Nearly everyone says the Roth is a great investment. And nearly everyone is wrong.

I heard it on radio shows, saw it plastered all over my social feed, and even confirmed it with a few Roth calculators. The Roth was the way to go. Pay taxes today and never pay taxes again? Sounds good. So I invested blindly for a decade.

Just recently, I ran the numbers myself—and discovered the horrifying truth.

By choosing a Roth, I had already cost myself $400,000 in retirement income.

First, I shed a tear.

Then I immediately flipped all my investments to a Traditional 401k.

Finally, I did an in-depth survey to see how many others had been duped into thinking the same way as me—that the Roth was an excellent investment and would save them money in retirement.

The results?

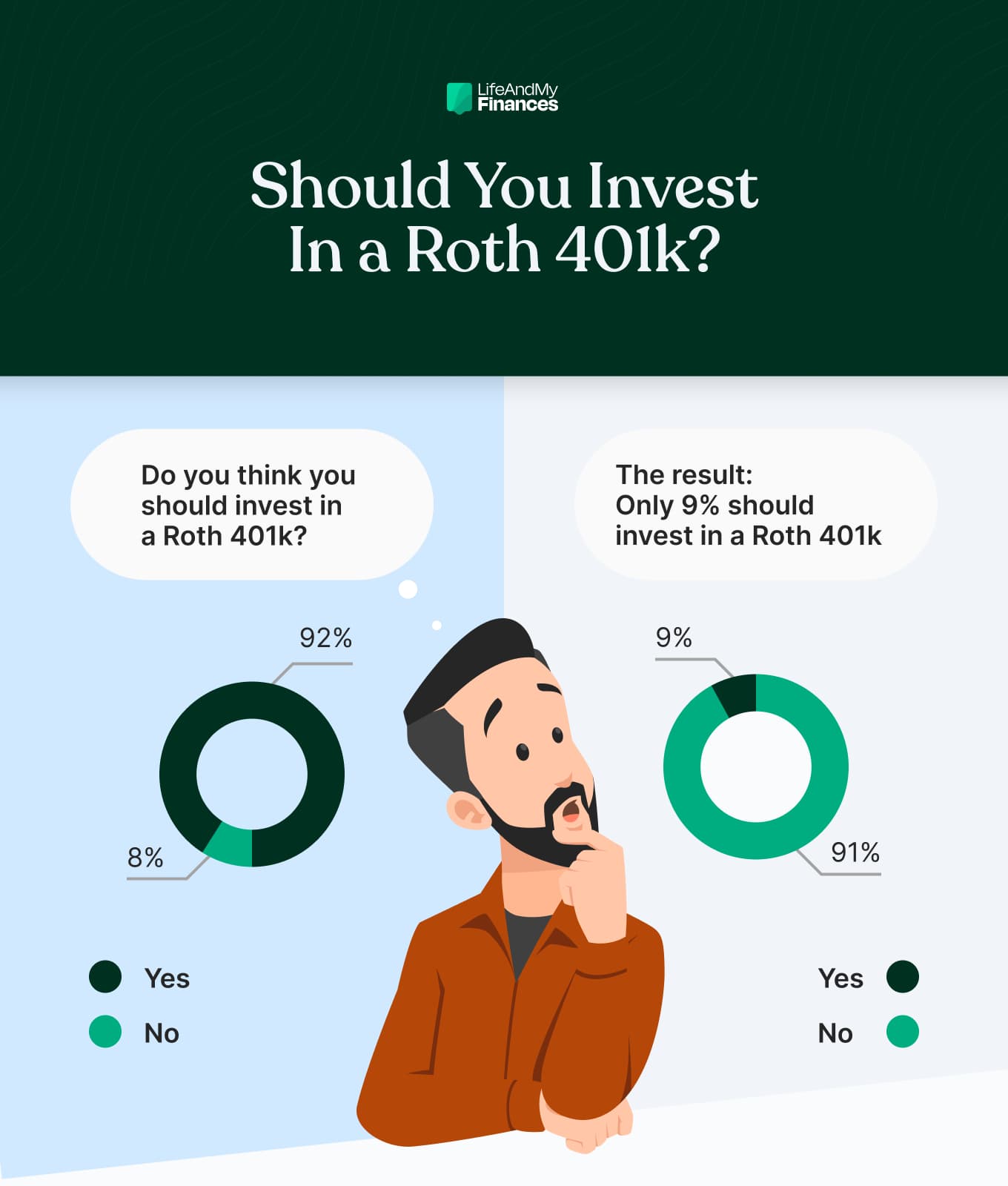

92% of people believe they should invest in a Roth. (Turns out I wasn’t the only one.)

