Saving a large amount of money can be challenging, but it’s not impossible. Even with an average income, you can learn how to save $5,000 in 6 months, give or take.

Saving $5,000 in less than a year is a great goal if you’re looking to save up for a down payment on a home, book a dream vacation, or even save to pay for a large purchase such as furniture or appliances in cash.

The key to saving money is to give yourself a realistic timeline. If you’re wondering how to save $5,000 in 6 months, here’s what you need to know.

How to Save $5,000 in 6 Months

Whether you want to save money quickly to grow your emergency fund or purchase a car in the future, it’s very doable with the right strategy.

Yes, your income matters, but it’s not the only factor, and you don’t need to be rich or earn six figures.

Here are some specific steps to help you get started.

Break It Down

Whenever I have a big financial goal that requires me to save aggressively, I love to break the goal down. I’d actually recommend this method for other types of goals too.

Imagine someone saying they want to lose 60 pounds in one year and get healthy. This can seem daunting, but when you break it down to just 15 pounds every 3 months, the goal seems more doable.

Be sure to use this same method when determining how to save $5,000 in 6 months.

Monthly Savings to Reach $5,000 in 6 Months

Saving $5,000 in 6 months is $833.33 per month. Or, consider it $416.66 every two weeks. If you want to track things weekly, that’s $208.33 per week.

This breakdown answers the popular question: how much do I need to save a month to get 5,000?

Since this is such a specific goal, you know the exact amount you need to save each month or week to reach it.

Setting aside $200 per week may sound like a lot, but it does seem less intimidating than coming up with a lump sum of $833 extra each month.

Related: 10 Easy Financial Goals You Can Meet This Month

How to Save Your First $1,000 This Year

Start Using a Budgeting App

Once you’ve broken your goal down into more reasonable chunks, you’ll want to start using a budgeting app ASAP. Getting on a budget is key for any financial goal, but a budgeting app can be extremely helpful.

You’ll want to get very serious about tracking your income and expenses. I’m not against using a written budget or a budget binder. In fact, these tools have really helped me a lot in the past.

However, if you’re trying to maximize savings in a short timeframe, budgeting apps can be extremely helpful because they tend to catch things we don’t see or forget about.

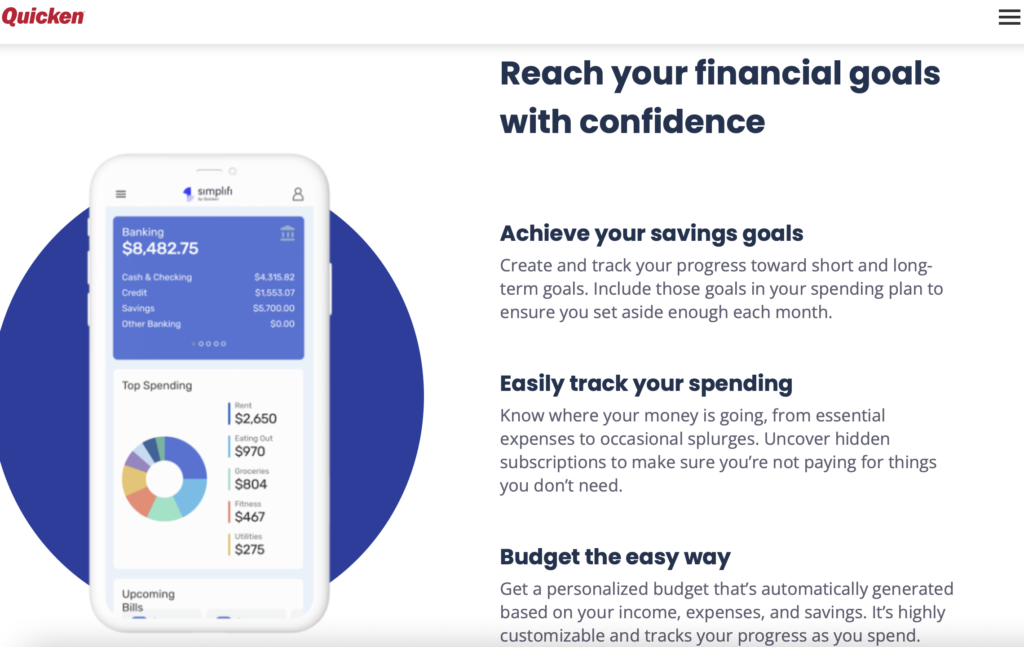

Earlier this year, my husband and I started using Simplifi by Quicken. It’s an excellent budgeting app for several reasons:

- We each get our own separate logins and can connect all our financial accounts to view in one place

- This app tracks your balances, transactions and cashflow – Cashflow is KEY is you want to round up extra money to save each month

- Simplifi also helps remind you of upcoming bills and holds you accountable for goals you set

One of my favorite things about Simplifi is the Spending Plan section. This is where you can create your budget and adjust spending goals. As the month goes on, the app syncs your transactions and helps you keep up with spending to see if you’re going to exceed a budget category.

Also, the visual aspect is amazing if you’re trying to focus on honoring your budget to free up more money to save.

Another feature I love is the Watchlist. You can add a specific retailer or expense category and have the app “watch” your purchases to motivate you to keep your spending under control. I like to watch my Amazon purchases with this feature.

Simplifi is just one of several budgeting apps. I encourage you to explore options to see what works for you whether it’s Mint, Every Dollar, or another budgeting tool.

Related: Budgeting With a Low Income, Yes It’s Possible

How to Get Your Spouse on Board With Budgeting

4 Common Budgeting Mistakes to Avoid Making

Get Strategic About Earning More Money

Once you have your budget under control and you can clearly see where your money is going and limit overspending, it’s time to focus on earning more money. Saving $208 per week or $833 per month won’t happen by accident.

