On May 6 the annual Hoover monetary policy conference returned. It was great. In particular, the opening panels by Rich Clarida, Larry Summers, and John Taylor, and the final panel with Jim Bullard, Randy Quarles, and Christopher Waller were eloquent and insightful. Alas, the videos and transcripts aren’t quite ready so you have to wait for all that. There will also be a conference volume putting it all together.

In the meantime, I wrote a paper for my short talk; and thanks to the Hoover team I also have a transcription of the talk. The paper is “Inflation Past, Present and Future: Fiscal Shocks, Fed Response, and Fiscal Limits.” It pulls together ideas from a bunch of recent blog posts, other essays, bits and pieces of Fiscal Theory of the Price level. Sorry for the repetition, but repackaging and simplifying ideas is important. Here’s the talk version, shorter but with less nuance:

Inflation Past, Present and Future: Fiscal Shocks, Fed Response, and Fiscal Limits

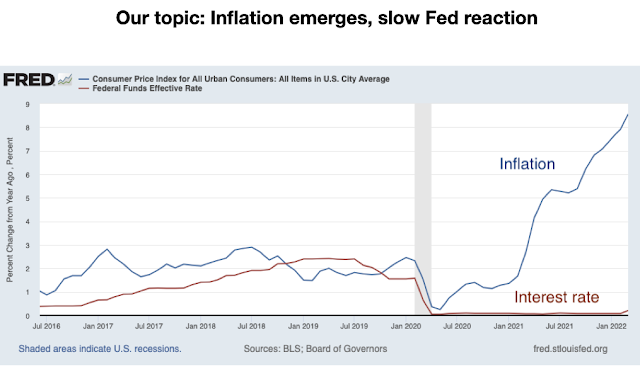

Here we are. Inflation has emerged, and the Fed is reacting rather slowly.

Why? Where did inflation come from, is question number one, and Charlie Plosser gave away the answer in his nice preface to this session: The government basically did a fiscal helicopter drop, five to six trillion dollars of money sent in a particularly powerful way. They sent people checks, half of it new reserves, half of it borrowed. It’s a fiscal helicopter drop. Imagine that this had been simply $6 trillion of open market operations. Well, as Larry just told us, $6 trillion more $10 bills and $6 trillion fewer $100 bills won’t make much difference. If there had been no deficit, it certainly wouldn’t have had such a huge effect.

The impulse was not the fault of interest rate policy either. Interest rates have just been flat. One can blame the Fed for contributing to the great helicopter drop, but not for a big interest rate shock.

So that’s the inflationary impulse, but where is inflation going now? Now, attention turns to the Fed. Interest rates stayed flat while inflation got going from the fiscal shock, as you see in the first graph.

So the next question is, does this slow response; this period of nominal interest rates far below inflation, constitute additional monetary stimulus, which creates additional inflation on its own? Or are we simply waiting for the fiscal (or supply, if you must) shock to blow over?

The Fed is certainly behind the curve by historical standards. In this graph, the arrows point out every tightening since 1960. In every single one, the Fed raised interest rates roughly one for one or more with current inflation. Even the dreaded 1970s, the Fed never waited an entire year before doing anything at all.

Why did the Fed take so long to move now? There are many answers to this question, and I won’t go deep into it. One of the features was likely forward guidance, which the previous panel alluded to. The Fed kept rates interest rates low because the Fed said it would keep interest rates low. There was this elaborate formal new strategy that said we’re going to keep interest rates low. That strategy was, I think, a beautiful Maginot Line crafted against deflation but, as with the original, it forgot: what if the Germans come through the Ardennes instead? We discovered a halfway point between Larry and John Taylor. The problem of forward guidance is, does anyone believe the Fed will do it ex post? (Time consistency.) Critics like me who said no I think were proved wrong. The Fed held itself ex post to a good deal of what it had promised. Unfortunately, it promised something that was inappropriate in the circumstances, which is the whole point and conundrum of forward guidance. And what John would say is, well the Fed should have had promises that include, if a serious inflation breaks out, inflation, then we’ll do something else.

The Fed in general does far too much “here is what we think will happen so here is what we are going to do,” and far too little contingency planning in case things don’t work out the way it projects. Which, we have just learned, can happen in large measure and with dramatic speed. Military planners know this. They red-team their projections, obsess over unlikely contingencies, and follow failures with detailed self-critical investigation. The Fed should also.

