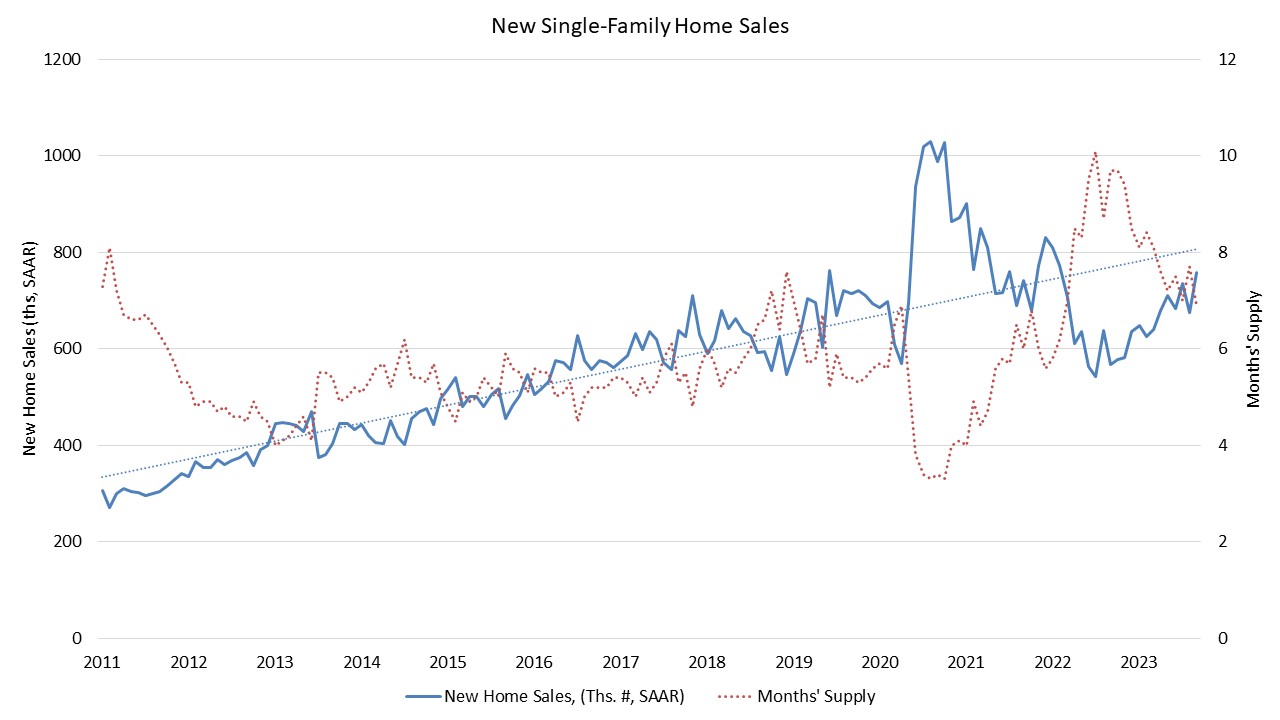

Despite mortgage rates that are at a 23-year high, new home sales posted a double-digit percentage gain in September because of a lack of inventory in the resale market. The U.S. Department of Housing and Urban Development and the U.S. Census Bureau estimated sales of newly built, single-family homes in September at a 759,000 seasonally adjusted annual pace, which is a 12.3% increase over a upwardly revised reading of 676,000 in August. The pace of new home sales in September was up 33.9% from a year ago.

A new home sale occurs when a sales contract is signed or a deposit is accepted. The home can be in any stage of construction: not yet started, under construction or completed. In addition to adjusting for seasonal effects, the September reading of 759,000 units is the number of homes that would sell if this pace continued for the next 12 months.

New single-family home inventory in September was 435,000, down 5.4% compared to a year ago. This represents a 6.9 months’ supply at the current building pace. A measure near a 6 months’ supply is considered balanced. Total new home inventory peaked in October 2022 at 466,000 and has been declining since that time.

A year ago, there were just 53,000 completed, ready-to-occupy homes available for sale (not seasonally adjusted). By September 2023, that number increased 39.6% to 74,000. Completed, ready-to-occupy inventory, however, remains just 17% of total inventory and homes under construction account for 59% of the inventory. Homes that have not started construction when the sales contract is signed account for 24% of new homes sold in September.

The median new home sale price fell 3.3% in September to $418,800 and is down 12.3% compared to a year ago. Decline in home size and stability in building material costs, especially lumber prices, have contributed to a fall in home prices. In terms of affordability, the share of entry-level homes priced below $300,000 has been steadily falling in recent years. Only 17% of the homes were priced in this entry-level affordable range while 36% of the homes were priced above $500,000. The majority of homes (46%) were priced between $300,000-$500,000.

Regionally, on a year-to-date basis, new home sales are up in all four regions: 12.8% in the Northeast, 0.5% in the Midwest, 5.4% in the South and 2.5% in the West.

Related