But here’s the kicker.

Based on their ages, incomes, and expected retirement withdrawals, the Roth only makes sense for 9%.

This is shocking. But you know what? It gets even worse as we dig deeper into the numbers.

In this article, we’ll cover:

- The basics of the Traditional and Roth IRA.

- The Roth survey results of 635 individuals.

- When it makes sense to invest in a Roth IRA.

- Why the Roth IRA is a bad investment for most.

- How much the average person loses by investing in a Roth.

Similar articles:

Roth IRA vs Traditional IRA

Before we get too far ahead of ourselves, let’s quickly define the Traditional IRA and the Roth IRA.

The traditional IRA started in 1974. It’s a great way for people to invest in their retirement with before-tax dollars and defer those taxes until they withdraw the funds in retirement.

The Roth IRA was introduced in 1998 and flipped the script on the traditional Roth rules. Instead of deferring taxes until retirement, with a Roth IRA you’d pay the taxes before investing—and then never pay them again, even at the time of withdrawal.

Who Should Put Their Money Into a Roth IRA?

Everyone thinks they should contribute to a Roth IRA, but that’s true for only a handful of people.

So who is that handful?

Who would benefit from putting their money into a Roth IRA?

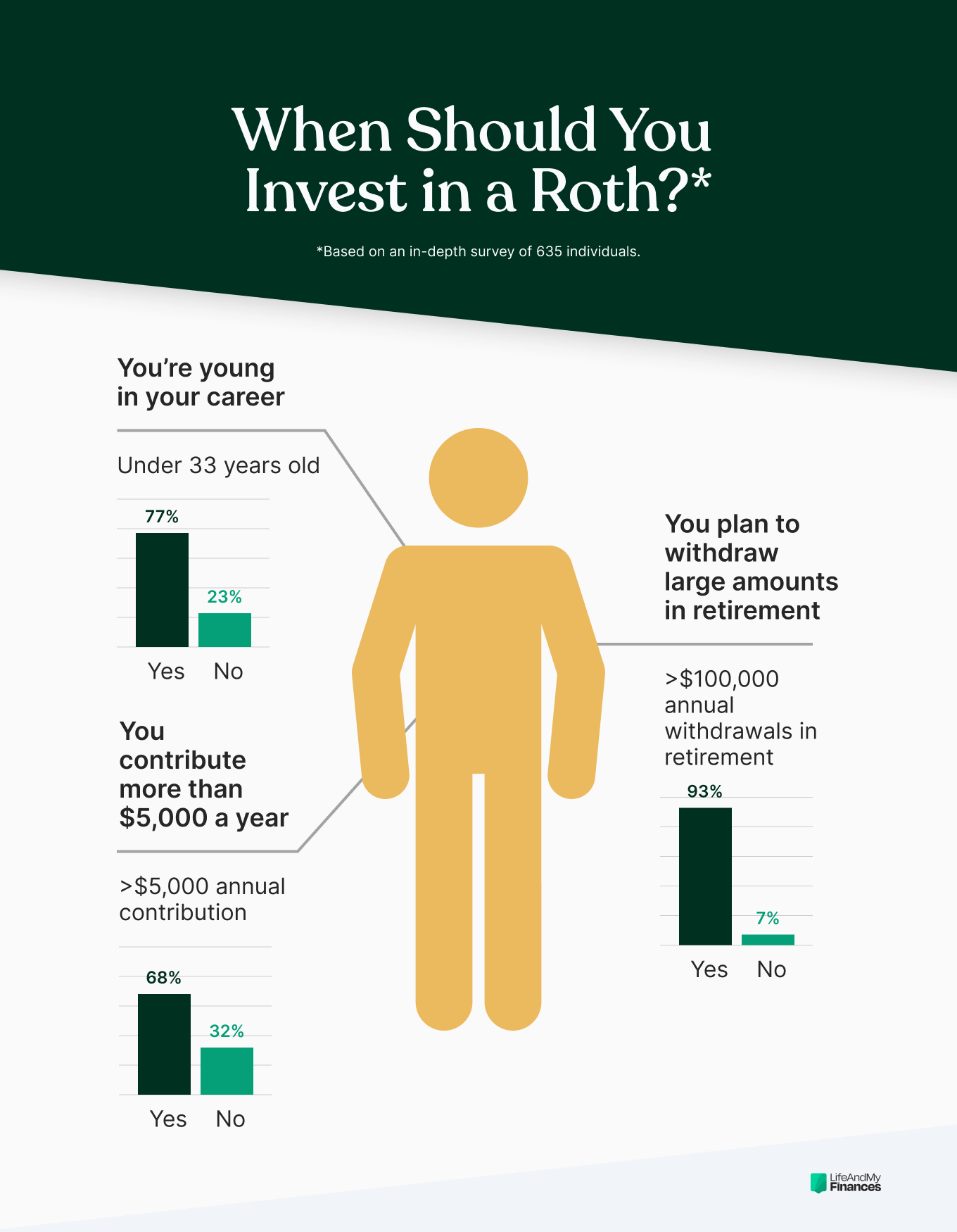

For the 9% of people in our survey that would benefit from a Roth IRA—

- 77% were 33 or younger.

- 68% contributed more than $5,000 a year.

- 93% expected to withdraw $100,000 a year or more in retirement (in today’s dollars).

So if you’re early in your earning years, contribute heavily into retirement, and plan to withdraw far more in retirement each year than you earn today—you should likely contribute to a Roth IRA.

If not (and most of us are in this camp)—you’re better off investing in a traditional IRA and deferring your taxes until retirement.

Is a Roth IRA Worth It?

We already dropped this truth bomb on you, but it’s worth repeating:

- 92% of people believed they should invest in a Roth IRA.

- Only 9% of the survey respondents would actually benefit from a Roth IRA investment.

And remember I told you the story gets even worse?