You will likely need to focus on increasing your income. Luckily, there are so many ways to do this these days, especially if you’re willing to offer a service or do some work online.

Start with higher-paying extra income opportunities that don’t require much startup costs or materials. Doing things like taking surveys online wouldn’t work at all because you’d never be able to earn enough to save $5,000 in 6 months with this option.

Instead, look to options such as delivering food, helping small businesses with social media, writing online, walking dogs, or pet sitting.

Also, you can consider doing things like helping people move on weekends, babysitting or cleaning houses.

Put all the money you make from your side hustle directly into a savings account to avoid spending it.

Related: 20 Ways to Make Extra Money Today

How I Make $7,000 Per Month With a Side Hustle

5 Legitimate Ways to Earn $1,000+ per Month

5 Things You Can Do NOW to Save $5,000 in 6 Months

Learning how to save $5,000 in 6 months comes down to taking specific action steps to help you limit spending and maximize savings.

Here are 5 things you can do now to improve your progress.

1. Switch Your Grocery Store

I know that grocery prices have increased, but you can still switch stores and find other ways to save on your grocery bill. My husband and I just found this out recently.

We went from spending just $350ish per month on groceries a few years ago to $800 per month recently. Talk about inflation!

I probably never would have realized how much we were spending had it not been for Simplifi tracking our spending so specifically. However, we made some changes and got our new budget down to about $550 to $600 per month. That’s $200+ in monthly savings.

To get similar or even better results:

- Consider doing most of your shopping at discount stores so long as you compare prices. I used to always go to Aldi to save money on groceries, but after comparing prices,I found that Aldi doesn’t always have the lowest prices. Gather a list of discount grocery stores in your area and look at their sales and comparison shop.

- Start using a meal plan. Planning out meals in advance will save you so much money and time. We start our meal plan at home by going through the cabinets to see which food items we can use to create meals. Bonus Idea: Never run out of affordable food ideas with the $5 Meal Plan.

- Use coupons and savings apps. If you haven’t already, consider using apps like Shopkick, Ibotta, and Fetch Rewards to save money on store items and earn cash back. Trust me, these savings really add up!

Related: How to Save Even More Money on Groceries With Fetch Rewards

How to Save Money With Shopkick

Foods That Help You Keep a Low Grocery Budget

2. Limit Dining Out to Once Per Week

Dining out is fun but also so expensive at times. Try to limit dining out to more unique and intentional experiences only while you work on saving $5,000 in 6 months. Prioritize sticking to your meal plan and eating a majority of your meals at home while also bringing lunch to work.

Then, plan to have a family dinner at a restaurant once per week or meet up with a friend for a meal and to catch up.

To stay motivated in this area, calculate how much you currently spend in dining out and takeout meals. According to the Bureau of Labor Statistics, Americans spend around $3,000 annually on dining out.

Some people spend even more than this. But imagine if you could cut back and spend just a third of that amount. You’d instantly have $2,000 in savings.

3. Downgrade Your Subscriptions

Cutting out any subscriptions (even if it’s just temporary) can help jumpstart your savings as well. Review transactions for the past 2 months and make a list of all your recurring expenses.

Aim to cut out 90% of your subscription services, delivery apps, and other unnecessary purchases. Then, divert all the money to savings instead.

4. Start Selling All Your Old Stuff

Selling unwanted items from your home is another great way to boost your income and savings. Go through each room of your home and be honest about what you don’t want and won’t be using. Then, start listing items online using Facebook Marketplace, Offer Up, and other sites.

You’d be surprised and what people will buy used if you take quality pictures and price your items competitively.

I’ve sold everything from clothes, rugs, shoes, furniture, and home decor online for extra cash.

Related: Side Hustles Explored: Selling Items on Amazon and eBay

5. Get a Side Job to Earn More

I know this isn’t always doable for some people, but the simplest answer to the question: how to save $5,000 quickly? is to get a side job. It’s important to be realistic about the time and energy you can dedicate to a side job each week.

You can start by doing something that pays you at least $100 per week.

Then, you can lower your spending to save enough $100 to $150 per week.

Together, this will provide you with enough money to save $833.33 per month or $5,000 in 6 months.

We actually had to do something similar last year when my husband and I needed to come up with an extra $1,000 per month. The situation was temporary, but my husband was able to get a flexible side job on Saturdays and worked from around 7:30 am to 3 pm.

The job paid him $20 per hour plus tips so he’d earn around $160 to $250 per week by only working one day. Not bad for a side job.

Don’t Forget to Make it Automatic

Make things easier on yourself by setting up automatic transfers to grow your savings quickly. Once you have a plan in place to increase your cash flow, choose an amount you want to set aside each paycheck or each month.

I like to keep my savings in a high-yield savings account at a separate bank. That way, it’s not super easy to access but I’m still able to get to it when I need to.

Setting up automatic transfers will give you peace of mind knowing that you’re savings are on autopilot and you’re getting closer to meeting your goals.

How Can I Save Money Fast in 6 Months?

Saving a large amount of money in a short timeframe is not easy. Now that you know how to save $5,000 in 6 months, you will need to make some sacrifices and stay the course.

When you reach your goal, though, it will be well worth it. Start by getting on a clear budget that allows you to prioritize savings and consider using a budgeting app to make these more visual.

Have you ever tried to save a large amount of money in less than a year? What has been the most helpful piece of advice for your situation?

Stop Worrying About Money and Regain Control

Join 5,000+ others to get access to free printables to help you manage your monthly bills, reduce expenses, pay off debt, and more. Receive just two emails per month with exclusive content to help you on your journey.