reputation, the EUR is a relatively strong currency.

Learning 6: A good dividend can protect the downside, but doesn’t guarantee you a decent positive return

My own investment into Handelsbanken

My own investment history is that I bought a stake in Handelsbanken in January 2016 at a slightly lower valuation than in and then sold it in mid 2020 at a small loss (-6% incl. dividends) to focus on better “relative” value which turned out to be a good decision. My portfolio made about +40% overall in the same time period.

Is Handelsbanken a good investment right now ?

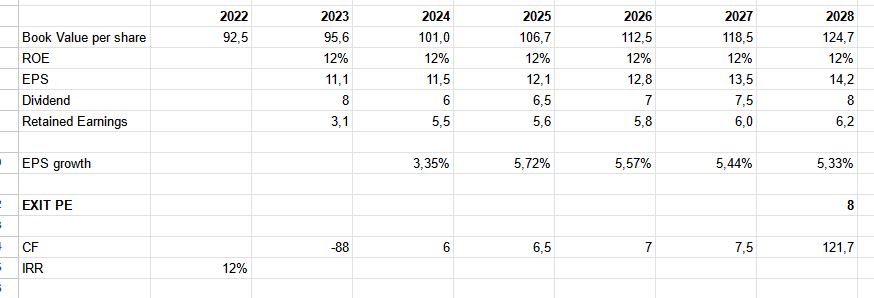

Now it is time to revisit my simplistic valuation model that I used for my investment decision which I had lined out in this post. My basic assumption was that Handelsbanken acheives an ROE of 15%, can reinvest 25% of its profit every year at that rate and gets an “stable exit multiple” of 14x earnings.

Obviously, my assumptions were much too optimistic. However, the question is clearly if Handelsbanken could eb a good investment now, at the much reduced valuation and without any “quality premium” compared to its peers.

Based on relatively conservative assumtption (12% ROE, 8x exit PE), one gets, not surprisingly, 12% return p.a. pre tax which I would consider as (much) too low considering the risk profile. Now we can play around a liittle bit with assumptions. Assuming an Exit P/E of 10x, which would be at the low end of the historical range, the expected IRR would increase to 17% over 5 years. That sounds more interesting. However, and that is a big HOWEVER, the situation in the Nordis and especiall in Sweden is quite difficult, especially in the real estate sector.

The coming Swedish Real Estate crisis ?

Sweden has been enjoying a few good decades since their last big real estate crisis. The poster child for this is a company called SBB that has lost around -60% since the beginning of the year. The FT calls Sweden the “canary in the coal mine”. The 10 year Govie interest rates have been going up from slightly negative to around 2,3% at the time of writing, about the same level as in Germany in EUR.

Sweden has relatively high LTV mortgage ratio according to some sources (>60%) , however Swedish mortgages are “full recourse”, that means the borrower cannot just walk away like in some US states. Inflation was ~8% in 2022 vs. ~9% in Europe, salaries only increased around 3%, so consumers are equally strained.

If we look back to the GFC, Earnings for Handelsbanken fell by 1/3 from the peak in 2007 and it took several years to regain that level.

What now wtih Handelsbanken ?

So far things look good and Handelbanken reported very good Q1 2023 numbers, with ROE reaching 15% for the first time in several years. On the other hand, a real real estate cycle will take a couple of years to play out if we get one.

Handelsbanken is famous for lending money only to people who don’t actually need it and has the lowest default ratios, but a real real estate crisis will clearly be a test. As far as I could see, Handelsbanken has mostly exposure to residential mortgages and very little exposure to commercial real estate.

Handelsbanken used to always come out ahead of crisis and the sale of the underperfoming businesses seems to be quite well timed. But still, I think in this case, there is clearly a reason why Handelsbanken is cheap and honestly, I do not have a different view if and how deep a Swedish real estate crisis could look like.

Therfore, I will continue watching Handelsbanken, but I will stay on the sidelines despit the very cheap valuation.

Summary:

There are many learnings in the Handelbanken case, but I think the most important one is the following two:

- In the long run, it pays to stick with high quality banks/financials, as the low quality players regularily run into problems

- However, paying a relatively large premium for high Quality financials might not be very good advice, as I experienced here with Handelbanken, but also with Admiral. Ideally you buy the high quality business during a down cycle without paying extra for quality. In a down cycle all the players get usually hammered and inevstors don’t seem to differentiate much.

My feeling is however, that for Handelbanken, we are not really in the down cycle for Swedish banks yet. I think I will revisit the situation by the end of the year to see how things have turned out by then.