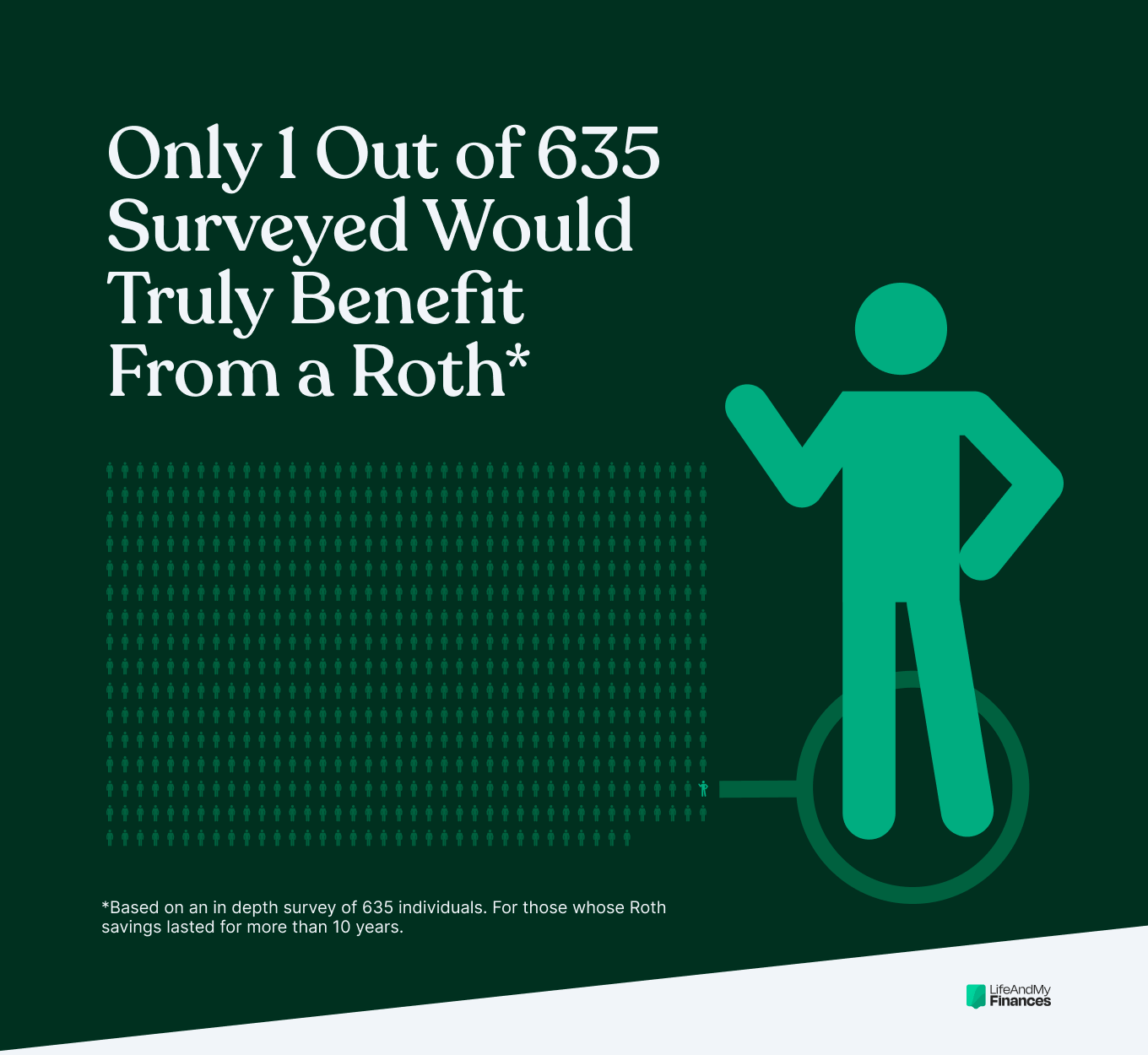

That 9% result is inflated.

These respondents’ answers triggered a Roth result because they plan to withdraw huge amounts of money in retirement, which is completely unrealistic given their retirement account balance.

In reality, only 1 of the 635 surveyed individuals would benefit from a Roth investment and have their savings last for more than ten years.

So is the Roth IRA worth it?

Based on our survey results, we estimate that the Roth IRA is worth it for 0.2% of the population.

The Roth IRA—an excellent tool for the government

Do you know who the Roth IRA is a good deal for?

The government.

Now, I’m not a big conspiracy theorist, and I generally don’t stand firmly on one side or the other, but these results really make me wonder about the intent behind the Roth IRA.

Was it for the people? Or was it for the deeply-in-debt government system?

Just think about it—

- Most people aren’t saving well for retirement.

- Most will have less money in their later years than they do today.

This means most are paying high taxes now—and will pay very little in retirement.

So would the government want you to defer your taxes and pay them later?

Of course not.

They’d like their money today, and they’d like to see more money rather than less.

This is precisely what the Roth IRA does. It forces you to pay taxes today and at a likely higher rate than you would in retirement.

What a great deal for the government and a horrendous deal for you, the taxpayer.

Who sold us on this thing, anyway? Why does everyone think the Roth is such a good idea?

Why Most People Think The Roth IRA Is a Good Idea

Most Americans think they should invest in a Roth IRA (and so did I).

Why?

Because everything about it just seems to make sense—

- Get tax-free growth on your money.

- Avoid paying taxes in retirement.

- Pay taxes now to avoid the higher tax rates of the future.

And on top of that, it seems like every money guru and investment professional touts the many benefits of the Roth.