But like the shock, the year of inaction is in the past. The relevant question is where do we go in the future? That brings us back to the question: Is staying put so long itself additional stimulus, which will cause inflation? Or, assuming the fiscal shock is over and until the next shock comes along, will inflation go away on its own?

I’ve graphed here the Fed’s projections from the March 15 meeting for unemployment, federal funds rate and inflation. The Federal Reserve believes that inflation will go away all on its own without a period of high real interest rates. That, I think, is the central premise that most of our commentators disagree with. To them, a period of substantially low or negative real interest rates will accelerate inflation. They would say, these projections are nuts. But are they indeed nuts?

The markets, by the way, seem to agree with the Fed. Until the Fed started saying it’s going to move, markets also seemed to think inflation would go away all on its own.

Well, one thing John emphasizes is to write down models. So I wrote down a model, so simple it can show up in the bottom of a slide. It says that output is lower when the real interest rate is higher, and a Phillips curve in which inflation depends on the output gap. Crucially, this model uses adaptive expectations in the Phillips and IS curves, as shown by the arrows.

Then I asked the question, let us start at last year’s inflation, where the Fed projections start; assume the shocks are over, but we inherit this inflation. What happens if the Fed follows the blue line, the federal funds rate? The initial inflation is given. The blue line is given. From the model, I calculate where inflation and unemployment go from there. The dashed lines are the Fed’s projections.

I think this graph encapsulates the view the Fed is way behind the curve; that low interest rates below inflation constitute additional stimulus. Inflation spirals off, at least until it gives in, raises rates sharply and causes a recession, as Larry Summers warns. That looks pretty awful. And it looks like the Fed is completely wrong in its forecasts of what will happen if it follows this fund rate path.

But what if expectations are rational? Here’s a little modification of the model with the arrows pointing to the changes. What if, the real interest rate and the Phillips curve are centered at expected future inflation rather than lagged inflation? Same simulation: Put in the federal funds rate path, anchor inflation at last year’s inflation. Turn off all shocks. What happens? I obtain almost exactly what the Federal Reserve is projecting.

Intuitively, the rational expectations Phillips curve looks at inflation relative to future inflation. Unemployment is low, as it is today, when inflation is high relative to future inflation. Inflation high relative to future inflation means that inflation is declining. And that’s exactly what this projection says. Rational expectations means you solve models from future to present. If people thought inflation was really going to be high in the future, inflation would already be high today. The fact that it was only five percent tells us that it’s going to decline and go away.

To be clear I don’t think the Fed thinks this way procedurally. They have a gut instinct about inflation dynamics, informed by lots of VAR forecasts and model simulations. But this theory gives a pretty good as-if description, a slightly more micro founded model that makes sense of those intuitive beliefs.

So the Federal Reserve’s projections are not nuts! Inflation might just go away on its own! There is a model that describes the projections. And this is a perfectly standard model: it’s the new-Keynesian model that has been in the equations if not the prose of every academic and central bank research paper for 30 years. So, it is not completely nuts. Our job is to think about these two models and think about which one is right about the world.

To put the question in another way, let’s find what interest rate it takes to produce the Fed’s inflation projection. What should the Fed be doing? With adaptive expectations, to make inflation fade away as the Fed thinks will happen, we need the interest rate to be nine percent. Right now. Why? Because you need a high real interest rate measured relative to lagged inflation in order to bring that inflation down. And we’re way, way off the curve. I think this calculation encapsulates a lot of the Taylor rule view.

But what if inflation expectations are rational? Again I find what interest rate path, it takes to produce the Fed’s inflation path, Here, the Fed is a bit ahead of the curve.

A quick summary: The Fed’s projections are consistent with a standard New Keynesian model. This is not a nutty model. It’s been around since 1990. It’s the basis of essentially all academic macroeconomic theory. It may be wrong or right. The point of models is to help us understand what ingredients get to different views, and thereby also use evidence from other episodes to guide this one. I’m not advocating for against it. I’m just saying this is what we need to talk about.

Here are the core questions.

- How forward looking are expectations in the bond market, in the economy, and in the Phillips curve? Do people think about expected inflation, about what’s going to happen next year? Or do they mechanically take whatever inflation happened last year?

In my view, the right answer is probably halfway in between. In the long run, people catch on. Why don’t we see the huge spiral? Because once we get to spiraling inflation, people catch on and get more rational in their expectations. In the short run, with a new event, there is likely some adaptive dyanmics. So don’t count on either one being perfectly right. But don’t count on either one being incredibly reliable either.

