According to the 2023 fourth quarter release of the Federal Reserve Z.1 Financial Accounts of the United States , the market value of household real estate assets fell from $45.21 trillion to $44.84 trillion in the fourth quarter of 2023. Over the year, household real estate assets were 5.28% higher.

Between the third and fourth quarters of 2023, the market value of household real estate assets fell by $365.85 billion, a 0.81% decrease. Total nonfinancial assets held by households and nonprofits fell by $551.886 billion to $57.9 trillion. Real estate owned by households is by far the largest share of households and nonprofit’s nonfinancial assets making up 77% of the market value. Nonprofit’s nonfinancial assets (real estate, equipment, and intellectual property) make up about 9%, while consumer durables make up the remaining 14% of nonfinancial assets in the balance sheet.

Total financial assets for households and nonprofits grew by $5.56 trillion over the quarter to end the year at $118.83 trillion. Directly held stock holds the largest share of total financial assets at 27% ($32.00 trillion)

Real estate secured liabilities of households’ balance sheets, i.e., mortgages, home equity loans, and HELOCs, increased 0.69% over the fourth quarter to $13.05 trillion,. Year-over-year, real estate liabilities have increased 2.81%.

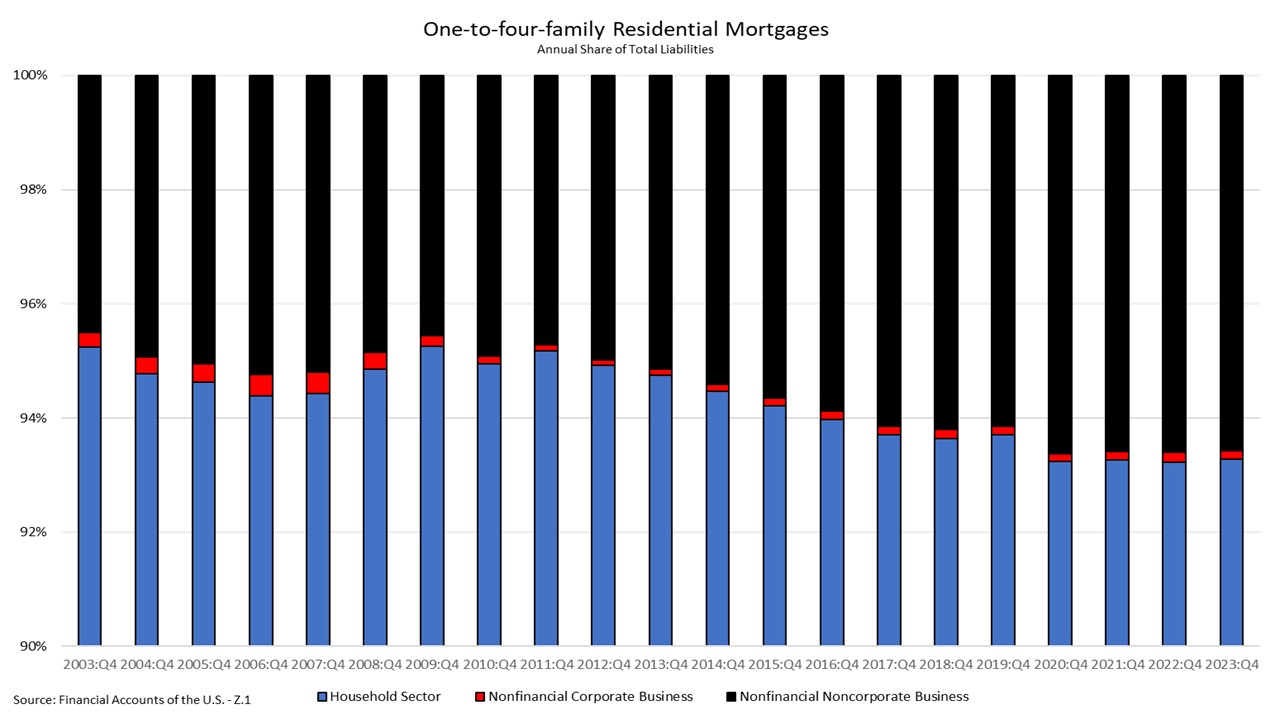

The level of one-to-four-family residential mortgages outstanding to end 2023 stood at $13.99 trillion. Of the parties that held these mortgages as liabilities, households held $13.05 trillion, nonfinancial corporate businesses held $20.7 billion, while nonfinancial noncorporate businesses held the remaining $920.5 billion. Since 2003, the shares of these outstanding liabilities have remained consistent, with households holding above 92%. To end 2023, households held 93.3%, nonfinancial noncorporate businesses held 6.6%, while nonfinancial corporate businesses held 0.01% of the outstanding liabilities of one-to-four-family residential mortgages.

Sectors that hold one-to-four-family residential mortgages as assets have seen little change over the past few years. The largest holder of these mortgages as assets continued to be Government Sponsored Entities (GSEs) which held $6.71 trillion or 48.0% of the assets. The second largest holder was Agency- and GSE-back mortgage pools, which held $2.40 trillion or 17.1%. Mortgage pools are a group of mortgages used as collateral for a mortgage-backed security. In the financial accounts, these mortgage pools equal the unpaid balances of the mortgages in the pools. The shift that occurred between the end of 2009 and 2010 between these two groups was due to new accounting rules in the first quarter of 2010 which required Freddie Mac and Fannie Mae (both GSEs) to move almost all their one-to-four-family mortgages on to their consolidated balance sheets. The GSE share of assets jumped from 3.9% in 2009 to 44.6% in 2010.