All signs indicate the Roth is a wise move—but 99% of the time, it’s not.

Why a Roth IRA Is a Bad Idea

First off, let’s dispel the myth of tax-free growth.

No matter what anyone says, whether you pay taxes now or in the future doesn’t matter.

If you pay 10% in taxes today, invest the rest, and withdraw it tax-free in retirement, you’ll end up with the same amount than if you invested the full amount and paid the 10% tax in retirement.

That’s just math.

So don’t worry about tax-free growth. It truly doesn’t matter and doesn’t play into this conversation.

Now back to the task at hand.

What are the disadvantages of a Roth IRA?

What makes it such a lousy investment when everyone under the sun thinks it’s so great?

1. Most people will earn less in retirement than they do today

According to the latest personal finance stats—

- 43% of Americans struggle to meet basic needs.

- 60% of non-retirees think they’re behind with their retirement savings.

- 65% of Americans don’t think they’ll ever be able to retire.

According to our recent Roth survey—

- 63% of women and 55% of men put less than $5,000 away for retirement each year.

- 41% of women and 35% of men saved less than $10,000 for retirement.

- 58% of people over 60 had less than $100,000 in retirement.

And when we asked people at what age they planned to retire, the responses continued to grow as they neared retirement—indicating that people aren’t planning well.

|

Generation |

Estimated retirement age |

|

Gen Z |

45 |

|

Millennials |

55 |

|

Gen X |

61 |

|

Boomers |

70 |

And look at the current retirement balances by age group. These numbers certainly don’t foreshadow a lavish retirement.

|

Generation |

Median retirement balance |

|

Gen Z |

$5,500 |

|

Millennials |

$35,000 |

|

Gen X |

$35,000 |

|

Boomers |

$75,000 |

Based on the stats, the retirement picture of the majority is bleak. For most, it’s clear that they’ll earn less in retirement than they do today.

So why pay taxes now? You’ll probably make far less in retirement and pay a lot less in taxes.