Another, more uncomfortable way of putting the question,

- Is the economy stable or unstable with an interest rate that reacts less than one for one to past inflation?

The Fed’s projections say, stable. If we just leave interest rates alone, eventually, inflation will settle down. There may be a lot of short-run dynamics on the way, which these models don’t capture. But it settles down in the end. This answers Larry’s last question. It’s not necessarily a mistake. This is a model of the world in which nominal things do control nominal things, and the nominal interest rate eventually drags inflation along with it. A k percent interest rate rule is possible. Not necessarily optimal, but possible.

Third, there is an important quantitative question.

- Are prices as flexible and the Phillips curve as steep as the Feds projections imply?

The Fed’s projections have inflation coming down very quickly. Implicitly, prices are very flexible. Maybe not.

You may still think the Fed’s view is nutty, but there is now some important evidence on the table. That experience may have shifted the Fed’s view of inflation dynamics. The model of spiraling inflation and deflation also predicts that when interest rates are stuck at zero for 10 or 20 years, inflation or deflation will spiral away. And inflation didn’t do that. The Fed funds rate was stuck at zero in the US for nearly 10 years. Inflation just batted around with a stuck interest rate. In Europe, inflation was stable with a stuck interest rate for a longer period. And in Japan, inflation was stable with a stuck interest rate for 25 years. The deflation spiral never broke out. Japan lived 25 years of the Friedman optimum quantity of money. This experience may be is something that the Fed is digesting in its verbal way, and that is what the rational expectations model says. So it’s not as nuts.

Next, let’s think about how inflation is going to proceed in the future. In the Fed’s projections inflation comes down very quickly. To match that I had to take a price stickiness parameter of 0.5. That means a very steep Phillips curve. One percent output gap means one percent inflation. Most people think of the Phillips curve as having been quite flat. In the 2010s, unemployment moved a lot with little change in inflation. Today inflation is moving a lot with little change in unemployment. What is the real amount of price stickiness? Or is the whole Phillips curve a mess?

To get at this, and other issues, here is the response to a fiscal shock in the full equations of the standard new-Keynesian model. I add long-term debt, and I perform slightly unusual simulations: I ask how the model responds to a fiscal shock with no change in interest rate, and I ask how it responds to interest rate changes with no change in fiscal policy.

This is now a full shock simulation: Rather than take initial inflation as given, I hit the model with a 1% fiscal shock, no change in interest rate, and derive the entire inflation path. What happens? Inflation rises, and then does go away on its own.

This is the stanford three equation model. So it really is not nutty that inflation would go away on its own.

But it takes years for inflation to go away. I cut the price stickiness parameter in half, but I still have a pretty steep Phillips curve. Using the full model adds persistence. So the Fed may also be wrong in thinking that inflation will disappear on its own quite as quickly, even if the fiscal shock has ended (as it has in the simulation) and even given its view that inflation is stable in the long run.

A one-time fiscal shock can lead to drawn out inflation, not a one-time price-level jump. We may have a ways to go. In this model the 8% inflation we have just seen is only 40% of the eventual price-level rise.

Now, what can the Fed do about inflation? Suppose the Fed does start raising interest rates aggressively? Here I feed the model an AR(1) interest rate, with no fiscal policy shock, to evaluate the independent effect of monetary policy. Many models implicitly specify that when the Fed raises interest rates sthere’s a big increase in surpluses. We’re just going to leave fiscal policy alone and see what happens in what is the apparently Fed’s model, if the Fed raises interest rates.

The interest rate rise does lowers inflation, but only in the short run. There’s a form of Tom Sargent’s “unpleasant arithmetic”at work. Lowering inflation today raises inflation in the future. We had a fiscal shock. That has to come out of the pockets of bondholders, by inflating away bonds. The Fed can choose to inflate that away now or inflate it away in the future. But the Fed cannot get rid of the fact that there has been a fiscal shock which inflates away debt. So it has a limited power. It can smooth inflation but cannot completely get rid of inflation.

What if there is a 1% fiscal shock, but the Fed responds with something like a Taylor rule? We basically add the last two figures. We get lower inflation in the short run, but much more persistent inflation in the long run. Smoothing inflation is a great thing in this model. It reduces output volatility. (Output is related to inflation relative to future inflation, so has almost no movement here.)