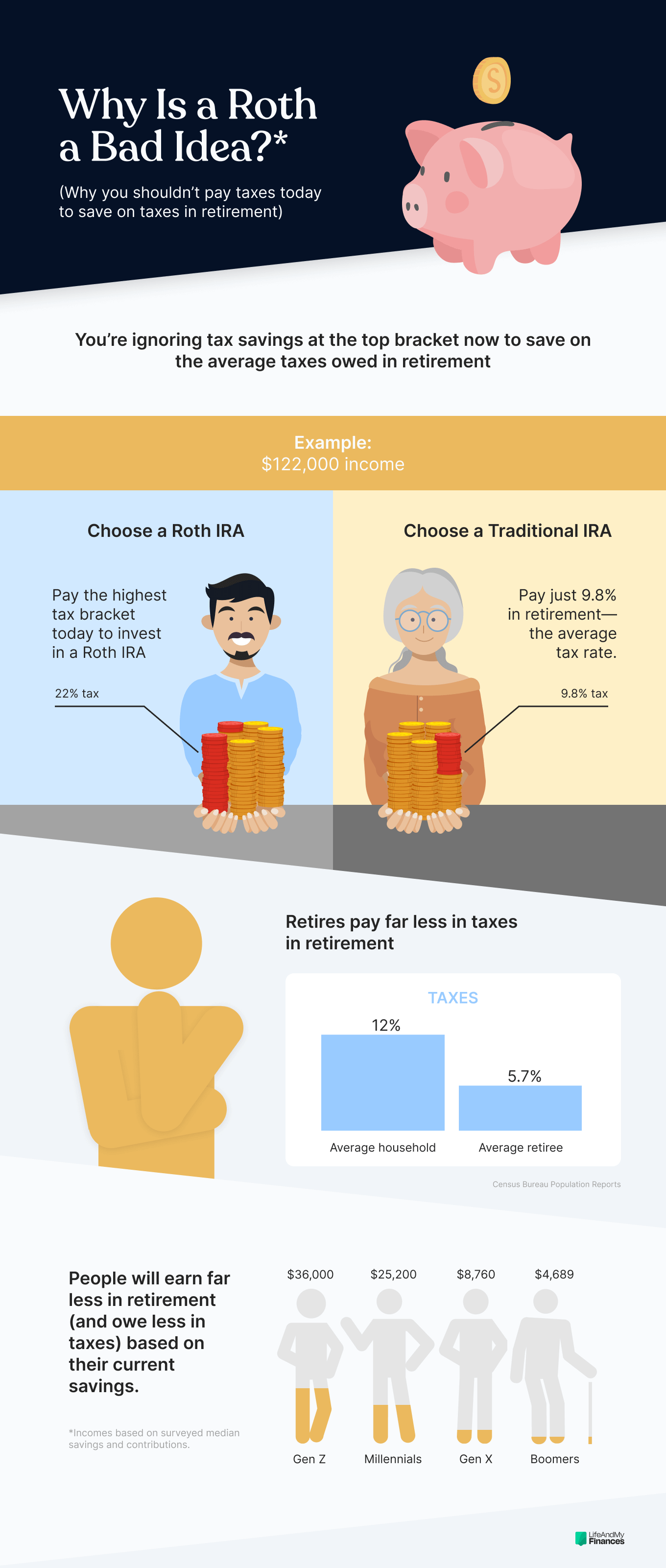

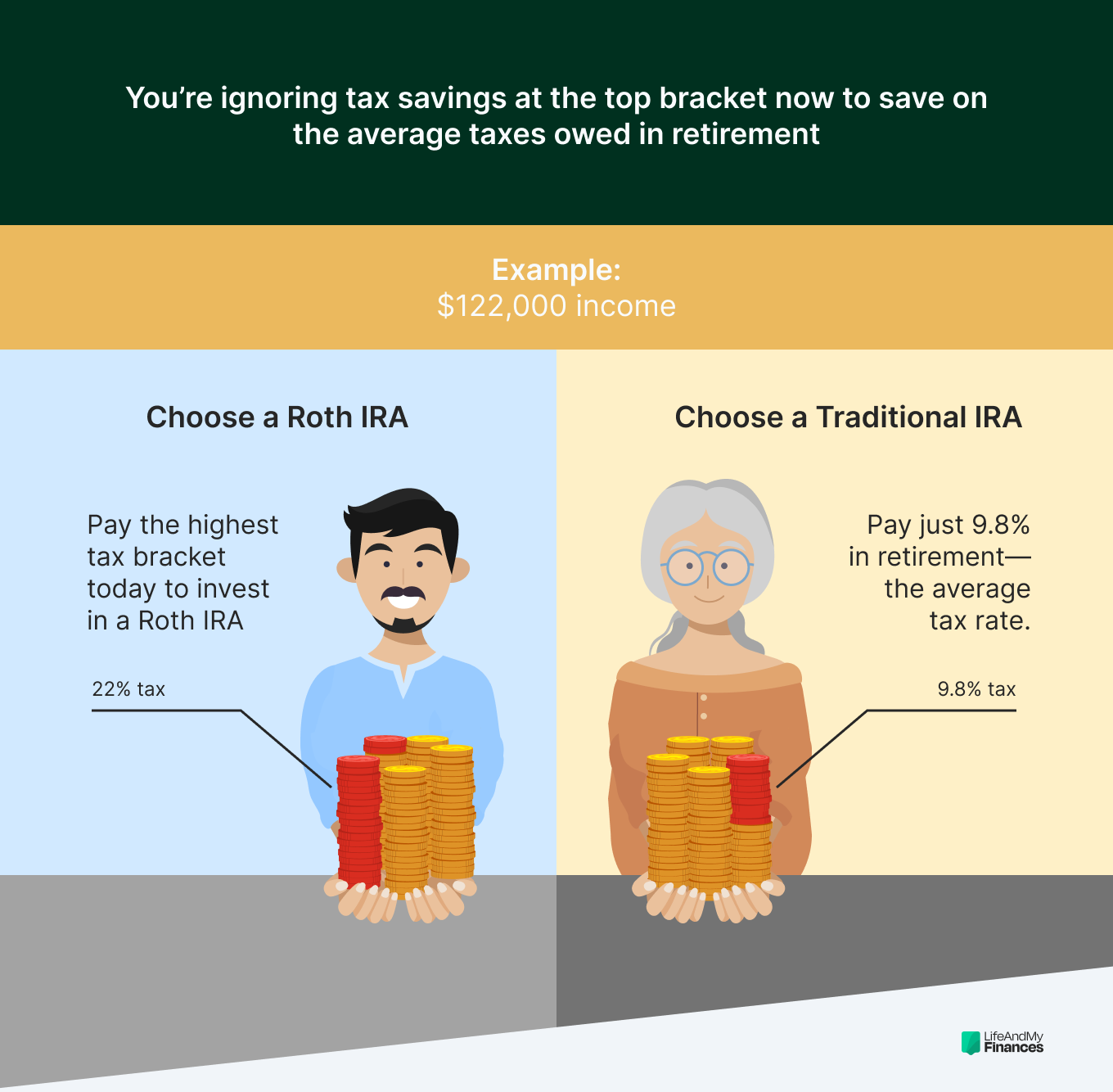

2. You’ll be paying a higher tax rate now than you will in retirement

To contribute to a Roth, you need to pay the taxes of your upper tax bracket.

In retirement, you’re saving money on the average taxes you pay.

So let’s say you’re in the 22% tax bracket. If you earn $122,000/year now and make the same amount in retirement, you’re effectively paying 22% tax today to invest in the Roth to save 9.8% in retirement.

This is obviously a bad move that no one should sign up for.

Don’t believe it? A recent retirement study found that retirees pay an average of just 5.7% in federal taxes.

3. Many retirees today pay nearly nothing in taxes

According to the Census Bureau Population Reports, the median income for households aged 65 and older is $47,620.

Based on that information, we can get the likely tax picture for a retired married couple today:

- Primary Social Security = $1,600/month

- Spouse Social Security = $1,100/month

- Additional draw from retirement = $1,268/month

- Annual income = $47,620/year

So what do you owe in taxes as a married couple filing jointly on $47,620 a year?

- Annual income = $47,620

- Standard deduction = -$27,700

- Adjusted gross income = $19,920

- Tax rate = 10%

- Taxes owed = $1,992

The effective tax that the average retiree pays is 4.2%.

To invest in a Roth, you’re likely paying a tax rate of at least 12% so that you can save 4.2% in retirement.

Yet another data point that confirms investing in a Roth is a bad idea.

How Much Could You Lose By Investing in a Roth IRA?

I mentioned early in this post that investing in a Roth cost me nearly $400,000.

That sounds unreal—perhaps even impossible.