We have one more reason for a Taylor rule: It does not give us stability, as it does in adaptive expectations models, it does not give us determinacy as it does in new-Keynesian models. It gives us quiet, the absence of volatility, which is perhaps the best of all.

Now let’s think about the further future. This is the CBO’s debt and deficit graph to remind you of our fiscal situation. We don’t have just a one-time $6 trillion helicopter drop, we have an ongoing fiscal problem. The CBO’s projection is debt if nothing bad happens. But every 10 years we have a shock, and the debt goes up again like a cliff.My little black line there is a guess of what happens with occasional shocks. In sum, we have five percent of GDP structural deficits, once per decade stimulus/bailouts, and here comes Social Security and Medicare.

If there isn’t more bad fiscal news, there are fiscal constraints of monetary policy. In 1980, there was only 25% debt to GDP ratio. Now it’s 100% and rising. We need coordinated fiscal and monetary policy to get out of a serious inflation. But the fiscal constraints on monetary policy are going to be four times harder this time.

How? First, there are interest costs on the debt. Suppose the Fed raises interest rates to five percent. We’ve been talking about eight, nine, ten percent, so five percent isn’t that much. But today five percent interest rate is five percent of GDP debt costs, a trillion bucks. If the Fed wants to raise real interest rates 5% to fight inflation, we need a fiscal contraction of a trillion dollars a year to pay those debt costs, or else raising interest rates does not stop the inflation.

Second, once inflation gets baked in to bond prices, then if we disinflate, the government has to pay bondholders a big windfall, by repaying debt in more valuable dollars. Ten percent disinflation and 100% debt to GDP ratio means a ten percent of GDP present from taxpayers to bondholders. If we don’t pay that, the monetary tightening will fail.

And we’ve seen that failure in Latin America. Countries get into fiscal problems, they have inflation, they raise interest rates, that just raises debt costs, and the inflation spirals on up.

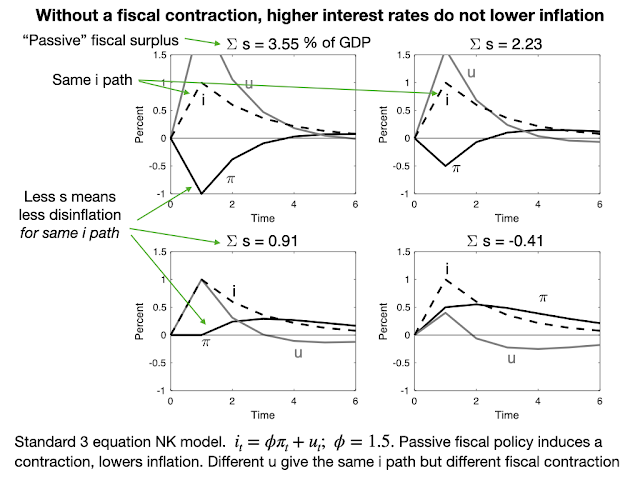

Here is a simulation of that effect. Here I took a totally standard New Keynesian model — none of this fiscal theory of the price level stuff. I ask what happens if the Fed raises interest rates, following the dashed line? In the top-left graph, you see that interest rate go up and inflation goes down. The rate rise lowers inflation. But that higher nominal interest rate with lower inflation means higher debt service costs and a present to bondholders. New Keynesian models say that Congress and Administration “passively” provide whatever fiscal backing is needed, but how much is it? The title calculates: This disinflation requires 3.5% of GDP fiscal surpluses.

What if Congress says, to the Fed: “You’re out of your minds. We’re not doing that.” Well, then it can’t happen.

In the second simulation, I follow the same interest rate path, but in the New Keynesian model, by changing the time-series pattern of the monetary policy shock, you can get the same observed interest rate with less needed fiscal policy. So here, I have the same interest rate path but only 2.3% of GDP fiscal surpluses coming out of Congress. But you get less disinflation out of it. In the bottom bottom right, Congress only provides 0.91% of GDP fiscal surpluses. The interest rate goes up, but now inflation doesn’t move at all. There are still surpluses, because we still have to pay the higher real interest costs. In the bottom right case, higher interest rates raise inflation. Why? Because in this case, we have deficits.

Without without coordinated fiscal policy tightening, raising interest rates will not lower inflation. Even in the completely stock New Keynesian model.

What about 1980? 1980 was not just monetary policy. 1980 was a joint monetary, fiscal, and micro economic deregulatory reform. It set off a boom in growth that set off a boom in tax revenues. It exactly was a fiscal reform and tightening. I graph here the primary surplus following 1980. Most of the “Reagan deficits” were just higher interest costs on a very large debt. By the 1990s you can see fiscal surpluses were surging. It took a while, but there was a fiscal and deregulatory reform (1982, 1986) that went with the monetary reform. Whether by those reforms or just by luck, growth took off, and paid off a lot of that debt.

You can see this in the debt to GDP ratio even, which includes interest costs on the debt. By the 1990s, those reforms were paying down the debt.

Suppose that you bought bonds at a 15 percent yield in 1980. By the late 1990s, you got those back at four to five percent inflation. You got a ten percent per year rate of real rate of return, courtesy of taxpayers. Much debt was rolled over at higher rates, courtesy of taxpayers. The graph also warns us that bond yields never have been very good at forecasting inflation.

The joint fiscal and monetary policy was absent in many Latin American countries. They raise interest rates, the deficits don’t get cured, and the whole thing falls apart. That could have happened in the US as well.

Last, I offer some good news. We’re forgetting a lot of the economics of the 1970s and 1980s. We can have painless disinflations. We keep talking as if we have to redo 1980, and endure a horrible recession. There is a way out. And the way out is to coordinate the fiscal, monetary, and micro economic reform to a durable new regime, move that expected inflation term in the Phillips curve, by having people convinced that it really is going down. Then we get a miraculous disinflation. It can happen. It does happen.

I offer three examples. First, remember the inflation targeting reforms of the early 1990s. This one is New Zealand. The GST notation signals rise in goods and service taxes. There was also a suite of microeconomic deregulatory reforms. The inflation target was a joint fiscal, micro economic, and monetary reform. Inflation dropped like a stone with no recession at all. The central bank never needed to use its independence to replay US 1980. It turns out that is not the point of inflation targets!

Canada did the same thing in the early 1990s. The inflation target was not just, “Dear Reserve Bank of Canada, plese be tougher.” It was also a commitment by the Treasury, “we’re going to raise taxes if necessary to pay off our debts at this and only this value of inflation.” It also included micro economic reforms. Inflation melted away, like snow by about mid-July in Canada.

And of course, as Tom Sargent told us, remember the famous ends of hyperinflations. Inflation stopped on a dime, even with lower interest rates, even with printing more money, even with more short-term deficits, because countries solved the structural fiscal problem.

If we get to the point that we need to disinflation, remember that all successful disinflations, including the US in 1980, has been joint monetary, fiscal, and micro economic. But they had to reform to credible, durable, time-consistent regimes. You can’t forward-guidance your way out of inflation. You can’t just give more speeches about “anchoring.”

Remember “WIN” (Whip Inflation Now) buttons? They may be coming back as we replay the 1970s. They were, of course the ultimate attempt at forward guidance or expectations management that didn’t work. You need a durable change of regime so that people understand the underlying fiscal problem is solved.

But back to doom and gloom. We will have a new fiscal shock, something bad is going to happen sooner or later, and we have little fiscal space. If (when?) China invades Taiwan, we’re going to have a huge financial and economic shock, along with a nasty war. The government is going to try to to borrow or print another $5-$10 trillion to bail out, stimulate, insure, and fight a war. On top of, say 150% debt to GDP and unreformed entitlements. It will be very interesting to see what happens then.

In my reading, we have crossed the Rubicon. We have found the point that people didn’t want our debt anymore, started to spend it, and caused inflation. Are we now at the fiscal limit where we can’t do a big deficit-financed stimulus again? Or do people, can people, think that future deficits will be repaid by even further future surpluses, and they will happily lend those trillions without inflation?

So here’s the unknown theoretical question number two.

- Is fiscal inflation a stock or a flow phenomenon? Deficits vs. GDP gap, or debt vs. expected repayment?

I think Larry Summers’s vision, beautifully articulated, is a flow limit. The deficit multiplied by 1.5 should not be bigger than the GDP gap. If it is, you get inflation. So long as the flow of deficits is below that, don’t worry about increasing the debt; we can always pay it off sooner or later.

The view I’m putting up here is a stock view, a present value view. Inflation is fundamentally when we have too much debt relative to people’s expectations that the government can pay it back in the future. Then even small deficits, or changes in those expectations, can cause us fiscal problems.

We have good and fundamental questions. Let’s debate the answers.