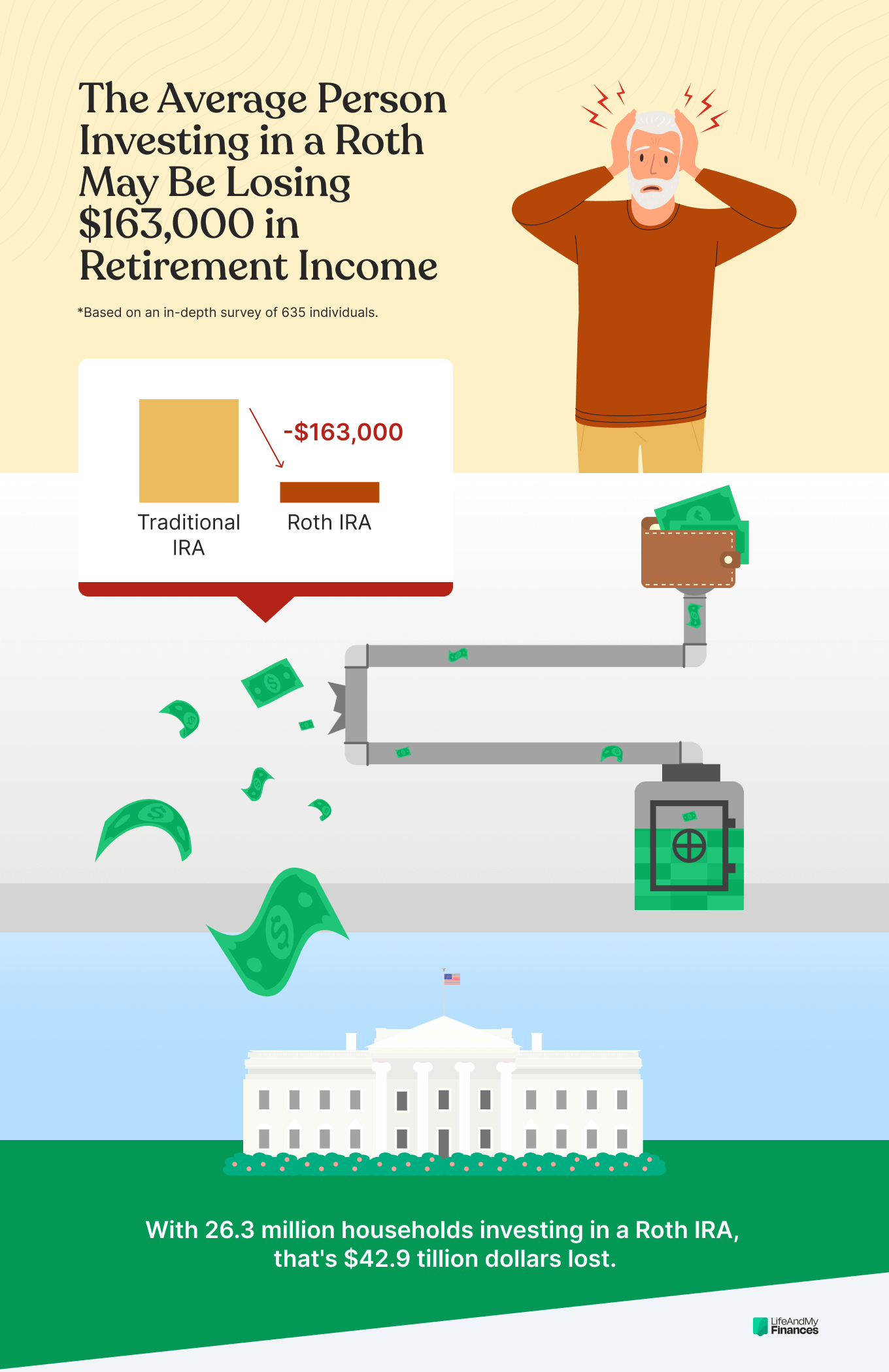

But what about the surveyed individuals?

What if they invested in a Roth instead of a traditional IRA? How much would they lose on average?

For those that had proper withdrawals to make their investment last 20 years or more, all would lose money by investing in a Roth IRA.

- If they invested in a Roth, the average respondent would earn $1,340,512.

- If they invested in a traditional IRA, the average respondent would earn far more—$1,503,865 over the course of their retirement.

So, on average, by investing in a Roth IRA, retirees lose out on $163,000 vs. those who invested in a traditional IRA.

Estimate of Total Money Lost in American Retirement

According to the Investment Company Institute, 26.3 million households invest in a Roth IRA.

If each of these households experienced the same loss as our survey respondents, how much money might America be currently leaving on the table in their retirement accounts?

26,300,000 Roth IRA accounts x $163,000 left on the table = Total $ lost in retirement

The answer?

$4.29 trillion.

Yikes.

Over the course of our American lives, we’re likely paying $4.29 trillion too much in taxes—and we’re paying it early in life.

All because we’re choosing the wrong investment account for our retirement.

Survey Methodology

We surveyed 635 individuals and asked them over a dozen questions, including:

- Do you invest in a Roth or Traditional 401k (or other)?

- Do you think you should invest in a Roth?

- Current annual income.

- Annual retirement contributions.

- Current retirement balance.

- Expected retirement age.

- Expected annual withdrawal in retirement.

We received responses from 167 Gen Zers, 288 millennials, 94 Gen Xers, and 86 boomers. Of the 635 respondents, 370 were men, 264 were women, and one declined to answer.

We ran the responses through our Roth 401k calculator to see how much each individual would earn over their lifetime with a traditional 401k vs. a Roth 401k. With these numbers, we could identify who should and should not be investing in a Roth IRA.

Key Takeaways

Don’t blindly trust people with your money. Do your homework and check the numbers yourself.

- 92% of people think they should invest in a Roth IRA (an after-tax retirement account).

- Based on the survey results, only 9% of individuals would benefit from a Roth IRA.

- A Roth is only worth it if you’re early in your career earnings, you invest heavily into retirement, and you plan to withdraw far more in your later years than you earn today.

- More than likely, your tax rate will be much less in retirement vs. the rate you can save on today.

- Our recent survey found that the average investor will lose out on $163,000 by investing in a Roth IRA.

FAQ

Is there a free Roth IRA calculator?

Yes, the best Roth 401k calculator is found here: https://lifeandmyfinances.com/retirement/roth-401k-calculator.

This calculator is one of the few that provides the direct comparison between a Roth IRA investment vs. a traditional IRA, less the tax break received.

At what age does a Roth IRA not make sense?

Typically, if you’re older than 35, the Roth IRA doesn’t make sense.

But, if you’ll likely earn far money in your 40s and 50s—and invest aggressively—then it still might make sense for you.

Why is my Roth IRA losing money?

A Roth IRA is just an investment shell. Within it, you can invest into stocks, bonds, mutual funds, and many other types of investments. If those investments are going down in value, then the value of your Roth IRA will reduce as well.

What is the downside of a Roth IRA?

The main downside of a Roth IRA is that you’re paying taxes today to invest in one. If you’re likely to pay less tax in retirement, you’re losing money on every dollar you invest in a Roth IRA.

Be sure to put your numbers into a reputable Roth IRA calculator to see if it makes sense for you to invest in one.

Who should not contribute to a Roth IRA?

There are three main reasons not to invest in a Roth IRA:

- You’re 40 years of age or older.

- You’re in your peak earning years.

- You plan to withdraw less per year in retirement than you earn today.

What are the pros and cons of a Roth IRA?

Roth IRA Pros:

- You’re not subject to required minimum distributions. (You don’t need to withdraw money if you don’t want to.)

- You can withdraw your contributions penalty-free at any time.

Roth IRA Cons:

- You don’t get a tax deduction since you’re paying taxes before your contribution.

- Many will pay lower tax rates in retirement, so a Roth IRA is costing them money since they’re paying higher taxes today.

- You can’t withdraw earnings before age 59.5.

- The maximum contribution is fairly low.

Can an IRA lose money?

Yes, an IRA can lose money. An IRA isn’t an investment in and of itself. It’s just an account where you can make investments. If you invest in a particular stock and it goes down in value, then your IRA will lose money.

Sources

See all

Individual Retirement Account (IRA) Resource Center. (n.d.). Investment Company Institute. Retrieved May 10, 2023, from https://www.ici.org/ira

Hrung, W. B. (2004). OTA Papers, Introduction of Roths. US Department of the Treasury. https://home.treasury.gov/system/files/131/WP-91.pdf

Semega, Jessica and Kollar, Melissa. (2022). Income in the United States: 2021. https://www.census.gov/content/dam/Census/library/publications/2022/demo/p60-276.pdf

Chen, A., & Munnell, A. (2020). Retirement and Disability Research Consortium, 22nd Annual Meeting. Boston College. https://crr.bc.edu/wp-content/uploads/2020/01/2020-RDRC-Meeting-Booklet.pdf

Holden, S., & Schrass, D. (2021). The Role of IRAs in US Households’ Saving For Retirement, 2020. 39. https://www.ici.org/doc-server/pdf%3Aper27-01.pdf